Siemens and Toshiba latest to drop new-build coal

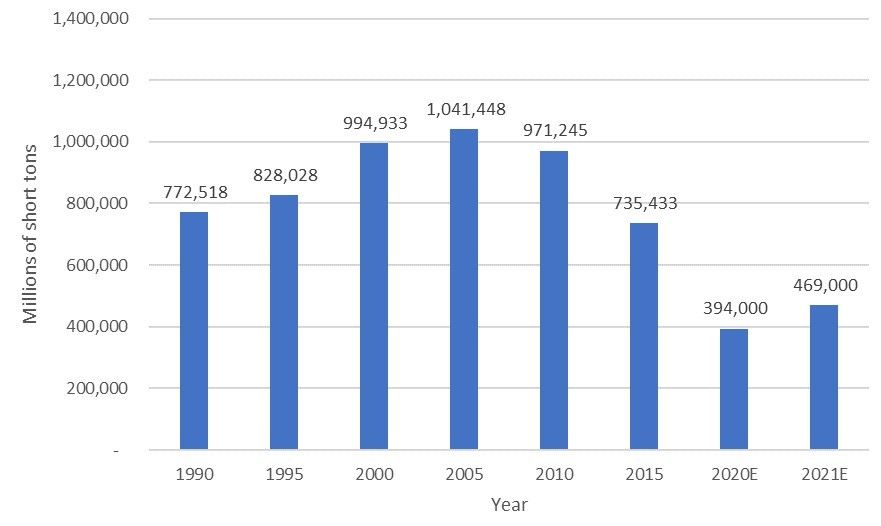

Consumption of coal by U.S. electric generators. Source: Electric Power Monthly and Short-Term Energy Outlook reports, U.S. EIA.[/caption]

Toshiba Corp. and Siemens Energy are the latest energy companies to cease investment in new-build coal power plants. Toshiba announced on Nov. 11 it will stop taking new construction orders for coal plants, one day after Siemens said it will stop selling turbines for new coal-fired plants. Toshiba and Siemens Energy are the two latest large companies to end investments in the coal sector in recent months, following similar announcements from GE and Black & Veatch.

Nobuaki Kurumatani, Toshiba’s president and CEO, made his company’s announcement Nov. 11 during an online press conference from Tokyo, Japan, whose prime minister, Yoshihide Suga, said in late October that the country intends to realize its goal to reduce its greenhouse gas emissions to net zero by 2050. Toshiba said it intends to cut greenhouse gas emissions from its business in half by fiscal year 2030.

The Japanese government in its latest energy plan, released before the current leadership took office in September, calls for 25% of the nation’s power to come from renewable energy by 2030. The country, which ranks fifth in the world in carbon emissions and relies heavily on coal, expects fossil fuels, including coal, to generate as much as half its energy.

Siemens still plans to fulfill existing commitments including placed bids while honoring its service contracts. It also will continue to participate in combined heat and power projects, some of which could be coal-fired. Earlier this week, the company reported its overall business to remain profitable. Turbine sales to coal-fired power plants in the past year totaled about $970 million, which makes up less than 10% of the company’s sales. Siemens Energy, in addition to its gas and steam turbines, generators, and wind turbines operations is also invested in offshore wind transmission technology and hydrogen.

The big picture

The mass divestment from coal caps off decades of investment in renewables. Some regions are beginning to seriously invest in hydrogen. The writing is on the walls: not only does coal have more harmful environmental effects, it is simply not as profitable as it once was. Renewables are now delivering better financial returns than fossil fuels, at least in the U.S., U.K., and Europe, according to a May report by the International Energy Agency.

Coal generation resources may be steadily shrinking in the USA and Western Europe. But worldwide, the picture is quite different as the global coal-fired generation market is estimated to account for 2,057 GW in volume by the end of 2027, according to report from Coherent Market Insights. Due to increasingly stringent emissions standards, demand for coal gasification and fluidized bed combustions is expected to increase.

The broad outlines for the 2021-2025 period are clear: renewables, often buttressed by battery energy storage systems (BESS), are expected to continue to crowd out coal and, increasingly, gas-fired new-build generation.

The commercial coal segment dominated the global coal-fired generation market in 2019, accounting for 56.7% share in terms of volume, followed by residential segment. Pulverized coal system segment dominated the global coal fired generation market in 2019, accounting for 50.1% share in terms of volume, cyclone furnaces and others, respectively.

The report found that pulverized coal systems, which uses powdered coal to generate thermal energy, are gaining traction in the market and may augment the broader coal-fired power generation market. The rate of combustion in pulverized coal can be controlled easily. Also, it offers faster results to load changes.

Rapid industrialization across developing regions will help drive the use of coal-fired power generation in commercial applications. Growth in the manufacturing industries, along with upcoming power plant projects across developing regions, is expected to bolster market growth.

Approximately 80% of new-build generation scheduled to begin construction between 2021 and 2025 is expected to be renewables, mostly wind and solar, according to Industrial Info Resources. Gas-fired generators will account for about 18% of new-build generation, with nuclear taking about 1% of the market.

While their zero fuel costs give renewable energy projects a cost advantage compared with other types of generation, many renewable projects will require backup power. That points to increased demand for gas turbines and gas-fired reciprocating engines.

An analysis by Forecast International, published in our 2020 Handbook, projects the market for gas turbine-powered electrical

generation sales for 2020-2029 to reach $102.33 billion - an increase of 6.5% from the sales projection for the 2019-2028 period. In terms

of units, the analysis projects worldwide sales of 4,291 gas turbines for electrical power production between 2020 and 2029. This is an increase of 4.8% over the equivalent figure in last year’s review.

Fuel Flexibility in Heavy-Duty Gas Turbines: A Key Driver for Energy Transition

March 13th 2025From Hydrogen to HVO, Mr. Federico Bonzani, Chief Technology Officer of Ansaldo Energia, describes the fuel flexibility state-of-the-art solutions of the Company to meet the actual and future needs of power generation industry.