MidOcean Energy Acquires Further Interest in Hunt Oil’s Peru LNG

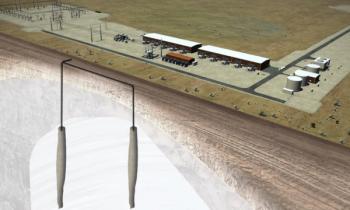

Peru LNG’s assets consist of a natural gas liquefaction plant, a 490-km pipeline, two storage tanks, a marine terminal, and a truck loading facility.

EIG’s MidOcean Energy and Hunt Oil Co. recently entered a definitive agreement—MidOcean will absorb an additional 15% interest in Peru LNG (PLNG) from Hunt Oil. Following transactional close, MidOcean’s stake in PLNG will increase from 20% to 35%. Aramco managed parts of the acquisition, including technical and commercial due diligence and engaging with stakeholders for transaction approval.

PLNG owns and operates an LNG export facility in Pampa Melchorita, 170 km south of Lima, Peru. Its assets consist of a natural gas liquefaction plant with 4.45 MMtpa processing capacity; a 408-km pipeline with 1,290 MMcf/d capacity; two 130,000 m3 storage tanks; a 1.4-km marine terminal; and a truck loading facility with up to 19.2 MMcf/d capacity.

“We are pleased to increase our stake in PLNG, a strategic asset that aligns with MidOcean’s vision of creating a global, diversified, and resilient LNG portfolio,” said De la Rey Venter, CEO, MidOcean Energy. “Our belief in the long-term fundamentals of the LNG market and in the strength of PLNG’s position as the only LNG export facility in South America remains steadfast. We look forward to strengthening our partnership with Hunt Oil and the other PLNG co-venturers and continuing to support the project’s impact on the Peruvian energy market.”

The transaction will be funded by Aramco, which will raise its interest in MidOcean to 49% and its indirect stake in PLNG to 17.2%. In addition to EIG and Aramco, Mitsubishi Corp. and other blue-chip investors own stake in MidOcean. Hunt Oil’s PLNG interest will decrease from 50% to 35% but will maintain status as sole operator.

MidOcean Energy News

In March 2024,

Recent Aramco Investments

In August,

Sub-topics within selected research areas include:

Energy Transition

- Liquids-to-chemicals conversion

- Future refineries research

- Low-carbon aviation fuels

Sustainability

- Hydrogen

- Carbon capture and storage

- Renewables

- Energy storage solutions

And, in July,

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.