Turbomachinery Symposium: Where the industry meets

There is no show on the calendar like the Turbomachinery Symposium for

bringing together

all the key players of our field — a technical gathering that

represents the heart of our industry.

This year’s meeting featured in-depth

discussions about compressor repair, steam turbine efficiency, subsea

reliability, compressor diaphragms, high-performance bearings and offshore

inlet-air filtration. Included were contributions from Dresser-Rand (DR),

Siemens, GE, Southwest Research Institute (SwRI), GE Lufkin, ExxonMobil,

Solar Turbines, Clarcor Industrial Air, Camfil and MAN Diesel & Turbo.

Organized by the Turbomachinery Laboratory (Turbo Lab), part of the Texas

A&M Engineering Experiment Station (TEES) & The Texas A&M University

System, the symposium comprised 19 lectures, 20 tutorials, 28 discussion

groups and 18 case studies as well as 350 exhibiting companies.

“This is the premier conference for turbomachinery and pump professionals

developed for the industry and by the industry,” said Dara Childs, Director of

the Turbo Lab.

“Our goal is to promote professional development, technology transfer, peer

networking and information exchange among industry professionals.”

“Market challenges” was the focus of keynote presentation. Lennart Nilsson,

head of technology in the new DresserRand (DR) business within Siemens

Power and Gas, began by reminding the audience on just how much change

has occurred over past 12 months. In that time crude oil has declined from

$100 per barrel to less than $50 and Siemens acquired both DR and the

Rolls-Royce aeroderivative business (RR).

“Oil and gas companies are decreasingtheir investments and reducing

CAPEX,” said Nilsson. This means that many greenlighted projects will either

be delayed or will have to be revised considerably in order to find a way to

do them more cheaply.

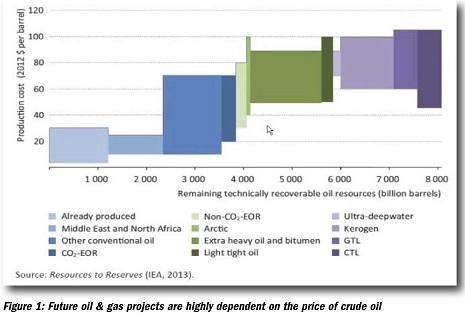

“Low oil prices will shut high-cost production technologies out of the

market,” said Nilsson. “Long term, if oil prices remain at current levels, a lot

of pressure will be put on oil and gas producers to innovate and to find ways

to bring costs down via collaboration.”

He added that the threshold for economic recovery of around 50% of

remaining global oil resources is $60 per barrel.

He cited various oil

producers that have announced cutbacks as well as tactical shifts to move

their investments to easier projects. They are scaling back efforts in oil sands,

the Arctic and deep water to focus on the extraction of more economically

sound oil reserves (Figure 1).

“The rotating equipment industry must respond with reduced CAPEX, no

more project overruns, higher efficiency, flexibility and the delivery of

integrated solutions,” said Nilsson.

This is particularly relevant to

Siemens as it just invested a considerable amount on its D-R and RR deals.

While this positions the company to compete more broadly in the oil and gas

market, the timing of the oil price could not have come at a worse time. But

once the company rides out the current market challenge, it has a portfolio

now that includes micro LNG technology (LNGo), medium- and large-sized

LNG (BOG and EFG compression), and floating LNG. Nilsson reckons the

market sweet spot right now for LNG is in the 1- to 3 MTPA category.

Siemens also possesses a hermetically sealed compressor for up-stream

business especially for asset sour gases which already has 18,000 hours in

operation in an onshore production plant. It can also be used for enhanced oil

recovery (EOR) and CO2 injection. But with cash so tight at the moment,

Siemens is giving attention to the services space. Nilsson touted his

company’s ability to recondition existing rotating equipment to make it

suitable for variations in plant capacities, gas compositions and other

changing client needs. And regardless of the ups and downs of the economy,

he remains bullish about overall prospects.

“Oil and gas is the backbone of the world’s infrastructure and industry, and

rotating equipment is the backbone of the oil and gas industry,” concluded

Nilsson.

Read more in the November-December 2015 issue of Turbomachinery International