Tough Times Ahead for Power Generation

POWERGEN 2013 DEBATES COAL’S STRUGGLES, DEMAND RESPONSE, DISTRIBUTED GENERATION, RENEWABLE CHALLENGES, NEW BUILD AND AERO FLEXIBILITY

The PowerGen 2013 show in Orlando, Florida featured over 21,000 attendees, 1,400 exhibitors and more than 200 speakers who highlighted the vast changes in the marketplace and the shape of the grid going forward.

Featured keynote speaker, Peter Delaney, Chairman, President and CEO of OGE Energy Corp (parent company of Oklahoma Gas and Electric), said that U.S. industry must enhance the relevance of the grid due to an uncertain future. The tactics developed by his organization are to build no new capacity until after 2020 and instead focus on demand response.

With 7,000 MW of capacity, OGE has a portfolio comprised of 40% unscrubbed coal, 10% wind and about 50% natural gas. Delaney said market volatility was at an alltime high due to low-to-negative growth in electricity consumption, federal preference toward renewables and tighter CO2 regulations, which are forcing tough decisions upon coal plant owners.

“We have 55 months to comply with EPA CO2 standards at our four coal units,” said Delaney. “These are uncertain times for an industry in transition. Therefore, it is best to stay away from long-term bets and find less-capital intensive alternatives.”

For OGE, that means a focus on investment near the customer, such as the installation of 800,000 smart meters in homes and businesses. These devices let consumers see what their increased costs are buying them. They can then choose how they use power and tailor their usage to the rates they prefer to pay. OGE also feels it is vital for the utility of the future to ensure high quality power is available to the user.

That strategy is important, he said, in light of the romanticized notion of going off the grid.” If utilities allow their rates to be driven up, the grid itself could be made less relevant. So despite burdensome legislation, power producers have to figure out how to keep costs down, especially through a drive towards higher efficiency.

During peak times, for example, thermostats in smart meters can respond to customer decisions on pricing based on price signals from the utility. This initiative has already saved OGE 70 MW in peak demand in its first year and 126 MW in its second year.

“We have to rethink our business model, our overall regulatory model and our customer model,” said Delaney. “We have transitioned from thinking of people as rate payers to considering them our customers.”

Future generation

Developing markets will be Fluor’s target in the coming years. With the Earth’s current population of 7.28 billion due to surpass 9 billion by 2040, 75% of that growth will take place in Asia and Africa, said David Dunning, Group President for Business Development and Strategy at Fluor Corp. Yet there are already a billion people in those regions that do not have electricity. For many of those without power, gas is not available. That’s why coal is predicted to still be producing 40% of world power output in 2040.

Dunning pointed out that despite the great number of gas plants constructed over the past two decades, gas’s piece of the worldwide pie has only increased by about 4%. It is the same with renewables. Even with spectacular worldwide growth that expands renewables 5X by 2040, they will be contributing no more than 5% of total global energy.

“Gas is not the default answer in all parts of world,” said Dunning, “and 5X renewable growth doesn’t move the needle much in terms of the world energy picture.”

That said, Fluor embarked on a solar power program in 2009, focusing initially on Concentrated Solar Power (CSP). However, photovoltaic (PV) panel pricing has dropped dramatically so the company has changed over to that technology.

Amy Ericson, President of Alstom U.S., thought the U.S. could learn some energy lessons from the rest of the world. Instead of eliminating coal entirely, the UK is pursuing clean coal via carbon capture. Meanwhile, the French and Germans are aggressive on the offshore wind front. The energy policies of these countries reflect these priorities.

But Europe gets it wrong as often as it gets it right. Case in point: the German government’s closure of nuclear after Fukushima actually led to a 2% hike in emissions and has driven up energy prices.

“We need to be investing more in existing fleets,” said Ericson. “We must make today’s fleets as clean, reliable and efficient as possible.”

She pointed to Asia, which has the world’s most advanced ultra-supercritical coal plants, which claim 25% efficiency.

The final keynote speaker, James Rogers, Chairman of Duke Energy Corp., achieved the distinction of being voted the most influential person in power over the last 25 years.

He offered a history lesson: the utility monopoly days were first eroded by the National Energy Act of 1978. Prior to that, vertically integrated and regulated utilities ruled the roost. But the Public Utilities Regulatory Policies Act (PURPA) led to 60,000 MW of additional generation capacity. With the generation monopoly gone, we have gradually seen the transmission system follow suit.

Now, said Rogers, it’s the turn of the distribution monopoly to go by the boards. “The 20th century was all about electrification of the country while the 21st century will be about modernizing the grid.”

He called for closer collaboration to change the regulatory model, build a more resilient grid using micro grids to prevent cascading shutdowns, safeguard against cyber-attacks and proof the system up against the weather. As that takes a lot of money, the utilities will have to step up and make grid resiliency a central element.

Integration

Justin Zachary, Director of Power Technology, at EPC contractor Samsung C&T Corp., covered the challenges in combined cycle integration of the latest H- and Jclass gas turbines. These turbines, he said, are strikingly different from earlier models, not the least of which is their achievement of 60%+ efficiency.

With coal being driven out of the picture in many parts of the world, the sheer size of combined cycles makes them an obvious choice for a utility-sized alternative to a largescale aging coal plant. They offer the allure of more than 1,300 MW in a two-by-one combined cycle plant. Additionally, the J- and Hclass provide 30% more exhaust flow than the F-class as well as higher exhaust temperatures and better part-load efficiency.

“The MHI J-class and Siemens H-class have accumulated sufficient hours to show reliability,” said Zachary. He explained some of the challenges in integrating these larger machines into combined cycle operations.

In combined cycle, he said, you have to take into account the exhaust flow and temperature as well as the power output and heat rate. He recommended conducting a complete operational profile of these factors to include fast startup of the plant and its performance at various loads. The final goal is to obtain the lowest possible levelized cost ofelectricity (LCOE), which he said, is the duty of the EPC provider.

“In countries with limited or no natural resources, such as Japan and Korea, where fuel represents 60% to 80% of LCOE, high efficiency combined cycle designs represent a viable and economical way to produce electricity,” said Zachary.

Supporting solar

The past year has seen a surge in utilityscale solar power construction in the U.S. The 400 MW Ivanpah Project near Las Vegas and the 800 MW concentrated PV (CPV) Sentinel Energy Project in Southern California are a couple of examples.

But Thomas Mastronarde of Gemma Power Systems mentioned a little-known fact. These renewable showcases typically harness gas turbines to enhance their operating flexibility and reliability.

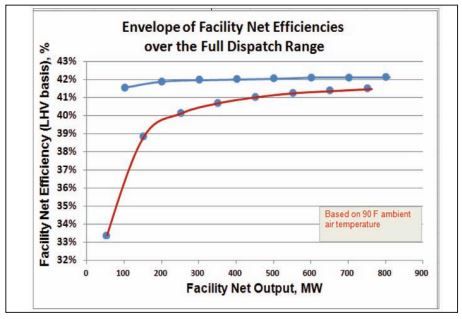

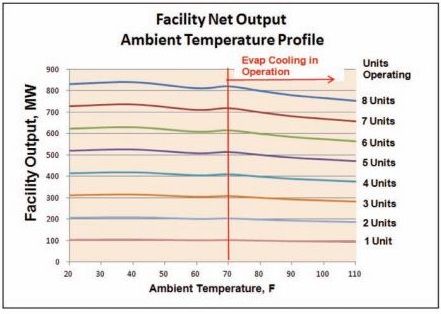

In the vicinity of Palm Springs where wind and solar are in heavy evidence, Gemma Power has erected eight GE LMS100 machines, each of which runs 2,800 hours per year as peakers (Figure 1). As they operate in desert environment, they use inlet air cooling above 70°F (Figure 2).

Figure 1: Facility net efficiency

Figure 2: Inlet air cooling is used on all eight LMS100s when inlet air temperatures exceed 70°F[/caption]

For the balance of plant (BOP), Gemma went with individual wet cooling towers rather than the original design of a centralized cooling tower system. The latter proved to be inefficient in terms of cost, space, money and power consumption. Reason: a centralized cooling tower system for the turbines requires common circulating water pumps. Each LMS100 also has an on-skid intercooler circulating pump for the cooling tower.

Due to gas pressure constraints, centrifugal compressors are the usual companion of the LMS100. But they could not be used in this case as they required too much exhaust recirculation, energy consumption and cooling. So Gemma used reciprocating compressors on each turbine. This, said Mastronarde, saved 1-to-3 MW in power consumption at the site.

On the emissions front, the plant achieves its NOx emissions target 25 minutes after startup without electric pre-heating of an ammonia vaporizer. Instead, it uses hot gas recirculation. Further innovations include a zero-liquid discharge system. Waste water is stored in a large tank with five days capacity at peak consumption. “We have the flexibility to bring 50 MW to 800 MW online within 10 minutes to support the region’s growing renewable resources,” said Mastronarde.

Grid support

Jonathan Li, Senior Manager of Power Generation and Aftermarket at Rolls-Royce, was another who extolled the virtues of aeroderivatives in grid support and renewables. As they generate power at a medium voltage instead of high voltage, there are lower line losses and higher efficiencies.

Aeroderivatives, after all, come from aircraft engines which are specifically designed for cycling. The same disks are used in the aircraft and industrial versions, although the combustors are different and extra turbine blades are added to convert more energy faster.

“Historically, aeros have been viewed as peaking units, but they are moving more into flexible applications,” said Li. “They operate very well in a single shaft combined cycle configuration where you can provide a high level of pre-design for the power island.”

Lars-Uno Axelsson, Chief Engineer of Development at Opra Turbines discussed the use of alternative fuels, such as wellhead gas and biomass-based fuels in the OP16 gas turbine. While these fuels are sometimes cheaper, and are sometimes available as a byproduct at various sites, they come with challenges, such as low heat content, the tendency for the composition to change suddenly, and the potential for components degradation.

He gave the example of an oil site in Siberia using the OP16. The flare gas at the wellhead is very sour, containing heavier hydrocarbons with a composition that varies over time. The turbine has been running untreated flare gas for over 50,000 hours without overhaul despite a high H2 content (up to 4% volume).

OPRA has also been successful in operating with low-calorific fuels, low-BTU gases and liquid fuels. In the latter case, the turbine is modified to deal with a larger fuel volume. In one case, the company has been burning pyrolysis oil from wood chips, which has high viscosity and low energy density. This fuel is acidic and contains particles, which easily creates sediments.

“It requires a long time for complete combustion so we needed a larger combustor,” said Axelsson. “But it is possible to burn pure pyrolysis oil at 70%-to-100% load while maintaining NOx emissions at the same level as for diesel fuel. We can also burn diesel and ethanol using this same combustor.”

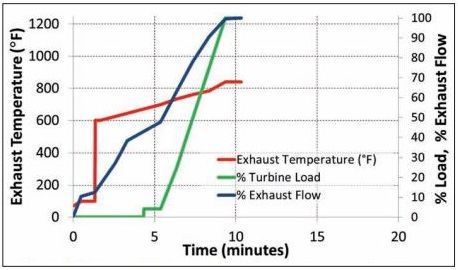

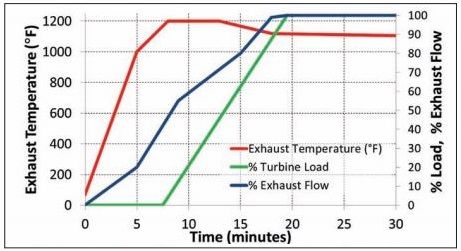

Kelly Flannery, Chief Thermal Engineer at Vogt Power, covered the heat recovery steam generator (HRSG) side of combined cycle generation. His solution to flexible operation is to combine aeroderivative turbines with once-through steam generators (Figures 3 and 4).

Figure 3: Trying to harness large frame GT’s for fast start presents challenges for HRSG design[/caption]

Figure 4: Aeroderivatives may be better suited to modern fast start requirements

“You have to have a durable HRSG with a robust life expectancy for a gas turbine engaged in heavy cycling,” said Flannery. “The steam balance of plant needs to have systems that can accept rapid load change, especially the steam turbine bypass system.”

He explained that the steam turbine is typically the bottleneck. Therefore, plant designs have to be based on the steam system’s limitations. For example, you need a superheater and reheater capable of a specific number of startup cycles and hours at elevated temperatures. This is critical due to modern high temperature exhaust turbines. “Large frame turbines in combined cycle mode have a very high exhaust temperature which is a big challenge for the HRSG,” said Flannery. “With aeroderivatives and small industrial GTs, you rarely get above 800°F versus 1,200°F in large frames”.

Frank Schneider, Program Manager for Siemens, talked about the company’s SGT- 2000E Series. This E-class engine (115 MW at 60 Hz and 172 MW at and 50 Hz) has been in production for over 30 years with more than 300 engines sold worldwide. Siemens has added wet compression into the turbine in recent years to provide an additional power boost.

“No engine damage occurs by putting in water for wet compression,” said Schneider. “However, you have to understand droplet sizes, nozzle types and positions, and utilize demin water.”

This E-class machine can run on most fuels. Most recently, it has been modified for crude oil. This entailed some minor changes such as a modified fuel treatment system and a turbine wash system.

Replacement parts

In today’s challenging high temperature and rapid cycling, fast start climate, replacement parts can become a big issue. Alexander Hoffs, President of Power Systems Mfg, LLC (PSM), owned by Alstom, said his company has expanded its product range to include combustion systems and compressors. Additionally, the company offers a 7FA machine performance upgrade package which is currently running in a 2-on-1 facility. “Our parts are mostly retrofitable into an existing frame, and they are not large scope upgrades,” said Hoffs.

After designing a replacement part, PSM typically validates it for 8,000 hours in a customer site. However, the 7FA upgrade package has been under validation for two years and 17,000 hours with very good results. According to Hoffs, it has produced a 4.3% power increase, which amounts to an additional 22 MW on a 2-on-1.”