GT Market Summary 2013

Mark Axford, principal of Axford Consulting and frequent contributor to Turbomachinery International examines the gas turbine marketplace and evolving trends.

What was the forecast for 2013 and how did it turn out?

On a worldwide basis, GT orders were up about 5%, very close to our prediction. But the U.S. market was a no-show. We expected a 25% up-tick, but orders for gas turbines fell by 5%.

What did you regard as the big news this year?

The headline was “Algeria orders 9,700 MW of gas turbines, 80% from GE.” This was an off-the-charts order. In 2011, Algeria had only 11,000 MW of installed power generation capacity. All the gas turbine OEMs had been working on this deal for over two years but most were surprised so much equipment was actually ordered. This huge order boosted GE’s gas turbine worldwide market share to 47%.

Why were U.S. results soft?

We were expecting a better bounce in the industrial sector in conjunction with a boost in manufacturing. But the economy remained sluggish and consumption of electricity grew at less than 1.0%. A significant portion of new generation capacity was wind and solar.

How is the long-term U.S picture?

The U.S. has at least a 100-year supply of natural gas at current consumption rates, perhaps 200 years. This is great news for the gas turbine business but only if we have the political will to use it. In some regions, there is opposition to fracking and indeed all forms of hydrocarbon production. These concerns need to be addressed and resolved if the U.S. is to harvest its endowment of natural gas. Otherwise, we will forgo low-cost power which is a major draw for the automobile and other industries.

What about China?

China had a big influx of GT orders during 2011. This included GT compressor units for the West-to-East pipeline and combined cycle plants near Hong Kong and Shanghai. China is now taking a breather as the pipeline is essentially built out. China makes about 80% of its electricity from coal-fired steam plants due to fuel costs. But potential game changers could be China’s significant shale gas formations and a gas pipeline from Siberia to Beijing.

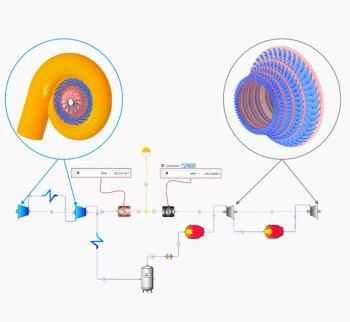

How is the aeroderivative GT market doing?

About 8,000 MW of aero GTs were ordered worldwide, up 2% from 2012. GE won more than 80% of those orders. Over the last 6 years, the aero fraction of total GT orders has ranged from 12% to 16%. But if you compare the market share of aeros vs heavy frame for unit sizes 18-to-65 MW, aeroderivatives win 61% to 66% of total orders.

What about GE’s LMS100?

The LMS100 is a hybrid gas turbine — part aero, part heavy frame. Orders in 2012 and 2013 have been disappointing after the product had appeared to gain market traction. During 2013, six LMS100 turbines were ordered, all for the U.S. Most customers will tell you that they love the LMS100 efficiency but the installed cost per kW is too high for peaking duty.

Which aero GTs do well outside of North America?

I am amazed by the growth of the LM2500 market. GE has developed a few different versions of the product rated 18 MW to 35 MW, customized for power generation or mechanical drive. After shipping the first three LM2500 gas generators for mechanical drive service in 1971, more than 400 units have been ordered in the last four years. I have known technicians who have done repairs on LM2500 turbines and now their sons are also working as tech reps at the same job sites. Looking ahead, the globalization of the natural gas markets means the LM2500 and Rolls-Royce RB211 should do well. They are sized nicely for oil and gas applications and have a track record for reliability and ease of maintenance.

Are most GT orders for simple or combined cycle?

Over the last six years, 61% of the GT capacity ordered in the U.S. has been for combined cycle. The old rule of thumb of 50-50 has drifted upward as GT ratings have increased. Large combined cycles with heavy frame GTs produce a lower installed cost per kW and higher efficiency than a combined cycle plant using aeroderivatives.

What factors will influence the U.S. market?

Consumption of electricity is linked to the vitality of the economy. When we use more electricity, new power plants must be built and gas is the low-cost winner. But politics and subsidies often distort the market in the U.S. and elsewhere. The price of electricity in Germany, for example, has skyrocketed because of renewable subsidies coupled with the decision to retire their nuclear fleet. Germany is worried their blue chip industries will move more production to the U.S.

What is the outlook for 2014?

I’m bullish on the U.S. market but we could have a replay of 2013 if federal and state renewable subsidies are continued. Unless Europe gets back in the game, I see worldwide orders off about 5%. There is not Algeria in the playbook to save the coming year.

What else intrigues you?

Mexican president Enrique Peña Nieto is opening Mexico’s markets to competition in oil and gas production as well as power generation. We could see more gas and electricity flowing across the border. Keep your eyes on Mexico (see "Energy Reform in Mexico" heading

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.