THE RISE OF DISTRIBUTED GENERATION

AS WIND, SOLAR AND COMBINED HEAT AND POWER PLANTS COME ONLINE, UTILITIES AND INDEPENDENT POWER PRODUCERS ARE RETHINKING THEIR ROLES IN THE ELECTRIC POWER SYSTEM

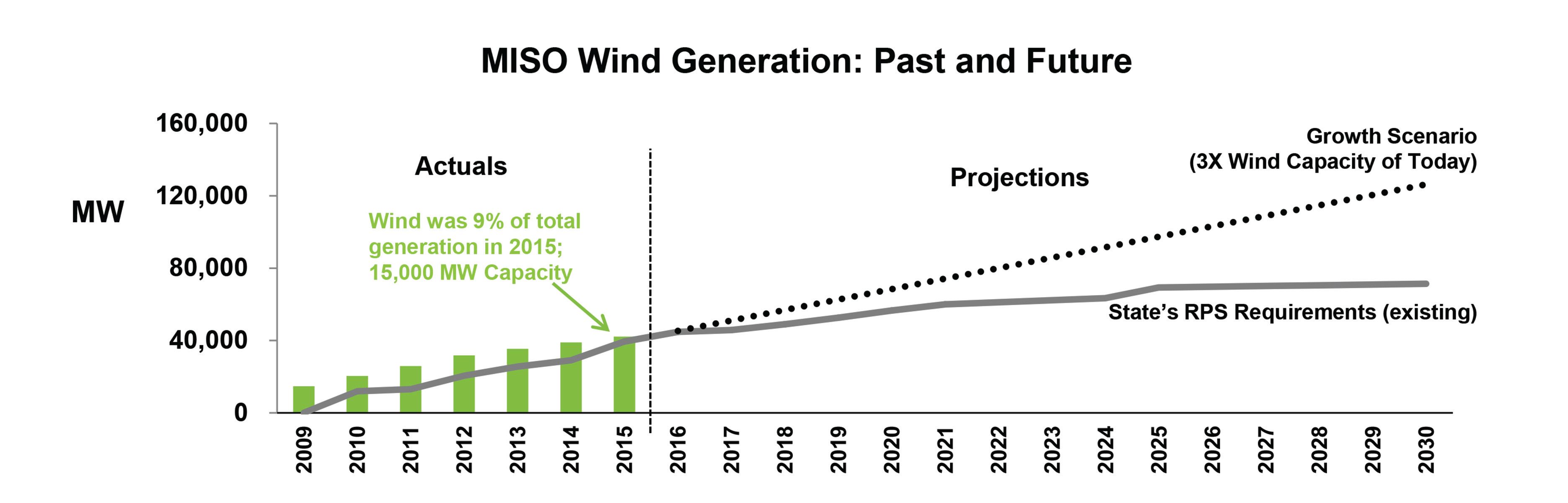

Figure 1: The influence of wind, solar and other factors is significantly altering the market dynamics for natural-gas fired generators. Wind generation projections at MISO show a 3X wind capacity jump within 15 years, well in excess of current state Renewable Portfolio Standard requirements[/caption]

Utilities and independent power producers are preparing for the coming storm — distributed generation (DG). As more rooftops deploy solar, more wind energy goes online and more small-scale combined heat and power (CHP) plants are commissioned, existing power plants are being forced to reconsider their role as part of the larger electrical system (Figure 1). Some are looking at the fast-ramp market, while others are considering ways to supplement revenue through additional services, such as synchronous condensing to remain profitable.

The impact of DG was the biggest takeaway at the bi-annual Combustion Turbine Operations Technical Forum (CTOTF) that took place last month in St. Augustine, Florida. Gas turbine operators from across the U.S. were briefed on a variety of topics, as well. Tracks covered GE E, EA, F and FA turbines, Siemens aeroderivatives (formerly Rolls-Royce) and heavy frame gas turbines (GTs), Pratt & Whitney Power Systems (PWPS) aeroderivatives, Mitsubishi Hitachi Power Systems (MHPS) GTs and GE-Alstom turbines.

Attendees were also treated to additional tracks and sessions covering operations & maintenance (O&M), combined cycle best practices, environmental regulations and generators. Companies, such as Dresser-Rand, Spectra Energy, SSS Clutch, Power Systems Manufacturing (PSM), EthosEnergy, Sulzer and NV Energy, either presented or had their products featured during user discussions.

CTOTF, by design, is a smaller, more diverse user group than many others. Attendees are offered a menu of power plant and industry sessions, and users are treated to much smaller breakouts where anywhere from one to three dozen individuals can discuss ongoing issues with their peers. This more informal atmosphere within the breakouts engenders a greater level of individual participation in discussion groups than can be witnessed at some other events. One user would pitch in concerning a specific problem and several others would either offer up the various solutions they had attempted, or refer the user to the best aftermarket vendor or OEM to achieve resolution.

“Our mission at CTOTF is to be the premier mechanism for the exchange of information to shape, lead and advise the power generation industry,” said CTOTF Chairman Jack Borsch, who is also Electric Utility Director for the City of Lake Worth. “This exchange is critically important as our industry is facing rapid technology change, alternate energy options and a projected shortage of personnel.”

While user discussion predominates, CTOTF brings in speakers representing OEMs and industry experts to brief the group on ongoing trends. The big theme this year was preparing for the coming storm due to disruptive technologies, in particular DG. And who better to talk about grid pattern changes than an independent system operator (ISO). Tag B. Short, Interim Director, South Region Operations, Midcontinent Independent System Operator (MISO), detailed the big shifts affecting his region’s 180,000 MWs of capacity, 1,600 generating units and 66,000 miles of transmission.

MISO is a diverse region with natural gas comprising 38%, coal 41%, nuclear 8%, wind 8% and others 5%. MISO North/Central accounts for 133,000 MW of installed capacity where coal dominates at 48% with gas trailing at 28%. However, in MISO South (47,000 MW), gas is king at 67% with coal at 19%. Short outlined many factors influencing power plants today, including environmental and energy policy, wind, solar, DG, fuel supply shifts, power pricing dynamics, infrastructure investment requirements and industry consolidation. The number of U.S investor-owned utilities has decreased from 100 in 1994 to 47 in 2014.

“We anticipate the retirement of 10,000 to 12,000 MW of coal in MISO,” said Short. “But these coal plants already have all the transmission lines and natural gas supplies coming in so where better to position another plant?”

The problem is that it takes four or five years from a coal plant’s retirement to decommission it and replace it with a combined cycle plant on the same site. In the interim, MISO is seeing decreasing supply

resources compared to the past. If facilities could be built and brought onto the grid faster, some of the pain from coal decommissioning

could be eased, he said.

Meanwhile, gas-fired generation is growing steadily in MISO, particularly in MISO South. From just 6% of electrical generation (MWH) in 2011, natural gas accounted for 23% of all generation by 2015. Part of the increase was due to the addition of MISO South into the overall regional total two years ago. But since that point, total gas MWH has jumped by 6% in MISO.

“2015 significantly eclipsed prior gas utilization,” said Short. “We have seen increases of 35% since 2014 (70% for MISO North/Central) due to supportive gas pricing and changes in fleet composition.”

At the same time, MISO has also seen the rapid rise of MW provided by wind farms. From 1,112 MW in 2006, wind now exceeds 15,000 MW, or 9% of total generation in the region for the year. Current projections envision three times that amount of wind on the grid by 2030.

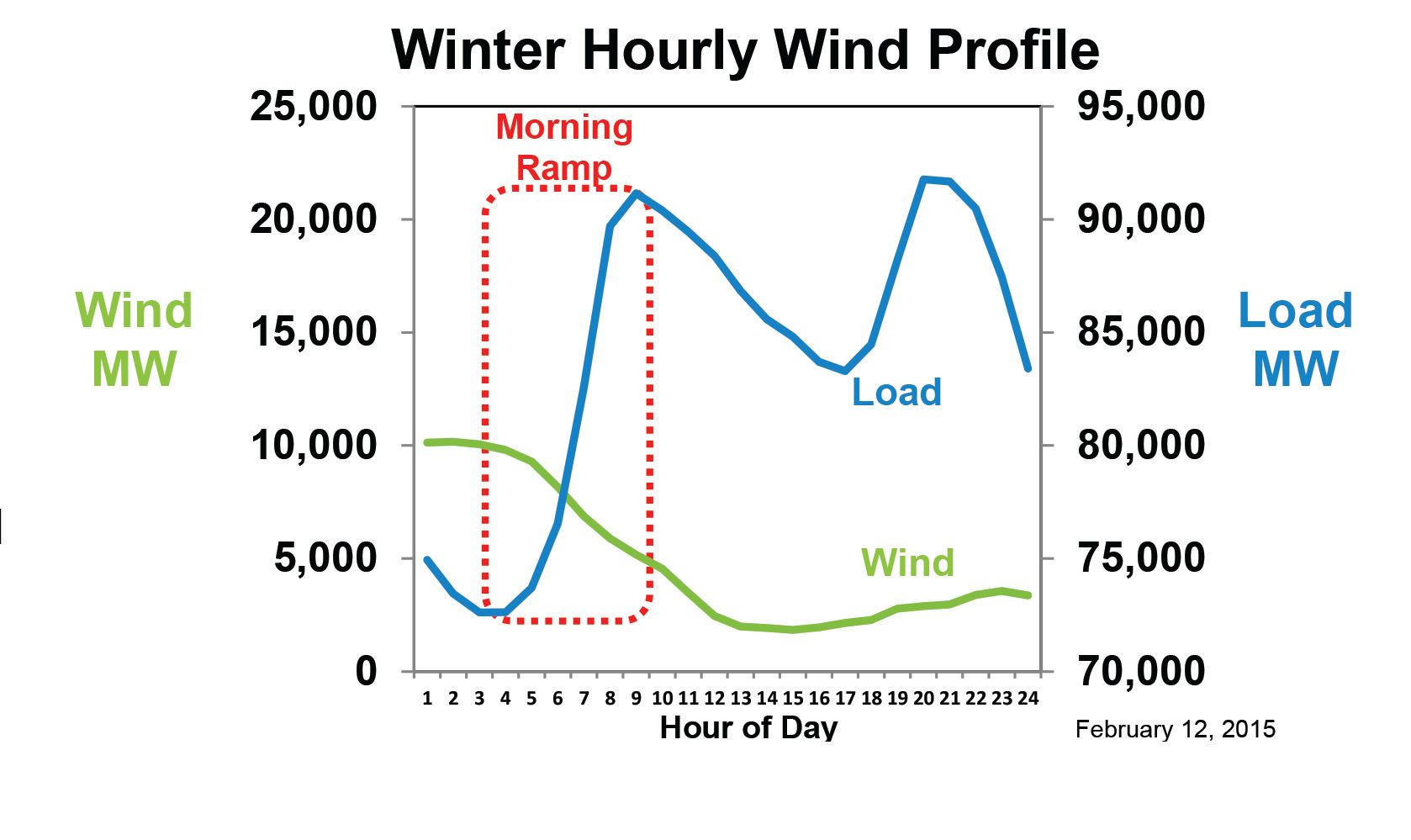

“Wind production can fall off just as load is rapidly increasing in early winter mornings,” said Short. “In the future, MISO expects the challenges of intermittent renewables will be amplified, requiring more flexible gas-fired generation.” (Figure 2).

Figure 2: Wind’s hourly profile in MISO shows a sharp fall off of available wind generation during the morning peak demand period[/caption]

Varying power loads

To add to the challenge, the pattern that load follows during the day varies significantly, depending on the time of year. Therefore, operators are required to use resources differently to ensure the load is served. A further challenge is that MISO’s dispatch varies dynamically within the day with large ramps in the summer and dual peaks on winter days. It is up to gas-fired generation to provide much of the swing, added Short.

Yet another issue within MISO is that the region has over 200 gas-fired generators with connections to 30 pipelines and more than 20 gas distribution companies. Some are connected to interstate pipelines, others to local gas utilities. However, gas flows to power plants from a variety of sources.

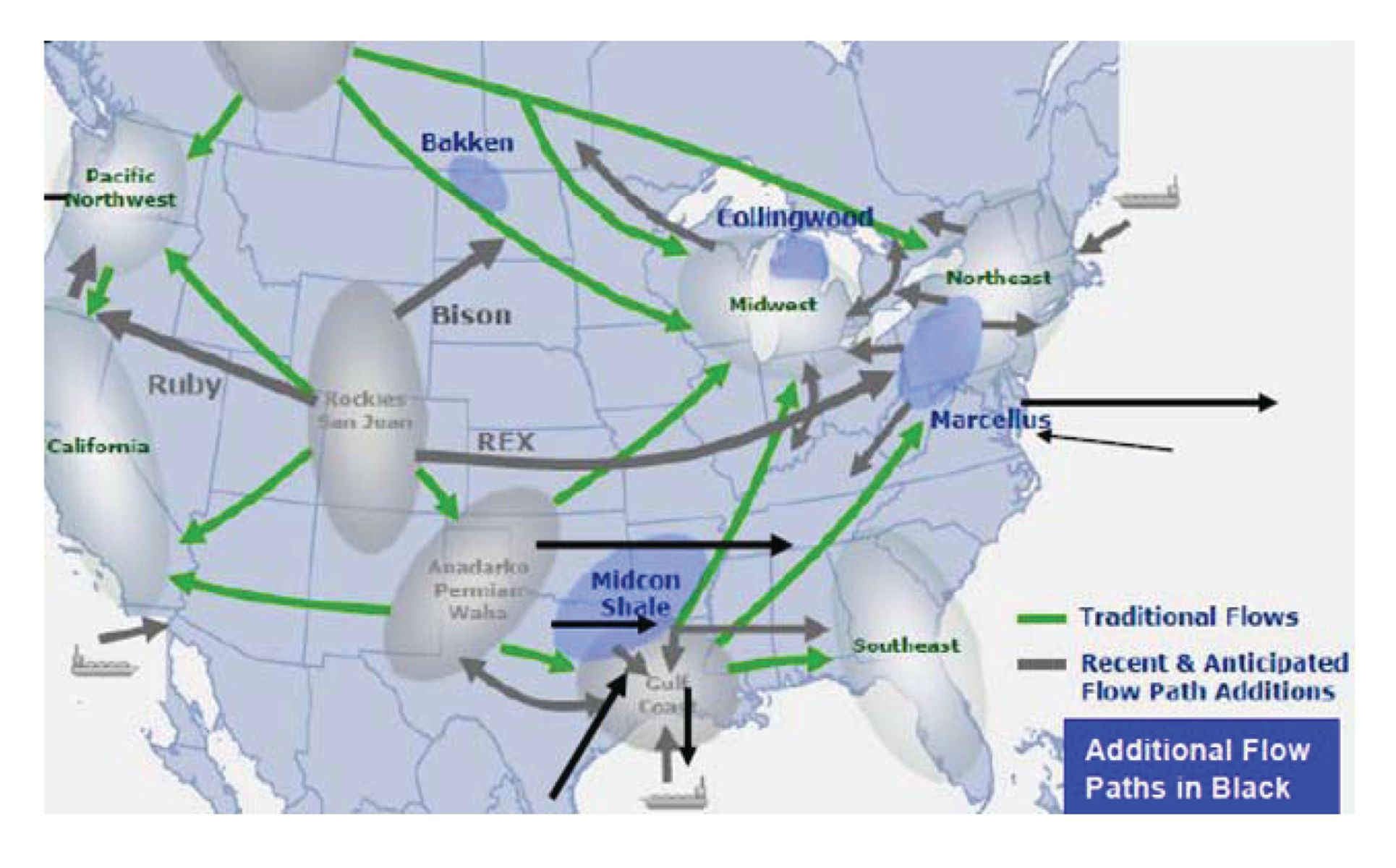

“We need to continue our efforts towards better coordination with gas pipeline operators,” said Short. “Shale gas from Marcellus/Utica gave us a better gas supply at low gas prices.”

This can be seen sharply in the shift in gas distribution within MISO. Historically, gas flowed from few sources in predicable patterns in a specific direction. The network was supplemented by Liquefied Natural Gas (LNG) imports into the Eastern seaboard and the Gulf of Mexico. However, the shale boom has brought about added complexity in the gas distribution landscape. Instead of importing LNG, the U.S. is beginning to export it to areas with high gas prices, such as Europe. Pipelines that formerly transmitted gas from the Gulf Coast, Canada, and Texas to the Northeast and Midwest are now reversing direction.

“Perceived sustained long-term abundance and environmental benefits are driving demand response and LNG exports,” said Short.

Pipeline construction Many pipelines are now being added in various parts of the U.S., said Lew Rutkin, Project Director of Business Development for the Southeast at Spectra Energy, which operates 19,000 miles of natural gas transmission pipelines in North America. He highlighted how shale gas extraction has radically shifted the pipeline requirements throughout the country.

Spectra Energy, for example, is currently building a 500-mile pipeline through Alabama, Georgia and Florida that will provide the Southeast with new energy infrastructure to support regional power generators and the growing demand for natural gas. A graph of annual U.S. pipeline construction showed mileage and capacity additions peaking around 2009. However, based on ongoing and announced projects, the next several years show a return to those prior growth levels.

“Shifting supply sources are altering traditional pipeline flows and driving new construction,” said Rutkin (Figure 3).

Figure 3: North America has seen a major shift in gas distribution patterns in recent years and further change is expected[/caption]

To keep up with growing energy demand, the U.S. and Canada will require an average investment of $26 billion per year (from 2015 to 2035) of midstream infrastructure for natural gas, crude oil and natural gas liquids, or $546 billion in total, over that period. This is based on an April 2016 report by the Interstate Natural Gas Association of America (INGAA).

Utility perspective

Short looked at things from the viewpoint of the grid operator. But the utility perspective on grid disruption can differ in some respects. Steve McInall, Director of Electric Production Resource Planning at Jacksonville Electric Authority (JEA), zeroed in on DG as being one of the most disruptive elements in the energy world.

DG refers to power generation at or near the point of consumption. This eliminates the cost, complexity, interdependencies and inefficiencies associated with transmission and distribution. However, the downside is

forfeiting the economies of scale realized by utility scale generation.

Most discussion of residential electric rates is about how we are paying a little more or a little less than the previous year. But viewed over the long term, a different picture emerges.

“Decentralization of generation was the big innovation of the last century,” said McInall. “Economies of scale and efficiencies lowered the average price of electricity drastically.”

That said, the era of centralization appears to be over, with the trend now

reversing towards a more distributed grid. This is being driven by cost, among other factors. McInall said the price of Photo Voltaic (PV) solar in JEA’s service zone has declined by 75% or more over the

past 10 years.

You would think that with so much sun in Florida and lower cost, that the rooftops of Jacksonville would be overrun with solar panels. Not so, said McInall. JEA’s number of solar customers has been doubling each year but is currently only around 600.

The utility has been having some issues with net metering — the concept of distributed generators giving what they do not need back to the grid and also being able to take from the grid when they do not generate

enough for their own needs. The electric meter, in effect, runs both

ways and you are left with either a net amount owning the utility or a net amount that the utility must pay the consumer. But with solar panels typically being purchased by more affluent customers, net metering can lead to inequities.

“Net metering charges 99.9% of our customers a premium to provide an incentive to 0.1% of our customers,” said McInall. “The utility ends up paying $67 a month on average to those with solar who send more to

grid than they consume.”

Another form of DG attracting more interest in JEA’s territory is CHP. Most CHP projects, said McInall, tend to favor natural gas. With more businesses such as paper mills, beer plants and hospitals in the area looking into CHP, JEA’s policy is to get involved in their discussions, and

help them figure out the economics and the technology.

“If you don’t help, you are losing a 5 MW to 25 MW customer,” said McInall. “The math is similar from project to project: If you can use more than 50% of your waste heat on an annual basis, CHP generally

makes economic sense. In addition, the savings from CHP rise as the electricity price increases or the fuel price drops.”

However, each project is unique and never one size fits all. According to JEA’s numbers, CHP projects using gas turbines are cheaper than those using microturbines and reciprocating engines. But that only holds true from about 3 MW or higher. The addition of DG via solar or CHP also requires utility engineers to model the electric power system differently. Load, resource type and system architecture all need to be accurately assessed.

While CHP plant consumption can vary depending on the needs of the facility, it is solar variability that presents the biggest challenge. The Sunshine State gets clear skies or below 50% cloud coverage for only 26% of the time (assuming 50% for night). In Jacksonville, then, the annual capacity factor for solar PV works out about 18% to 20%. GT coexistence

With so many renewable and DG resources flooding onto the grid, it is up to GT operators to find a way to peaceably coexist with this new reality. That was the theme of a presentation by Jesse Murray, Director of Renewable Energy Programs, NV Energy. “Coal is to be gone in the state by 2019, replaced by natural gas and renewables,” he said.

Murray previously ran a GT plant so understands the issues from all sides. At the moment, Nevada has 58% natural gas generation, 12% renewables, 9% coal, and purchases 22% non-renewables. A total of 57 generating units produce 6.1 GW. Renewables are dominated by geothermal (71%), with solar (18%), wind (8%), biomass (2%) and hydroelectric (1%) as of the end of 2014. Solar surged over 20% last year. Net metering is now available for more than 20,000 customers, with another 12,000 more expected within a month or so.

There are many incentives available to encourage people to put solar on their roofs. The emerging energy market calls for GT operators to change their priorities, added Murray. Flexibility becomes more important, and greater competition occurs in the wholesale and retail markets. “The inherent flexibility and low cost of the GT allows it to provide the backbone for a new renewable energy focused grid,” said Murray. “GTs can provide energy when there is no sun, accept energy when too much is generated, can be used to start large appliances, provide virtual energy storage and can play a vital role in emergency grid response. These are some of the many grid services that utilities can and should be performing.”

He outlined a personal story from his days running the 2x1 Tracy combined cycle plant near Reno, Nevada, which used a steam injected 1x1 6FA GT. Between 2006 and 2015, the operating profile of the facility completely changed from high hours and low starts to many starts but far fewer operating hours. "Once we started cycling heavily in 2010, we saw an impact in 2012 and beyond in terms of lower availability,” said Murray. “Parts limitations in a cycling unit are a real problem; concepts like metal creep become more real.”

Consequently, the plant started conducting biannual borescopes and this shift in maintenance practices caught blade damage that could have been catastrophic if not spotted. Murray advised turbine operators to assess third-party vendors carefully to find those that provide real value in areas such as parts repair. In addition, he recommended listening carefully to field personnel as they know the equipment. He also noted the greater need for condition-based maintenance when the volume of starts rises.

“We went from two boiler tube failures in several years to three in a month,” said Murray.

Synchronous condensing

With so many speakers calling for GT operators to widen their zone of potential services, it was fitting that the CTOTF board invited Morgan Hendry, President of SSS Clutch, to deliver a presentation on synchronous condensing as a way to the maximize value of existing assets.

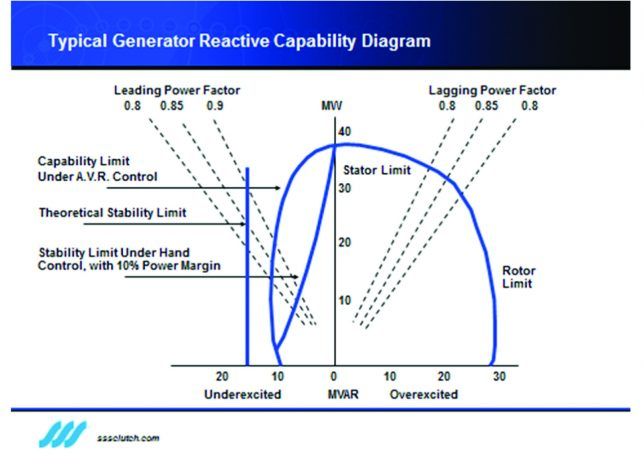

Synchronous condensing is needed for stability as the fact is that every point in the electrical grid does not operate at the same voltage, frequency and power factor. Losses during transmission, or fluctuating supply and demand require constant correction of power quality. With synchronous condensing, a generator is brought up to the speed necessary to synchronize with the electrical system at which point it is then disconnected from the turbine or other driver. The generator absorbs leading volt-amp reactance (VAR) when overexcited and lagging VAR when underexcited (Figure 4).

Figure 4: Typical generator reactive capability diagram[/caption]

In the case of the City of Key West at the western end of the Florida Keys, Hendry said synchronous condensing raises the amount of power available locally. High fuel costs forced the Keys Electrical System (KES) to move from running its own generation plants to bringing in most of its power through dual 138kV transmission lines from a Florida Power and Light (FPL) station in Florida City, 185 miles away. Demand for power But growing demand for electricity and line losses during transmission led KES to use an idle steam turbine generator as a synchronous condenser, which provided up to 34.1 MVAr lagging power and 22.5 MVAr leading power. An SSS Clutch was used to disconnect the generator from the driver once it reached synchronous speed. This boosted the transmission capacity of the line by up to 34 MW, as well as improving grid stability. KES then placed another clutch between a GE gas turbine and generator to enable it to be used for either generation or condensing depending on need.

“With so much wind and solar available, synchronous condensing is needed for power factor correction and to provide needed inertia on the grid,” said Hendry. “Putting synchronous condensers back on the grid helps to add stability and ride through when system disturbances occur.”

He added that LA Department of Water and Power (LADWP) has been adding clutches to LMS100 turbines to prepare for California’s transition from 25% to 50% renewables by 2030. Candidates for synchronous condensing include the generators of aeroderivatives, large frame gas turbines or steam turbines. This works best when the machines are located near load centers or at the end of long transmission lines. While the turbines may be used to serve peak demand, the rest of the time they can be employed as synchronous condensers. To do so, they require a means to accelerate the generator to synchronous speed, and a clutch to detach the prime mover from the generator after synchronization. Such clutches are being retrofitted onto PWPS FT4s, with some users also considering adding them to FT8s.

“Generators operating as synchronous condensers may qualify for spinning reserve requirements or credits,” said Hendry. “This arrangement can complement static capacitors by providing finite adjustment of VARs, thereby reducing the need to switch capacitors off and on, extending their service life.”

Siemens, D-R integration

It has been more than a year since the Siemens and Dresser-Rand (D-R) merger was announced, with Siemens also picking up Rolls-Royce (RR) aero-derivative assets late in 2014. Duncan Swan, Vice President of North America Services Sales for Dresser-Rand, provided an overview of the integration process. “This is a complex merger and it will take time to fully integrate D-R and Siemens,” said Swan.

He outlined the complexities being faced, both culturally and organizationally, which, he said, are to be expected in a merger of this scale. These, he said, were being addressed by taking the best-of-the-best from each company. For example, Siemens has a Product Competency Center (PCC) where they undertake repairs, and control and promote upgrades. This ensures machines being repaired are also considered for the latest upgrades. Swan believes the D-R business can benefit from applying this process to the compressor fleet. Additionally, Siemens has extensive expertise in long-term service contracts that D-R can learn from and apply to its compressor and turbine fleet. Dresser-Rand typically addressed the compressor within a train. Now, with its expanded portfolio of products and services, it can provide a single point of contact for the entire train and auxiliaries.

On the other hand, Siemens traditionally favored a more centralized business model, such as the PCC referenced above, compared to D-R, which has focused on localized service and support. Swan said Siemens, which had already started on a path toward a less centralized model, will accelerate this transition using the D-R infrastructure to better support clients locally.

Many users of Trent aeroderivatives were in attendance at the presentation. Some expressed concern that packaging will be moved from the facility in Mount Vernon, OH to Europe. However, Swan noted that packaging can be executed virtually anywhere. What is important is that parts and service will remain in Mount Vernon, along with engineering and project management experts. Other users complained about delays experienced in receiving spare parts for Trent engines. An effort is underway to industrialize the Trent supply chain, said Swan, so they do not have long delays due to having to qualify all their parts based on aviation regulations. Within five years, this transition should be complete. Trent turbines, however, will continue to benefit from innovations introduced in the aviation sector.

Swan concluded that with the large installed base of approximately 130,000 units (D-R has 96,000 units; Siemens 33,000 and former RR Energy Division 4,200), the global service support network and the broad range of products and services, there is undoubtedly much to be done.

Case studies

Many of the breakout sessions during CTOTF zoom in on how to fix turbomachinery issues and repair parts. For example, one session took up 7F part repair case studies. Marty Magby, Senior Chair for GE Large Frame Roundtables at CTOTF and Manager of Combustion Turbines at Westar Energy, kicked things off with a case study about an RO blade change out in a 7FA compressor. Heavy rubs and cracks were noted on first-stage blade tips. This simple cycle, dual-fuel machine went into service in 2001. It had a high starts, low hours operating profile. Annual borescopes were being done. He purchased replacement R0 blades from Power Systems Manufacturing (PSM).

“PSM had done this in another plant so I could verify that the new blades functioned well,” said Magby. He recommended that users committed to taking out blades should be prepared to find further damage once they begin. That’s why it’s best to do a thorough borescope in advance to minimize the potential for surprises. Since that repair, the turbine firing temperate has been successfully raised from 2380°F to 2420°F.

EthosEnergy and Sulzer were involved in another repair of 7FA compressor rotor disks 12 through 17, said one user. This machine had 2,600 starts and 20,000 hours of services. Sulzer performed the inspection, finding cracks on those rotor disks. A friend in another facility recommended that EthosEnergy be brought in to fix this problem. But Sulzer, in the meantime, was able to do some blending repairs to keep the unit in service until such time as the disks were to be sent to EthosEnergy.

Further issues discussed by the group included combustion tuning, meeting emission limits, running evaporative coolers, shim migration, leaking fuel nozzles, and the value of borescope inspections in convincing management of the need to shut down a turbine for an overhaul or repair.

A breakout session brought together PWPS users, most of whom ran three or more FT4s or FT8s. Raul Romero, Director of FT8 and FT4000 Aftermarket Services at PWPS, said the company now had access to a service and overhaul shop joint owned by EthosEnergy and PWPS parent company Mitsubishi Heavy Industries (MHI). “We are looking to see where we can collaborate with Mitsubishi in areas such as the MobilePac,” said Romero. “We are also now using some MHI generators as well as the Brush generators we normally utilize.”

The move under the MHI umbrella has increased the sales and customer service presence of PWPS around the world, he said. The company established an Algerian office with 15 staff in October 2014 to service a fleet of 54 MobilePacs, with plans to add another 5 to the staff. An Argentinian office began earlier this year to service users in South America. PWPS has been taking steps to increase its presence and responsiveness. This includes a new spares manager on post, several new account managers for spares, and controls upgrades, such as a new control system architecture using Woodward elements. The company offers training (either on site or offsite) in areas such as general familiarization, operations, maintenance, controls, borescope, control house and Woodward controls.

“Hot section nozzle and burner can replacement can be done in the field, as well as exhaust case replacement and gas carbon seal replacement,” said Romero. “You can also carry out an exhaust lube oil system piping flush, an output shaft alignment or a collector box alignment within a day or two.”

PWPS fleet

The PWPS fleet is comprised of 556 units of which 493 are operating, 21 are being commissioned, and 38 are either retired or used as spares. The company is giving particular emphasis to its latest model, the FT4000. To date, three have been delivered. One is in Argentina with the other two FT4000 SwiftPacs running at the Exelon Perryman Plant in Maryland. This 120 MW peaking facility has run for 1,700 hours to date. CTOTF meets twice per year, once in the spring on the East Coast and one in the fall in the West. The next event will be in Rancho Mirage, California between September 11 and 15, 2016. For more information visit www.CTOTF.org