Too many standards up project cost when oil prices are crashing

The crash in oil prices has brought into sharp focus the underlying inefficiency of the oil & gas field. Until recently, oil prices hadn’t fallen below $40 a barrel since the summer of 2003. They even surged above $100 on several occasions. With plenty of money around, oil companies grew complacent.

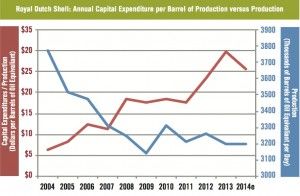

One 2014 study found that only 18 out of 100 large projects came in on budget. Further statistics show that the cost per barrel has increased by a factor of four in recent years. At the same time, construction productivity has fallen off sharply (Figure 2).

Figure 2: As the price of oil sourced during the 2000s, oil company cost increased by 4 times while overall productivity crashed

Here is the conundrum facing the industry. Oil is trading around $30 per barrel and few outside of Saudi Arabia can sell it profitably at that rate. For example, the production cost per barrel is over $50 in the UK, cost under $50 in brazil and over $40 in Canada. Shale oil has given the U.S. an edge, yet production costs hover around $36, according to Rystad Energy's database of tens of thousands of oil and gas fields around the world. The industry is reeling from harsh economic realities.

Accordingly, Shell has reorganized to change this trend by placing its projects and technology teams into the same division. Harry Brekelmans, Project & Technology Director, Shell, looks after that group and says it is much more efficient as those designing projects are forced to talk to those piecing together the various technology elements to be used in the field.

“We have seen in increase in specs, contractor requirements, documentation and team size raise by anywhere from 139% to 275% from 2000 to 2012,” said Brekelmans.

He found fault with the sheer number of standards in the industry. There are currently hundreds of standards for valves alone. To his mind, the surfeit of standards actually defeats the entire purpose of standards. Shell, therefore, is giving greater scrutiny to project scope. In a recent offshore project in the Gulf of Mexico, for example, a well simplification brought about a 30% reduction in costs. He views tighter collaboration as a big part of the solution.

“Given the industry downturn, oil and gas companies should be collaborating with a united purpose to secure a sustainable, more efficient and competitive future for our industry,” said Brekelmans.

“We are right-sizing, simplifying and standardizing our organization,” he said. “Cutting costs doesn’t mean we don’t want to grow, though. We are in a period of ambidextrous growth, and want to keep that momentum going.”

(Figure 3: Jakob Thomasen, CEO of Maersk Oil, said his company had embarked on a cost-transformation program)

These sentiments were mirrored by Jakob Thomasen, CEO of Maersk Oil. His company has also embarked on a cost-transformation program (Figure 3).

But the harsh realities of the current climate were hit home by Thierry Pilenko, Chairman and Chief Executive Officer, Technip. He characterized this as the worst crisis ever, even worse than the downturn of1986. The pressure comes, he said, from not only the declining oil price but also from the fact that it is harder to get to the resources, the industry is spending double or triple man-hours per piece of equipment for quality assurance, inflation in salaries, and regulations are all impacting productivity.

“To slash our soaring costs, technology, innovation, standardization, and simplification are critical,” said Pilenko. “But it is just as important to be able to collaborate with customers in the early stages of a project to make the right decisions, driven by safety and cost.”

In the short term, he thinks the industry may be able to cut cost by 10, 15 or even 20%. Yet customers are demanding reductions of 30-40%. “It is not just statistics or numbers, though, it is also about changing behavior” said Pilenko.

“Just like we collaborated around driving new behaviors about safety, we can partner and do the same for cost.”

John Hickenlooper, Governor of Colorado, provided counterpoint to an agenda packed with industry insiders. His state has an abundance of oil and gas and other energy resources, which bring in $2 billion in annual revenue. He called for simplification and standardization, particularly as regards regulation.

Colorado, for example, has been making efforts to be more energy and business friendly. An inspection revealed that 17,000 regulations existed within the state related to oil and gas, emissions, and clean air and water. That number has been reduced by 8,000 by forcing industry, regulators and non-profit environmental groups to work together.

“By diminishing friction, we figured out how to get rid of regulations that inhibited transportation of energy,” said Hickenlooper. “That led to 12,000 fewer truck trips by centralizing fracking fluid operations via pipelines.”

Meanwhile the biggest oil and gas company in the world Saudi Aramco is rolling out expansion plans to increase the size of its refineries by three times. Ahmed A. Al-Sa’adi - Senior Vice President Technical Services, Saudi Aramco, validated GE for an improvement in collaboration with GE since he last spoke at the show a few years ago.

“Saudi Aramco is collaborating with GE to pilot its Smart Signal predictive maintenance technology for rotating equipment at one of our gas plants to enable proactive detection of failure of critical equipment, and to increase equipment availability and reduce maintenance costs,” said Al-Sa’adi.

(Figure 4. GE Oil & Gas agreed to invest $600 million in Italy over the next five years.)

Those attending the signing ceremony included the Italian Minister of Economic Development Federica Guidi, the President of Tuscany Region Enrico Rossi, GE’s Chairman and CEO Jeff Immelt, the President and CEO of GE Italia Sandro De Poli, the President and CEO of GE Oil & Gas Lorenzo Simonelli, and the President of Nuovo Pignone Massimo Messeri.

Fuel Flexibility in Heavy-Duty Gas Turbines: A Key Driver for Energy Transition

March 13th 2025From Hydrogen to HVO, Mr. Federico Bonzani, Chief Technology Officer of Ansaldo Energia, describes the fuel flexibility state-of-the-art solutions of the Company to meet the actual and future needs of power generation industry.