Baker Hughes Annual Meeting: Turbomachinery in a Decarbonized Future

The Baker Hughes conference argued in favor of natural gas as a fuel that can help meet net-zero goals.

The 24th Baker Hughes Annual Meeting (AM) took place in late January 2024 in Florence, Italy. More than 2,000 customers attended, well up on the previous year’s total of 1,700. The show highlighted a surge in turbomachinery orders and the unveiling of decarbonization, carbon capture, and hydrogen-related advances.

BAKER HUGHES

Lorenzo Simonelli, Chairman and CEO of Baker Hughes, opened the event by announcing the overarching theme of energizing change. He laid out his three hard truths:

- The need to scale current technologies to reduce emissions and meet net-zero targets.

- There is no world without hydrocarbons, at least for the next several decades.

- The industry needs to continue to advocate for the displacement of coal with natural gas.

Simonelli urged attendees to strive for higher efficiency from current technologies. He cited the International Energy Agency (IEA): Technology efficiency improves by about 2% per year. If the industry can achieve a 4% gain per year, most emissions targets will be met despite there being a large increase in energy output.

“There is no path to net zero without innovation and collaboration,” said Simonelli. “We must achieve growth that meets our needs without compromising the ability of the future generation to meet theirs.”

A SURGE IN TURBOMACHINERY ORDERS

Baker Hughes’ annual orders for 2023 for its Industrial & Energy Technology (IET) segment (comprised of turbomachinery and other energy production, digital, and monitoring solutions) were 12% higher than last year’s record level.

“We booked the previously announced 9.6.metric tons per annum (mtpa) Ruwais LNG project in the United Arab Emirates,” said Simonelli. This is for two electric liquefaction systems and is one of the first all-electric LNG projects in the Middle East.

Baker Hughes was awarded a contract by SBM Offshore to provide turbogenerators, turbocompressors, electric motor-driven compressors, and commissioning and spare parts for a floating production, storage, and offloading vessel. Other orders included a contract for one electric motor-driven sour gas booster compression package to support the development of offshore natural gas fields in the Middle East. Further quarterly business included service contract commitments worth more than $1 billion, primarily driven by LNG and offshore projects in North America and the Middle East, as well as upgrade orders, particularly in Europe for refinery and gas network applications to boost efficiency and lower emissions. The company’s Cordant digital solutions also reached a multi-year deal with Shell to centralize the Baker Hughes System 1 asset condition and performance monitoring systems across 33 sites. There was a similar deal for System 1 with India’s Oil and Natural Gas Corp. Ltd., this time for 12 offshore platforms.

This does not include what is being characterized as the biggest turbomachinery order in Saudi Aramco’s history: The formal announcement won’t be out until late spring, but a few details have emerged: an order for 17 gas compression trains with more to come.

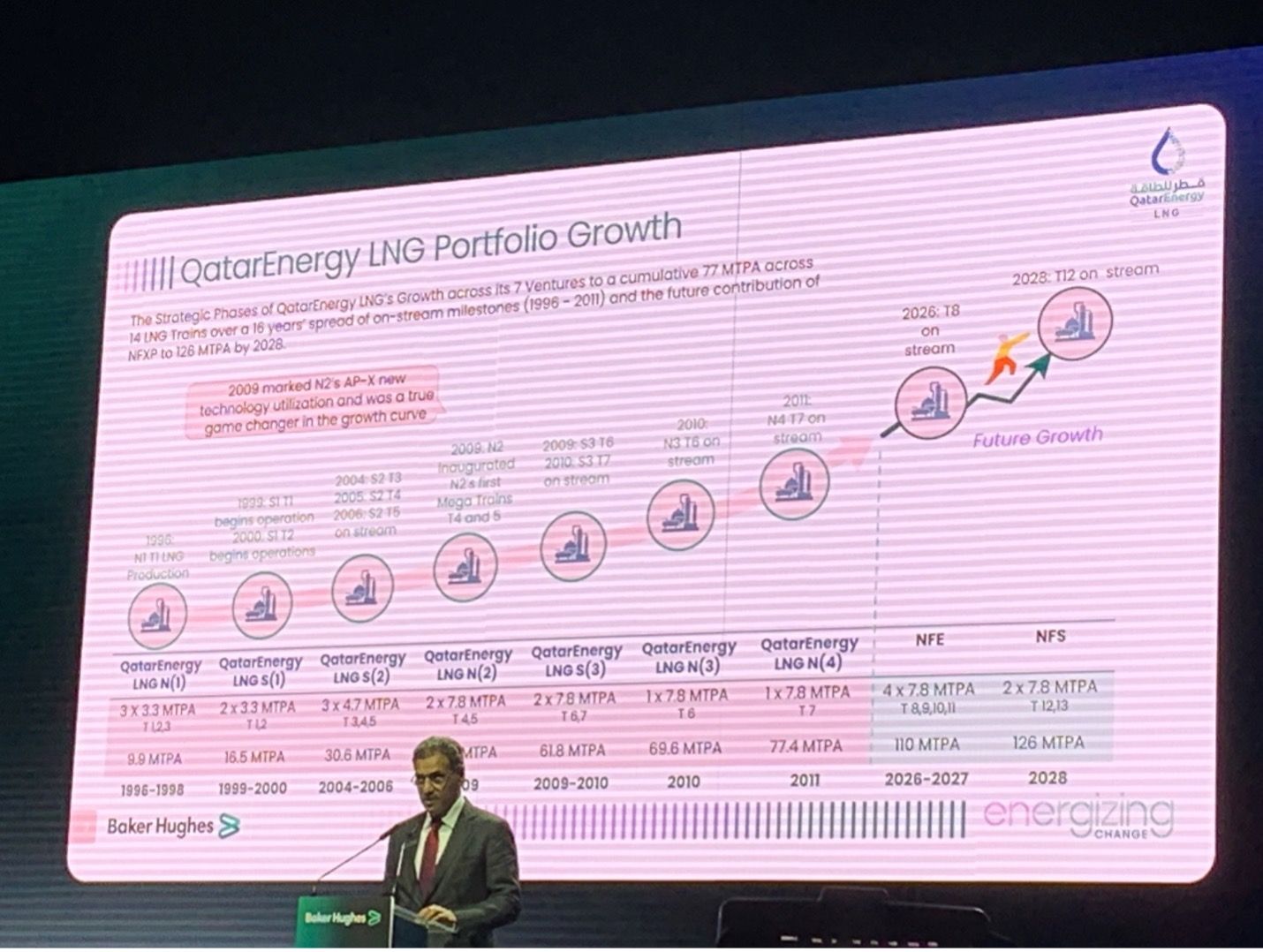

QatarEnergy LNG production expansion by 2030. Credit: Baker Hughes

Khalid bin Khalifa Al Thani, CEO of QatarEnergy LNG, laid out his plans for natural gas expansion: the development of 16 new offshore sites for gas production and six new mega LNG trains with a capacity of 8 mtpa each. This will take QatarEnergy LNG to 126 mtpa by 2030. In tandem, the company is developing carbon-capture and storage (CCS) technology.

“We are advancing the energy transition, and LNG is the solution,” said Al Thani. “Gas will be needed for baseload energy well beyond 2050.”

HYDROGEN NEWS

A new Baker Hughes hydrogen testing facility in Florence supports the deployment of hydrogen-ready technologies. It is being used to validate its NovaLT industrial turbines to run up to 100% hydrogen. Its test bench allows full-load testing with fuel flexibility and features a 300-bar pressure and 2,450 kg of hydrogen storage capacity. For example, Baker Hughes recently completed manufacturing and testing its NovaLT16 hydrogen turbines for Air Products’ Net-Zero Hydrogen Energy Complex in Edmonton, Canada. These machines underwent full-load testing.

NovaLT16 hydrogen turbine. Credit: Baker Hughes

In addition, the company reported the delivery of the first two trains of hydrogen compression solutions for the NEOM project in Saudi Arabia. This is said to be the largest green hydrogen project in the world. It is a joint venture of ACWA Power, Air Products, and NEOM. To further support the delivery of projects in the country, including NEOM, Baker Hughes is expanding its manufacturing site in Modon, Saudi Arabia, where it plans to do localized testing and packaging.

LNG PAUSE

President Biden's January 2024 announcement of a pause on all new LNG permitting approvals in the United States caused controversy at the AM.

“During this period, we will take a hard look at the impacts of LNG exports on energy costs, America’s energy security, and our environment,” said President Biden.

Several AM speakers and panelists took issue with the announcement.

“We are disappointed with today’s announcement by the Administration to disrupt the growth of U.S. LNG, which has been one of the most transformative energy success stories of this century,” said Simonelli. “We strongly oppose this moratorium and call on the Administration to approve pending export applications with no further delays.”

Mike Sommers, President and CEO of the American Petroleum Institute, called it the worst energy decision made so far by the current administration.

“It is a win for Russia, and a loss for U.S. allies, American jobs, and global climate goals,” said Sommers. “European and other allies are begging for U.S. LNG. This undermines world security at a time when energy demands are rising.”

Jack Fusco, President and CEO of the top U.S. exporter of LNG, Cheniere Energy, offered a rebuttal about price rises and environmental impacts. Carbon dioxide levels in the United States reached an all-time high in 2007 and are down 15% since then due to coal-to-gas switching and despite rising energy usage and massive exports of LNG.

"The price of natural gas is the same as it was in 2007 despite the huge increase in LNG exports," said Fusco.

Brad Crabtree, Assistant Secretary for the Department of Energy’s (DOE) Office of Fossil Energy and Carbon Management, found himself on the hot seat during an AM panel on government policy. It turned into a debate about President Biden’s announcement. Crabtree assured attendees that the administration would not allow any slowdown of urgently needed supplies to allies in Europe. He noted that the United States currently exports 14 billion cubic feet of LNG per day.

“Up to 48 billion cubic feet per day of LNG projects have already been authorized,” said Crabtree. “The pause does not include any of that. During the pause, the administration will conduct a robust analysis of the market and domestic, international, and environmental needs in order to make the right decision.”

However, several meaty projects have been left in limbo. These include Commonwealth LNG’s 9.3 million mtpa LNG export facility in Cameron, Louisiana; Sempra’s LNG trains 3 and 4 in Port Arthur, Texas (13.5 mtpa); Energy Transfer’s Lake Charles LNG facility in Louisiana; Magnolia LNG (developed by Glenfarne Group – 8.8 mtpa) in Louisiana; Venture Global LNG’s 20 mtpa expansion of its existing Calcasieu Pass project in Louisiana; and Cheniere Energy’s Trains 8 and 9 at its Midscale LNG project.

Audience at the Baker Hughes Annual Meeting. Credit: Baker Hughes

CARBON CAPTURE IS CATCHING ON

Carbon capture enjoyed a much higher profile at this event than in any previous one. Abdulkarim A. Al-Ghamdi, Executive Vice President for Gas at Saudi Aramco, said the company is targeting a 50% increase in gas production over the next five years supported by major investment in CCS. The nation intends to double its natural gas generation capacity and add up to 7 GW of combined-cycle capacity awarded each year for the next decade.

Danny Rice, CEO of NET Power, also advocated on behalf of CCS. His company is developing near-zero-emissions utility-scale power using natural gas. It uses natural gas and oxygen to fuel a supercritical CO2 (SCO2) cycle that generates electricity, while also capturing CO2. Baker Hughes is partnering with NET Power to develop SCO2 turboexpanders and other pumping and compression technology for NET Power.

“We need to reduce carbon in a way that assures the energy supply,” said Rice. “The incentives within the Inflation Reduction Act make it attractive to create CCS projects at low cost.”

Rather than focusing all investment and attention on new technologies that have yet to be proven, are difficult to scale, and lack the infrastructure to support them, Rice advocates using existing infrastructure and existing technologies to achieve emissions and net-zero targets.

ENERGY DIVERSITY

Maria Sferruzza, Executive Vice President of International Engineering, Construction & Solutions at Snam, stressed energy security as part of energy diversity. She explained that 70 bcm of LNG was suddenly needed in Europe to replace Russian LNG contracts when war broke out.

“LNG strengthens the natural gas market in Europe and will play a part in our energy mix for a long time to come,” said Sferruzza. “Diversity of supply is needed for security and lowest cost of supply.”

Snam has been expanding the pipeline network in the southern part of Italy to make it as strong as that in the north while making the entire network hydrogen-compatible and addressing methane abatement. This consists of instrumentation upgrades to detect methane leakage and verify pipeline integrity, as well as equipment to capture methane and recompress the captured gas.

MORE LNG NEEDED

Toby Rice, President and CEO of EQT, made it clear that the world needs more gas and more LNG now.

“We need more than three times the current volume of LNG being produced to be able to replace coal usage worldwide,” he said.

As for the environmental impact of gas, Rice noted that more than 40% of natural gas producers have already signed on to meet zero or near-zero methane emissions by 2030. He said the technology already exists to pinpoint methane sources.

Rice was critical of environmental lobbyists who attempted to stop new pipeline projects. He contended that more natural gas and less coal equals lower emissions. By making these new pipelines hydrogen-ready, the network can move closer to net zero via hydrogen blending.

“The argument that we should not build pipelines is ridiculous, as they will be needed for the changeover from coal to gas, when hydrogen becomes available for power generation, and when we start to capture carbon at an industrial scale,” said Rice.

ENERGY PRODUCER TAKES ACTION

Alessandro Puliti, CEO and General Manager of Saipem, is another energy producer that is acting to lower emissions.

“Gas is the fuel of today, will be the fuel of tomorrow, and offers plenty of opportunities to reduce its carbon footprint,” he said. “Without LNG, we couldn’t have coped with the Russian crisis. LNG is essential in moving energy around the world.”

Liquid hydrogen transportation, he said, is problematic due to its lack of energy density. Instead, he sees a future for low-carbon ammonia as an easier way to transport hydrogen. Once delivered, it can either be converted to hydrogen for energy production or used as a raw material for fertilizer and other uses.

"Ammonia is the best way to transport hydrogen on ships," said Puliti.

About the Author: Drew Robb, former editor of Turbomachinery International, is a freelance writer specializing in engineering and technology. Email Drew at drew@robbeditorial.com.