A BRIGHTER OUTLOOK FOR OIL & GAS

KEY TRENDS INCLUDE DIGITIZATION, ENVIRONMENTAL CONSTRAINTS, LOWER SPEND THAN IN THE PAST, INCREASED ASSET USE AND 3D PRINTING

BY DREW ROBB

The oil & gas industry has had a tough couple of years following the collapse in oil prices. But the January Annual Meeting of Baker Hughes, a GE company (BHGE), in Florence, Italy sounded a more positive note. This two-day event brings together more than 1,000 senior oil & gas leaders and government leaders from companies, such as Shell, Maersk Oil, SKF, Nvidia, Saipem, BP and Novatek. They outlined key trends, including digitization, environmental constraints, lower spending than in the past, increased asset utilization and the importance of 3D printing (also known as Additive Manufacturing or AM).

Most speakers saw a brighter future — but only for those that embraced a new way of operating — one that involved the latest technology and digitization of their assets, while keeping operating costs low.

Opening keynote

During his opening keynote, Lorenzo Simonelli, Chairman and CEO of BHGE, offered a positive outlook on the oil and gas market. “We began 2017 with a bearish outlook, but as we enter 2018, it looks a lot brighter,” he said. “People are optimistic, and they are starting to spend again.”

Simonelli outlined several mega-trends impacting the industry. The foremost one, a growing need to keep pace with the digital revolution that has seen the industrial world adopt many consumer market technologies. The result is that business processes are moving at a pace we have never seen before. In turn, this has generated a raft of new players coming onto the scene. Google and others are now looking to play a part in the energy sector. For some, this is a threat, for others an opportunity.

The environmental challenge was next. The oil & gas industry has been viewed in the past as a pollution generator. In this low-carbon regulatory environment, oil and gas needed to change. For BHGE, and others in the sector, this means moving to cleaner energy sources, such as natural gas and alternative production methods. A further trend is lower spending. “It’s no longer the oil price that matters alone - it is the need to reduce CAPEX and OPEX,” said Simonelli. “There is a strong drive toward efficiency to remain competitive. We cannot go back to the way things were before the oil price crash.”

The recent merger of Baker Hughes and GE Oil & Gas, he said, is one way to meet those goals and respond to those trends. This is enabling the company to increase asset utilization and lower by 50% the total cost of ownership. “The future of competitiveness in energy will be defined by radical improvements in project economics, significant shifts in the way we do business and the ability to balance energy demand and environmental responsibilities,” said Simonelli.

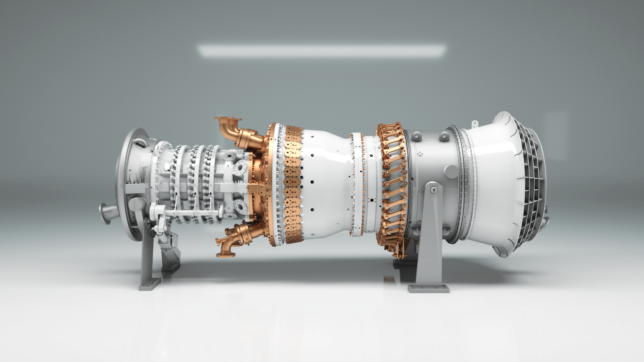

NovaLT turbines

BHGE is accelerating the use of 3D printed parts implemented within its NovaLT gas turbine series. The company was targeting oil and gas primarily but has found a great deal of interest from within the power industry.

Initially conceived for the mechanical drive market, BHGE is seeing sales for power generation due to the unit’s light weight and small footprint for areas needing power in the 5 MW to 16 MW range. Developed and built in Florence, Italy, the turbine can operate for up to 35,000 hours between maintenance intervals. It has been configured to ensure servicing activities can be completed quickly and efficiently, thereby reducing downtime, resulting in high levels of reliability, availability and efficiency, with reduced operating costs for the customer.

The Asia Pacific (APAC) region has proved to be a strong market for the NovaLT16, with 12 turbines sold to customers in 2017. Vietnam, for example, continues to have significant levels of oil & gas development both onshore and offshore, with increasing demand from power plants, refineries and petrochemical plants. A recent order will supply the turbine to Vietsovpetro to be deployed offshore in Vietnam. The NovaLT16 will be combined with the gas compression platform’s existing gas engine-driven reciprocating compressors to expand gas compression capacity at Block 09-1. Its mechanical drive capabilities will enhance the facility’s gas compression performance, with 89% or higher compressor efficiency.

Khuram Majeed, APAC Vice President for Turbomachinery & Process Solutions at BHGE, explained that GE’s heritage has been in large GTs. Until the NovaLT, it has never participated in the below 20 MW segment. This sets up an interesting scenario whereby oil & gas specialist BHGE is selling a power generation unit that GE Power cannot offer. The NovaLT competes with Solar, Siemens and Kawasaki turbines.

“We saw a market, invested $100 million in the NovaLT line, and make these machines in Florence,” he said. The company has sold 12 NovaLTs in Asia Pacific, he added, by far the strongest area for sales of this new machine: five 16 MW units and seven 5 MW units. The company expected this machine to be used primarily for oil & gas. However, it has also taken off as a power generation machine. Out of 12 sales, only three have been in mechanical drive.

“By offering the NovaLT as an industrial turbine, we are no longer tied to price of oil for sales,” said Majeed. High GDP growth in Asia is generating demand for power generation units below 20 MW. Rubber plantations, paper mills, cement factories and beverage producers are among those that have purchased NovaLTs to provide electricity to power their processes. In some cases, it is configured for combined cycle with exhaust heat used for steam production (three units are used this way).

Across APAC, he said, needs vary widely. China is currently engaged in a distributed power initiative. It is looking for many units in the 10 MW to 30 MW range to promote general manufacturing and smaller industrial parks. In Malaysia, palm oil and paper customers predominate. One NovaLT16 customer, for example, makes rubber gloves. They use the turbine to power a geothermal heat recovery system.

“These buyers prefer the NovaLT as they can use it continuously for four years,” said Majeed. Beyond the NovaLT, he said the strongest market segment for BHGE turbomachinery is in Liquefied Natural Gas (LNG). Most of that market is also in Asia or Australia.

Some LNG plants use large frame machines and others use aeroderivatives. Gorgon and Woodside LNG both use Frame 7s. Large LNG facilities gravitate towards turbines that produce 100 MW or more for power generation and driving a compressor for liquefication. The GE LM6000 PF is used at Wheatstone LNG. The plant is upgrading its LM6000 PFs to PF+, he said, which add 10 MW more power. In addition, the new 65 MW LM9000 should be in production by the end of next year. It targets a range of driver that BHGE believes will be in the sweet spot for more LNG projects over next few years.

Turbines deployed in LNG are getting smaller. While large reservoirs required big drivers, new fields tend to offer lower reserves (in the 1 to 3 million tons per annum range), Majeed said. Smaller turbines fit better for that range.

BHGE partnerships

New digital technologies are changing the way BHGE works. This has spurred closer partnerships with others in the industry. For example, a contract with Maersk Oil will see BHGE deliver an integrated scope of turbomachinery equipment for the topside production facility of the Tyra field redevelopment project in the Danish North Sea, including: seven compression trains featuring BCL centrifugal compressors driven by GE Power high-speed electric motors; three gas turbine generator sets; and two turbo expanders. The compressors use an active magnetic bearing (AMB) solution for both driver and driven equipment, and BHGE will supply AMB applications through a license-based partnership with SKF.

Adopting an AMB and high-speed electric motor configuration allows Maersk to eliminate lubricants and reduce the weight, footprint and maintenance costs for the equipment on the platform’s topside. The new BHGE NovaLT12 gas turbine compared to the existing NovaLT16 (light blue shadow)

BHGE has jointly developed Jewel Suite with Royal Dutch Shell, to enable better execution of field development planning by integrating data and workflows from seismic interpretation all the way through to geological modelling. This allows Shell to reduce uncertainties on well placement, reserves estimation and production planning.

“Digital technologies have been an important feature in our industry for years but now the pace of change is increasing dramatically,” said Harry Brekelmans, Director of Shell Projects and Technology. “What used to take years or months to be developed and deployed, can now take only weeks."

We are at the beginning of a renaissance, he said, as the industry adjusts to new concepts of digitalization, capital efficiency and operational excellence. Shell’s Stones project, said to be the deepest oil & gas project in world, uses a floating production, storage and offloading (FPSO) vessel. The initial wells for this project took only 60 days to drill, about half the time they would traditionally take.

The Appomattox deep water project had brought operational costs down 20% and capital costs down 25% using 3D printing, digitalization and analytics. “Shell is targeting a 20% reduction in its carbon footprint for ourselves and our customers by 2035 and a 50% reduction by 2050,” said Brekelmans.

Other speakers also detailed how the old ways were being replaced by a new reality. Dr. Dawood Nassif, Advisor to the Bahrain Oil Minister, Board Director of the Bahrain Petroleum Company and Board Director of Gulf Air, began with his view on the price of oil. With OPEC and Russia forming a partnership that controls half of worldwide oil production, he foresees the price of oil being pushed up further. But looking to the future, he predicted that the gasoline-fueled car is going away. The electric car and autonomous car (also known as a driverless car, self-driving car, robotic car) are coming, along with the end of individual vehicle acquisition. “80% of the time, a vehicle is parked at home or at the office,” said Nassif.

“We will all be using providers instead of vehicle ownership in the future.” Carlo Calenda, Italian Minister of Economic Development, offered a similar message. He said Italy has many old vehicles, and government policy was aimed at changing the paradigm of car ownership. This is part of a national energy strategy, which also encompasses natural gas as being the most important transition fuel between a fossil and a renewable economy. “We are pushing for more natural gas supply sources,” said Calenda. “Right now, a lot of supply comes through Russia and Ukraine. We need to diversify our supply.”

Digitization Emphasis

Binu Mathew, Senior Vice President & Global Head, Digital Products at BHGE, said the modern oil & gas company is as much in the data business as it is in the hydrocarbon business. To gain market share, they need to harness sensor, geolocation, weather, drilling and seismic data to derive organizational insight. A typical offshore rig generates 50 terabytes of data per year. A shocking 1% is used in analysis.

Accordingly, BHGE has formed a partnership with chip maker Nvidia to bring what is called “Deep Learning” to oil & gas. The companies are co-developing artificial intelligence (AI) technology which includes Nvidia-powered computing and BHGE’s analytics and digital twins. “A new generation of intelligent operations can dramatically improve efficiency and productivity for energy producers,” said Jim McHugh, Vice President and General Manager for Enterprise Systems at Nvidia.

The Graphics Processing Unit (GPU) was originally deployed in 3D game rendering. But people soon realized that it could accelerate computational workloads in oil & gas, finance, simulation and other fields. The GPU takes vast amounts data and does the same thing repeatedly at great speed. It is this focus on one type of task that boosts overall computational velocity.

BHGE is pairing the Nvidia GPU and the Nvidia DGX computing platform with its Predix cloud-based industrial platform to unify this data and break down isolated information silos. This enables engineers to gain analysis results in hours that previously could take months, opening the door to more intelligent machines and systems that can reduce the cost of discovering and extracting oil and natural gas.

Another touted benefit is greater accuracy in predicting machinery failure. This new generation of systems helps operators to visualize production and sensor data flooding in from equipment throughout a facility. Pressures, flow rates, temperatures and other parameters can be unified to draw accurate, automated conclusions. In addition, rapid number crunching helps explorers to identify optimum rock formations and predict reservoir location.

Plenty of Oil

Shale gas means more oil from recoverable resources than we need for next 30 years by a large margin. So, said, Bernard Looney, Chief Executive for Upstream at BP. He added that China, Algeria and other countries may have more oil than the U.S. Due to this surfeit of supply and pressure from electric vehicles (EVs) and renewables, some of these resources will not be needed.

“Competitiveness is the way forward: you have to be ready to compete efficiently and that demands different market responses,” said Looney. BP’s response is to strategically grow its natural gas business, which he said was the fastest growing non-renewable segment. The company is also focusing on what it called “advantaged oil” — sources where there is resilience to a range of prices. Looney was yet another advocate of digitization, which he termed a game changer.

“We use an algorithm to hear the sound of the type of rock, and whether liquid, gas or solids are present, so you can change the well speed, adjust pressure, and change drilling direction,” he said. “We now have miles of fiber optic cable in our wells.”

BP employs a system known as BHGE Plant Operations Advisor in its Gulf of Mexico Atlantis facility. It can run 40 million calculations on 40 pieces of equipment in one day. This enables the company to fix issues in turbines, compressors and other systems before they happen. The plan is to deploy this on all BP assets within the next two years. Additionally, digital analysis helped BP discover that it had 200 million more barrels of oil in one Gulf field than expected. Looney said the calculations involved would have taken 1,000 years to complete in 1919. They can now be done in two weeks.

Looney ended with a shift in how gas turbines are being sold. He gave the example of a turbine BHGE is supplying to a BP site in Trinidad. “Rather than buying it, we will pay for power by the hour,” said Looney. “As we pay for reliability rather than a piece of equipment, BHGE has an incentive to make it more reliable. In turn, it provides them with a predictable revenue source over decades rather than at one point in time.”

Saipem, too, has a strong relationship with BHGE for oil and gas. Stephano Cao, CEO of Saipem, said years of cost cutting is not enough. He is preparing the company for the digital world to be able to take advantage of big data, the Internet of Things (IoT) and analytics. He is also focused on developing local skills in the various markets where the company is active in conjunction with universities and local authorities to train more people on digital technology.

“Together with the digital revolution, we must develop a different way of dealing with clients, the countries in which we operate and our stakeholders,” said Cao. “We need to be more collaborative rather than operating in opposition.”

European pipeline

Reinhard Ontyd, Chief Commercial Officer, Nord Stream 2 pipeline, spoke about bringing Russian gas to Europe through the Baltic Sea from Finland, Sweden and into Germany. This will be operational by 2019. Nord Stream 2 will close Europe’s natural gas import gap due to lower LNG availability, and increase security of supply. A market study by the University of Cologne predicted the pipeline could save European consumers 8 billion euros every year.

The Nord Stream 2 pipeline will deliver gas from the Bovanenkovo gas field in Russia’s Yamal Peninsula, which holds 4.9 trillion cubic meters of gas reserves. The pipeline runs from the Baltic shore west of St. Petersburg to the German Baltic coast near Greifswald. It will also require compressors to keep gas moving to the European coast.

Mark Gyetvay, CFO and Deputy Chairman of the Management Board at Novatek, followed with an indepth briefing on Yamal LNG. This project is one of most challenging in the world, but the reward potential is high — 1.4 tcm of natural gas reserves. Train 1 entailed the drilling of 38,000 pylons due to the permafrost surface.

Heat exchangers are used to manage the permafrost to keep the ground stable. Special ships navigate and crush through ice of up to two meters thick to keep supply lines flowing. Some 208 wells are being drilled at 19 well drilling pads. The liquefaction plant consisting of three production trains of 5.5 mmt of annual capacity per train. The first train began production at the end of 2017. After the gas is brought out of the ground, initial separation removes mechanical impurities, water and methanol. Separated gas is supplied to the liquefaction trains.

The process involves removal of acid gas and methanol, dehydration, mercury removal, as well as extraction of liquefied petroleum gas and a propane cooling loop before the LNG is stored in cryogenic tanks. A power plant is also present with a capacity of 376 MW. Turboexpanders increase gas treatment efficiency.

Yamal LNG’s second and third trains will be operational in 2018 and 2019, respectively. With the experience gained at Yamal LNG, the company has launched Arctic LNG 2 about 70 km away. Once fully operational Arctic LNG 2 will have a production capacity of 18 million tons compared to Yamal LNG’s 16.5 million tons. Novatek is selecting Italy’s Saipem to build offshore platforms for Arctic LNG 2. As it is built on solid rock, Arctic LNG 2 should save 30% compared to the Yamal LNG project, Gyetvay said.

The Kamchatka Transshipment Complex is being established in the region to provide 20 million tons of LNG per year of planned capacity. Construction begins this year. This will enable the company to deliver LNG to the China market in 18 days, halving the time it previously took. BHGE is partnering with Novatek on both these projects to provide a wide range of turbomachinery equipment and services.

Data is the new oil

Mikko Hyppönen, Chief Research Officer of computer security firm F-Secure, delivered a lecture on cybersecurity. While he applauded the move to bring operational technology (OT) and IT together, he delivered a warning. “Whenever a device is called smart, it is vulnerable,” said Hyppönen. “However, the upside of using digital technologies outweighs the downside of potential attacks.” Security, he added, is a process, not a technology product. He urged the audience to make computer security a board-level subject. Only by doing so, can digitization become a true enabler of organizational goals.