U.S. POWER INDUSTRY OUTLOOK 2018

By Britt Burt and Brock Ramey, Industrial Info Resources

Elections have consequences, and Donald Trump as president has brought significant changes to the U.S. power industry. President Trump spent much of 2017 rolling back the Obama Administration’s energy and environmental policies. While the new president’s moves may stop the bleeding in coal country, there are questions about whether presidential power can overcome the power of markets.

The results of the November 2016 presidential election surprised many. As we predicted in last year’s Power Industry Outlook report, the trajectory and velocity of change in the power generation business likely would turn on what voters decided.

In choosing the new president, voters set in motion a complex set of changes with the potential to fundamentally reshape the power industry. As a candidate and as president, Trump has railed against regulatory overreach, sought domestic energy dominance and heralded an “America First” agenda anchored in job creation.

In the first year of his presidency, Trump has been active on issues affecting the electricity business. Most notably, he signed an executive order to withdraw and rewrite the Clean Power Plan (CPP).

In another early move, he mandated the accelerated review of high priority infrastructure projects for transmission and pipelines. He also nominated four new commissioners to the Federal Energy Regulatory Commission (FERC), ending a seven-month period when no vote on interstate energy projects could be taken because the commission lacked a quorum.

But for all these early actions, it remains an open question whether President Trump can overcome market forces. The early answer from power generators appears to be “no.”

Export markets boost coalMore coal was mined during the first quarter of 2017 compared to 2016. But that surge in production did not derive from U.S. asset owners switching to the black rock. Export markets, chiefly in Europe and Asia, drove increased production. The U.S. Energy Information Administration (EIA) expects full-year coal exports to be up 19%, or about 72 million short tons.

In the U.S., news organizations surveyed executives at coal-burning utilities. They asked if the president’s moves to boost coal would affect their long-range generation plans. Only one said, “maybe.” Dozens said, “no.”

The battle for the burner tip continues to be highly competitive. A slight increase in natural gas prices can cause some asset owners to switch to coal. And vice versa. But a secular reversion back to the days of centralized coal-fired generation? No way.

“I would be very surprised if any utility built a new coal-fired power plant in the next few years,” a D.C.-based energy lawyer and lobbyist told a mid-year power industry conference. Echoing predictions made by others earlier in the year, she added, “There is a consensus that carbon regulation is inevitable, it’s just a question of when. Given that, who wants to take that billion-dollar gamble?”

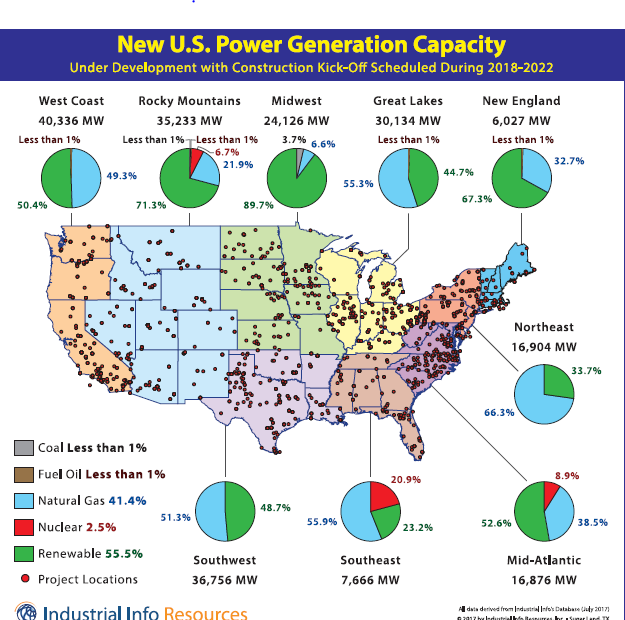

Power development plans show renewable and gas-fired generation are virtually the only types of power plants the industry plans to build over the 2018-2022 period. On a national basis, renewable energy projects are expected to account for 56.7% of all new power plants build over the next five years. Gas-fired generation will account for 42.3% of all power-plant construction starts between now and 2022 (Figure).

Nuclear and coal, by contrast, amount to slightly less than 1% of all new-build power projects scheduled to begin construction between 2018 and 2022. That number may fall even further. Plans to build two new units at the Virgil C. Summer Nuclear Power Station have been abandoned. And the troubled Kemper County Integrated Gasification Combined Cycle (IGCC) plant in Mississippi has been ordered to stop gasifying lignite and instead burn only natural gas.

Across the nation, the regions with the largest proportion of renewable power plants scheduled to begin construction between 2018 and 2022 are the Midwest, the Rocky Mountains, New England and the Mid-Atlantic. The Southeast, Northeast, Great Lakes and Southwest regions will see lower percentages of renewable energy projects during the next five years.

Between now and 2022, the regions where gas-fired new construction is expected to dominate are the Northeast, Southeast, Great Lakes and Southwest. Whatever their fuel type, though, there are fewer central station power plants scheduled to be built in the near future than has been the case in prior years.

Despite retirements and planned retirements of tens of thousands of megawatts of coal-fired generation, several factors have held down construction of new generation. This includes aggressive pursuit of energy-efficiency targets, more efficient appliances and the proliferation of distributed generation.

A mid-year study by the U.S. Energy Information Administration (EIA) showed declines in total residential electric sales, sales per capita and sales per household between 2010 and 2016.

Increasingly, utilities that are shuttering smaller, older and less-efficient coal-fired generators are turning to a combination of smaller gas-fired plants, renewable generation, customer efficiency programs and new pricing schemes to keep the lights on. That is the case at heartland utilities, such as Kansas City Power & Light and Omaha Public Power District, as well as farther-flung utilities in West Virginia, Arizona, Oregon and Florida.

New-build construction will also be affected if more utilities figure out economically advantageous ways to accommodate customer demand for rooftop solar and other forms of distributed generation.

Natural gas leads the packNatural gas is expected to keep its lead at the top of the fuel charts for utility-scale generation in 2017 and 2018, though its lead over coal is expected to slip a tad. The EIA forecasts that gas will fuel 31% of utility-scale generation in 2017 and 2018, down from 34% in 2016, the first year it dethroned King Coal.

A slight uptick in gas prices and the growing competitiveness of renewable energy will combine to cost gas about three percentage points of market share, the agency noted. Coal’s share of the fuel mix is expected to tick upward slightly, to 31% in 2017 and 2018, up one percentage point from its share in 2016.

Nuclear power will supply slightly less than 20% of U.S. electricity in 2017 and 2018, maintaining its traditional market share, the EIA said in its July 2017 Short-Term Energy Outlook. But nuclear’s share of the electricity mix is expected to decline over time as unit retirements surpass new capacity coming online.

Coal welcomed candidate Trump and rejoiced at his election. The industry hoped he could do something to improve the lives of coal miners, coal companies and the communities that depend on the extraction of coal.

As with other aspects of his energy agenda, the president will have to triumph over market forces if he wants to restore coal’s lost place in America’s energy economy. Tougher environmental regulation has certainly hobbled coal. And low-cost natural gas has certainly eaten into coal’s traditional share of the market.

But automation has been an important factor affecting coal miner employment. Between 1985 and 2015, U.S. coal production rose slightly but coal miner employment fell by about 109,000.

According to the EIA, U.S. coal miners produced about 884 million short tons of coal in 1985. That year, there were 173,700 coal miners, according to the Federal Reserve Bank of St. Louis. Each miner produced about 5,089 short tons of coal. Fast forward 30 years and production was 897 million short tons but only 64,400 miners employed: Each miner was responsible for about 13,900 short tons in 2015.

However, coal can expect the inhospitable power market in the U.S. to continue. IIR tracks about 938 MW of new coal-fired generating capacity scheduled to begin construction over the next five years.

New-build coal capacityMost of that new-build capacity will be at Unit 2 of the Holcomb Power Station, owned by Sunflower Electric Power Corp. The Kansas-based plant has cleared a gauntlet of regulatory and legal challenges, and construction is scheduled to begin in 2020. However, problems in obtaining financing, coupled with the low cost of natural gas will likely delay the start of construction.

In addition to a scarcity of new build, there has been a slowdown of in-plant capital and maintenance project spending. Asset owners are considering upgrades every 24 to 36 months instead of on an annual basis.

Most coal-related capital spending over the next five years is expected to go to in-plant capital projects, such as efficiency upgrades and demolition of shuttered plants, as well as the installation of environmental controls. This is being done to comply with NOx, Hg, coal combustion residuals (CCR) and effluent limitation guidelines (ELG) regulations.

On the new-build side, hopes that IGCC technology could spur construction of additional units have been dashed by the poor performance of the Edwardsville plant in Indiana and the cost overruns and in-service delays experienced by the gasifiers at Mississippi Power’s Kemper County IGCC plant. Those balky gasifiers eventually forced the utility to participate in settlement negotiations that could preclude billions of dollars of investment in the gasifiers from being recovered from customers in rates.

If Kemper County is forced to burn only natural gas at its facility, it would be the world’s most expensive gas-fired plant, at a cost of about $12.9 million per installed megawatt. Note that this figure also includes the cost to build lignite mines and a CO2 pipeline to transport the gas to an enhanced oil recovery (EOR) project.

Depending on how the U.S. Environmental Protection Agency (EPA) revises the CPP, stalled new-build projects could receive new life. But as we look at the market, there seems to be little prospect that building a new coal-fired power plant is high on any CEO’s “to do” list.

Meanwhile, coal plant closures continue to be announced by utilities across the country. During 2017, coal-fired plants closed in Nevada, New Jersey, North Dakota, North Carolina, Massachusetts and Indiana. Closure announcements continued to pile up.

Phoenix-based Salt River Project (SRP), a public power and water authority, earlier this year announced it was closing the largest coal-fired plant in the West, the three-unit, 2,250-MW Navajo Generating Station (NGS). That facility will go offline by the end of 2019.

For years, NGS owners negotiated with the EPA on ways to lower emissions of oxides of nitrogen (NOx) from the plant, located about 20 miles north of the Grand Canyon. The EPA asserted emissions from NGS were impairing visibility at the Grand Canyon and other Class 1 areas in the region.

A few years ago, the owners thought they had found a way forward: Shutting one of the plant’s 750 MW units and installing selective catalytic reduction (SCR) equipment on the other units. But ultimately, that plan was undermined by low-cost natural gas.

NGS will not be the only coal-fired plant in the West to close, just the largest. What has been happening there is a mirror image of what has been happening in the Midwest and East: Abundant, low-cost gas, extracted from unconventional formations, coupled with continued declines in renewable generation costs, have overturned long-held assumptions about the cheapest way to generate electricity.

While separate, the ELG and CCR rules intersect, which make it hard to estimate spending on compliance projects. IIR is tracking several billion dollars of ELG and CCR projects scheduled to begin construction over the 2018 to 2022 period. We expect that figure to rise dramatically, perhaps to as much as $5 billion per year. ELG compliance plans range from $23 million to $200 million per facility.

Natural gas outlookNatural gas-fired power plant development continues to grow. Between 2018 and 2022, developers have scheduled construction to begin for about 88,600 MW of new gas-fired generation. Gas power is expected to account for about 42.3% of all new generation capacity built in that period.

The regions that plan to rely most heavily on gas for new-build generation are the Northeast, Southeast and Great Lakes areas, followed closely by the Southwest and West Coast. Those relying less on gas for new-build generation are the Midwest, the Rocky Mountains and New England.

IIR tracks 133 gas-fired power plants scheduled to begin construction over the next five years. These projects represent about $64.7 billion in value. We do not expect all of them to begin turning dirt according to their original schedules.

Nor do we believe all of them will begin operating according to their schedules. But such a full gas-fired power development pipeline means any projects delayed or cancelled should have a small overall impact on the business.

Texas leads all other states in the dollar-value of gas-fired power projects scheduled to be built over the next five years, with 28 projects valued at $15.2 billion. Following Texas are:

• Ohio (10 projects, $7 billion)

• Pennsylvania (7 projects, $5.6 billion)

• California (11 projects, $4 billion)

• New Jersey (5 projects, $3.9 billion)

Further, there is a bevy of billion-dollar gas projects scheduled to be built over the next five years, including facilities in Florida, Ohio, Virginia, Utah, New Jersey, Pennsylvania, Illinois, Texas, and Indiana.

Shale gas continues to soar

Power developers in several regions are relying on low-cost gas extracted from one or more unconventional formations, such as the Marcellus, Utica, Eagle Ford, Haynesville, Niobrara or Barnett shales, as well as the Permian Basin. Gas is abundant, particularly in the Marcellus Shale, which accounts for about 36% of all gas extracted from unconventional formations. Experts expect this number to continue rising.

But getting gas from the field to the burner tip has encountered challenges. Some pipeline projects could not win regulatory approval. Others got caught in a seven-month period when FERC lacked a quorum, and could not make decisions.

The Senate approved two FERC commissioner nominees before it left for its August recess, restoring the quorum. Upon its return from recess, the Senate will consider two additional nominees to the five-member agency that regulates energy in interstate commerce and wholesale power transactions.

During 2017, the first North American deployment of Mitsubishi Hitachi Power Systems Americas (MHPSA) advanced J-Class turbine took place in Oklahoma, at the Grand River Dam Authority. The M501J gas turbine reportedly has achieved efficiencies of up to 61.5%.

The J-Class turbine is said to operate at a lower heat rate than previous technology, resulting in higher efficiency and about a 4% reduction in CO2 and NOx emissions compared to the previous generation. It also can quickly ramp up and down to respond to fluctuations in electric demand.

But all that is good is not necessarily great. The North American Electric Reliability Corporation (NERC) has publicly worried about reliance on gas-fired generation in certain markets, specifically New York, New England, Southern California and Texas.

In each of those markets, more than 50% of electricity is generated from natural gas. During unusually cold winters, NERC is concerned that such reliance could be a problem.

NERC is nervous as electric reliability can be threatened in several ways. This ranges from: A breakdown in gas storage capacity, like Aliso Canyon; extreme weather as in another Polar Vortex; a price spike caused by rising gas exports; or an exogenous factor like an environmental ruling against hydraulic fracturing. These kind of black swan events could drive up gas prices, undermine the economic rationale of the decade-long “dash to gas,” and potentially lead to a breakdown in electric reliability.

Utility executives and regulators continue to express support for fuel diversity and an “all of the above” fuel strategy. But when the rubber hits the road, the lowest-cost option is usually what gets built. For about a decade, gas has been one of the lowest-cost generation options around.

Why has gas-fired generation been a big winner for so long? It’s not just because of its own merits, but because it has backed up intermittent generation options such as renewables.

However, the decade-long dash to gas has forced some developers to recalibrate construction schedules. There is only so much equipment manufacturing capacity to go around. As the power generation business continues to lean heavily on gas-fired generation, potential bottlenecks and project delays stemming from limited supply-chain capacity are likely.

Renewables outlook

The rush to renewables, underway for over a decade, continues to change the face of the power generation business. Over the next five years, developers should begin construction on about 118,900 MW of renewable energy projects, amounting for about 56.7% of all new generation projects during this period.

On a percentage basis, the Midwest, Rocky Mountains, New England and Mid-Atlantic regions should see the most activity. The Midwest expects to see 21,637 MW of renewable energy projects kicking off construction between 2018 and 2022.

The Rocky Mountain area will go even greener, with 25,134 MW. The Mid-Atlantic region plans on slightly less than 9,000 MW, while New England expects to see slightly more than 4,000 MW of new renewable generation begin construction during this time.

Other regions like the Southwest, the West Coast and the Great Lakes have more renewable projects kicking off on a MW basis than the Mid-Atlantic and New England regions. But on a percentage basis, those three regions trail the Mid-Atlantic and New England.

Developers have been incented to get steel in the ground sooner rather than later by the 2015 extension of Production Tax Credits (PTCs) and Investment Tax Credits (ITCs). Wind power projects that began construction in 2016 were eligible for the full 2.3 cents per kilowatt-hour (kWh) generated for up to 10 years.

But developers who could not begin until 2017 lost 20% of that amount. Those who could not kick off construction until 2018 will only get 60% of the PTC, about 1.38 cents per kWh generated for up to 10 years. The tax credit is scheduled to sunset in 2020, though few things are certain these days.

For solar developers, the ITC extension similarly lasts until 2020. Projects that begin construction before 2020 will receive a tax credit equal to 30% of the cost of a project. The ITC then declines to 26% for projects that commence construction in 2020 and to 22% for projects that begin building in 2021. After 2021, the credits for utilities and commercial owners will drop to a permanent 10%.

IIR is tracking about $120 billion in 289 wind energy projects scheduled to kick off construction over the next five years. By region, developers plan to be particularly active in the Midwest, Southwest, Rocky Mountains and Great Lakes areas.

$27.7 billion in solar activitySome 216 active solar projects are also being tracked that are scheduled to begin construction between 2018 and 2022. The value of these projects is about $27.7 billion. States expected to see the greatest level of solar activity are in the Rockies, the West Coast and the Mid-Atlantic, notably North Carolina.

When discussing renewable energy project starts, it is important to emphasize that not all are expected to begin construction or start generating electricity according to their current schedule. Projects will be delayed or cancelled if they cannot secure funding or negotiate a power-purchase agreement (PPA).

Some utilities have a diminished appetite for wind or solar power PPAs. However, states such as California and Oregon have meaningfully expanded their renewable portfolio standards (RPS) in recent years, ensuring high levels of developer and utility interest there.

Costs have come down markedly for both wind and solar, though some analysts, including those at BP, think wind’s costs could decline faster than those of solar. In 2015, it cost between $50 and $110 to generate one megawatt-hour (MWh) from a U.S. solar installation, said BP in its annual energy outlook. Wind, by contrast, cost between $40 and $80 to generate a MWh. Both figures assumed a lifetime average carbon cost of $20 per ton, and all figures are measured in 2015 dollars.

Fast forward 10 years and the cost to generate one MWh from solar will fall to between $40 and $80, while wind can generate that MWh for between $30 and $65, BP said in its 2017 Statistical Review of World Energy.

Other analysts, including Karl Brutsaert of First Solar, report that solar power is selling for $35 to $55 per MWh today, making it competitive with conventionally generated electricity. But much depends on the specifics, including project size and local conditions.

Though the current administration has not yet released its rewrite of the CPP, renewable energy developers may find the rewrite less to their liking than the original. One of the few acceptable pathways to lowering carbon dioxide emissions in the original CPP was to build non-emitting generation like wind and solar.

For a president who speaks about energy dominance, the role of renewables is uncertain. It seems unlikely that the CPP rewrite will be as full-throated in its support for renewable energy as its predecessor.

Nuclear OutlookWestinghouse Electric Company’s decision to exit the nuclear construction business and file for Chapter 11 bankruptcy early in 2017 sent shock waves through the industry. Those shock waves soon overwhelmed the utilities building two new nuclear units at the V.C. Summer Nuclear Station in South Carolina.

Construction costs were estimated to exceed authorized construction outlays by several billion dollars, Scana Corp. determined. Even after factoring in Toshiba’s payment of $2.2 billion for withdrawing from the project, the math did not work.

This was largely due to construction delays that pushed the units’ in-service date beyond 2020, when they would need to be operating to be eligible for federal tax credits.

With the decision to abandon construction of Summer units 2 and 3, after Scana and partner Santee Cooper had invested billions of dollars, all eyes will turn to the South Carolina Public Service Commission. Will it allow the utilities to raise electric prices to recover their costs for the unfinished nuclear units? The utilities seem to think so, but the political blowback could be sizable.

Meanwhile, in Waynesboro, Georgia, Georgia Power officials conducted a “go/no go” analysis for the 66% complete unit additions at the Alvin Vogtle Nuclear Power Station. Best case scenario: Even with Westinghouse’s $3.68 billion pledge to the owners, completing construction of units 3 and 4 would cost billions of dollars more than the most recent estimate. The units would not begin generating electricity until 2021 at the earliest, years behind schedule.

Georgia Power is trying to determine the best path forward. This summer, it provided Georgia regulators with updated cost estimates and recommended continuing to build the new reactors. Regulators will spend time assessing those estimates. By year-end 2017, the path forward on Vogtle 3 and 4 will become much clearer.

Pushing those units’ in-service date beyond 2020 means the Vogtle project would lose its federal tax credits. In late 2016, Georgia Power agreed to forego several hundred million dollars of scheduled price increases between 2017 and 2020 to settle a dispute over construction costs and project delays.

In that settlement, Georgia regulators said they would lower Georgia Power’s return on equity by 300 basis points, to about 7%, if the new units were not operating by year-end 2020, a milestone Georgia Power officials have acknowledged is now out of reach.

At least one commissioner on the Georgia Public Service Commission supports completing construction of the two units at Vogtle. And the asset owners noted that, if completed, Vogtle units 3 and 4 would be an emission-free source of generation for decades to come. Should regulation or legislation be enacted limiting or taxing carbon emissions, they say Vogtle 3 and 4 would be a hedge protecting customers.

Nuclear cost overruns, delaysBut at what price? Financial analysts and power industry participants spent the summer of 2017 trying to interpret the most cryptic comments on Vogtle from Georgia Power and Southern Company officials. Even if Vogtle units 3 and 4 are completed, their vast cost overruns and delays, coupled with termination of construction of both the Summer units, are an ignominious end to the nuclear renaissance promulgated only a decade earlier.

Turning from nuclear units under construction to nuclear units in operation, 2017 was the year more utilities got more assertive in banging a tin cup for nuclear power. Following decisions in 2016 in New York and Illinois to financially recognize and reward the value of nuclear as a non-emitting source of baseload generation, utilities elsewhere — in Ohio, Pennsylvania, New Jersey and Connecticut — became more assertive this year in seeking financial support from lawmakers.

It is anyone’s guess whether Dominion Energy, owner of the two-unit Millstone plant in Connecticut, or FirstEnergy, owner of the Davis Besse, Perry and Beaver Valley plants in Ohio and Pennsylvania, or Public Service Enterprise Group, which operates the Salem and Hope Creek plants in New Jersey, will succeed in getting lawmakers to put a price on the carbon-free baseload characteristics of nuclear power.

Their efforts have drawn criticism from not only environmental, citizens and consumer groups, but also from power plant operators such as NRG Energy, Dynegy and Calpine. Those competitive power providers object to tilting the table in favor of one fuel at the expense of another.

No operating nuclear units closed during the first half of 2017, a welcome relief for an industry that has weathered several years of one or more plants deciding to close prematurely, typically because the units could not compete with low-cost gas generation.

For operating nuclear plants, IIR is tracking relicensing activity, as well as spending on maintenance and in-plant capital spending. We expect that to continue through 2022. Beyond that, small modular reactors (SMRs) may assume a larger role in the future of nuclear power. It could be that SMRs are the future of nuclear power.

Nuclear operators have spent billions of dollars over the last decade to make their plants as efficient as possible. Unit upgrades and uprates, as well as other in-plant capital improvements, have pushed capacity factors to about 95% in many units. Exelon and other nuclear operators throughout the country are looking at extending the operational life time of nuclear units to up to 80 years.

Through the relicensing process with the Nuclear Regulatory Commission (NRC), Exelon and other operators seek the relicensing of more than 30 nuclear facilities. They have submitted and completed the application process, and have either received their extensions or have a date for a decision to be made very soon.

Applications have been submitted for review for another five to six facilities, with the possibility of applications for an additional three to four facilities being submitted in the next four to five years. Nuclear utilities are serious about continuing to operate their U.S. units.

But there are clear threats to nuclear’s share of the electricity mix. Dwindling profitability, loss of market share and premature closures of peer facilities have made some operators think twice before committing to a life-extension project at a nuclear plant.

The lack of a national energy policy or even a CO2 emissions plan is another challenge for operators. The actions by Illinois and New York, which put a dollar value on the zero-emissions profile of nuclear power, could well be followed by other states over the next five years to keep nuclear units open.

And low-priced natural gas is not the only goblin haunting nuclear power: Residential electricity demand has fallen between 2010 and 2016, a result of energy efficiency programs, new electric pricing plans and ever-increasing efficiency of appliances.

This influenced PG&E’s mid-2016 plan to not relicense its two-unit Diablo Canyon nuclear plant. It wants to replace its lost generation with non-emitting resources on the supply and demand side. If realized, this will show just how far utilities, including nuclear utilities, have come.

IIR believe SMRs are the next step in the evolution of the U.S. nuclear fleet. The nuclear industry has been developing SMRs and so-called Gen. IV nuclear reactors for deployment after 2022. Seven such nuclear projects are being tracked in the U.S. that have been approved by the NRC.

These reactors are being designed to generate no more than 300 MW. Currently, there are three projects in the U.S. using SMR technologies. One of these is the NuScale Power LLC demonstration project at the Utah Associated Municipal Power Systems (UAMPS) SMR Nuclear Power Station located in Atomic City, Idaho. It is scheduled to receive approvals within the next 30 months. Another project is being evaluated by the Tennessee Valley Authority at its Clinch River facility.

All these SMR projects are still in the early stages of development. Factors that make this type of technology appealing are its emission-free electricity, lower overall investment costs, and factory fabrication of equipment. In addition, its ability to be used in power-intensive settings such as water desalination facilities and in microgrid planning are in its favor.

But no SMRs or Gen. IV nuclear units are likely to be deployed by 2022. The industry must continue research and development of these next-generation technologies, as well as seeking supportive policy changes, legislation and regulation.

Transmission & DistributionUtilities plan on making hefty outlays in their transmission & distribution (T&D) networks over the next five years. Most traditionally regulated utilities see T&D investments as a safer alternative to merchant generation.

Stung by life in competitive markets, FirstEnergy and AEP abandoned merchant generation in 2017 and embraced regulated T&D investments. The carnage in competitive markets, where gas is the fuel to beat, has bloodied coal- and nuclear-heavy merchant providers.

Besides, someone needs to bring the power from where it is generated to where it is needed. Increasingly, T&D investments are seen as the safer, smarter bet for most risk-averse utilities.

Some 783 U.S. T&D projects are being tracked worth $51.3 billion that are scheduled to kick off between 2018 and 2022. The Rocky Mountain region is far and away the leader in planned T&D spending, with 166 projects valued at $18.2 billion. A pair of $3 billion-plus projects are slated for Wyoming to transmit wind energy to points south, west and east.

But four other regions — New England, the Southwest, the West Coast and the Northeast — each plan to invest more than $5 billion in projects that remove congestion, strengthen and extend the grid and bring renewable energy to load centers.

Utilities in New England and the Northeast are looking to transnational transmission lines to bring Canadian hydropower south, to light and cool homes and offices in Burlington, Bangor and Boston.

The late-summer restoration of a quorum at FERC is the first step to thinning the backlog of interstate transmission projects. They languished for months during 2017.

Project spending is also expected to be brisk in the intrastate, sub-69kV market, with utilities spending as much as $10 billion to $15 billion annually on transformers, breakers, substations, and distribution lines over the next five years.

Additionally, numerous other projects are being tracked, including microgrids, energy storage and distributed energy. They are expected to impact T&D planning and T&D spending over the next five years.

Energy storage

Project spending on battery storage projects is currently about $3 billion, and that could rise as high as $11 billion by 2022. In Southern California, the repowering of the Alamitos power station includes at least 100 MW, and as much as 300 MW of battery storage. Other, smaller storage projects are popping up like mushrooms after heavy rain.

Storage projects could be used to store renewable energy, as well as bank conventionally generated electricity. The widespread diffusion of cost-effective storage is an X factor that could overturn a lot of conventional thinking about power generation and T&D spending.

Microgrid projects also have a significant disruptive capability, though they are in an earlier stage of development and deployment. Microgrids could be grid-connected, as well as serve islanded loads such as military installations. Right now, the industry is developing separate offerings for commercial, industrial, military and institutional deployment.

Microgrids address power generation concerns, T&D issues and cybersecurity fears. We should see about $2.5 billion spent on microgrids through 2020. Successful deployments should lead to a surge in spending after 2020.

Other factors affecting T&D project spending include combined heat and power (CHP) and industrial energy projects (IEP), both of which are on the rise. Customers turn to CHP or IEP to comply with environmental regulations, expand capacity, replace aging generation or reduce the use of grid-supplied electricity.

CHP and IEP projects can be as simple as converting boilers at pulp and paper mills or installing an internal combustion unit at a hospital or refinery. Larger-scale projects include complete microgrid integration to ensure uninterrupted power to a city or critical installations during a crisis.

IIR is tracking 697 industrial energy projects with a collective value of $11.6 billion that are scheduled to begin construction between 2018 and 2022. There are also about 35 to 40 microgrid projects worth about $3.2 billion during the same time frame