ANALYZING THE NUMBERS

By Drew Robb

Our annual worldwide gas turbine (GT) report from Forecast International is always a goldmine of information. It predicted 6.6% more GT revenue over the next ten years, compared to its expectations from a year ago.

The author noted that the strongest areas of the market will be large GTs and aeroderivatives. However, the market for small turbines has been suffering due to greater competition from natural-gas fired reciprocating engines.

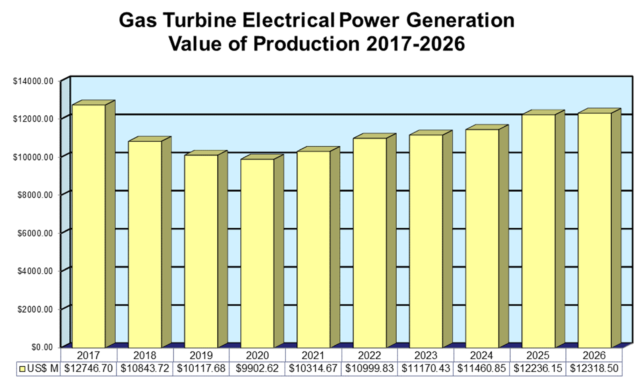

We took a closer look at the numbers and compared them to the same forecast from five years ago. The big thing that jumped out was a shocking drop in GT revenues. Forecast’s current analysis expects $112.1 billion in GT revenues over the next decade. Five years back, it anticipated $152.9 billion in the coming decade. More than a quarter of the market has evaporated in five years.

These losses show up most sharply over the next three years. The old report predicted about $15 billion in annual sales from 2018 to 2020. The current report has each of these years at $10 billion in sales. That’s a massive decline. The question is why?

Obviously, the oil price collapse destabilized markets and led to many projects being postponed or shelved. Following that, capital investment dried up across the boards. We are only now emerging from that period. The Forecast report details addition factors that will inhibit an immediate recovery.

Recip OEMs have found a way to capitalize on natural gas. No longer is it diesel recips competing with natural gas-driven turbines. Recips are comfortable running on gas, and they have upped their game to produce larger units that are attacking the lower end of the GT market.

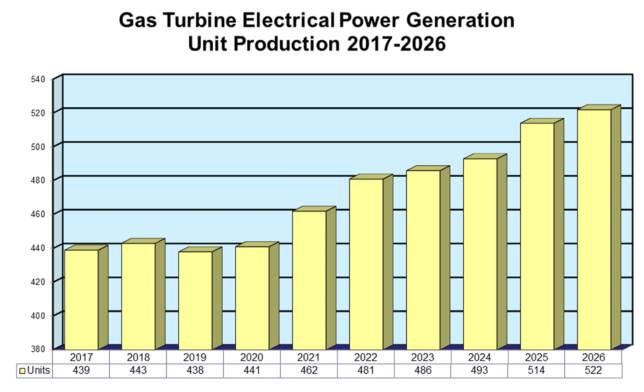

This is apparent in the comparison of reports from Forecast International. The number of units predicted to be sold over the next decade has shrunk from 12,521 in 2012, to 4,719 today.Machines in the 3 to 10 MW range are projected to account for 31.6% of unit production. It was 33% in 2012. Models smaller than that are experiencing low unit sales. Much of the loss is in the 0.2 to 3.0 MW grouping, which has fallen in that time from 19% of unit sales to less than 2%. A couple of years ago, we noted the early stages of this trend and called upon small turbine and microturbine manufacturers to tell us what they were going to do about it. The silence has been resounding.

But there is good news, too. The segment of 180 MW or greater represented 41.5% of predicted sales five years ago. Today, it is up to 65.0% of the expected sales for the next 10 years.

Further good news came from the U.S. outlook from Industrial Info Resources (IIR). It provides the same graphic each year of power sources: Natural gas, coal, fuel oil, renewables and nuclear. Five years ago, IIR determined that 67% of new projects planned for the next decade would be renewables. That’s down to 55% in this year’s prediction. Natural gas, on the other hand, has surged from 21% to 41.4%. Coal and nuclear continue to fall into the abyss.

The conclusion appears to be that the place of natural gas in our power mix looks secure for the next ten years or so. However, that won’t translate into booming revenues.

I want to thank our analysts at Forecast, IIR and IHS Markit. They put their hearts and souls into these reports and do a fantastic job based on the data on hand at the time of their analyses. However, black swan events, such as the oil price collapse, nuclear disasters, big shifts in renewable policy and subsidies, and presidential elections are matters far beyond their control.