Baker Hughes Releases Q1 2023 Financial Report

Baker Hughes reports growth in both oilfield services and equipment and industrial and energy technology segments.

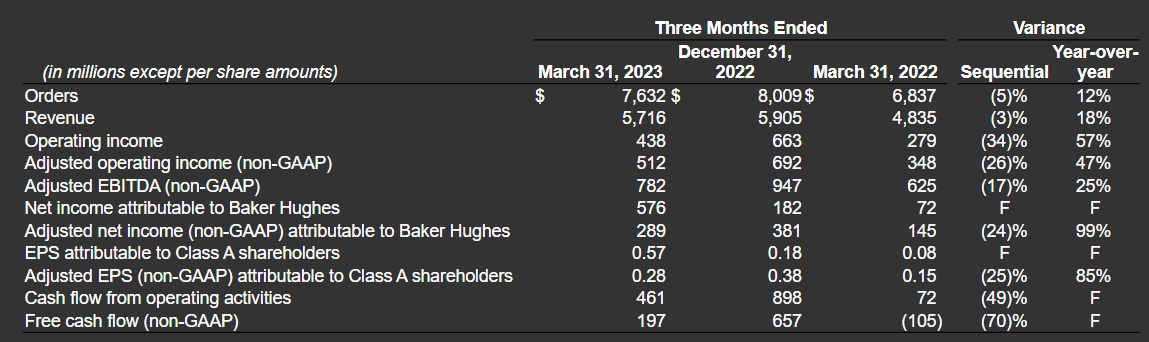

Baker Hughes Company has reported its financial results for the first quarter of 2023, highlighting positive growth in various areas. The company recorded orders of $7.6 billion for the quarter, up 12% year-over-year, and a revenue of $5.7 billion, marking an 18% increase year-over-year. GAAP operating income for the quarter rose by $160 million year-over-year to reach $438 million.

Additionally, the company reported an adjusted operating income (a non-GAAP measure) of $512 million, up 47% year-over-year, and an adjusted EBITDA (a non-GAAP measure) of $782 million, representing a 25% increase year-over-year. The GAAP diluted earnings per share for the quarter stood at $0.57, including $0.28 per share of adjusting items, while the adjusted diluted earnings per share (a non-GAAP measure) was $0.28. Cash flows generated from operating activities were $461 million for the quarter, with free cash flow (a non-GAAP measure) reaching $197 million.

Caption: "F" is used in most instances when variance is above 100%. Additionally, "U" is used in most instances when variance is below 100%.

In a statement, Lorenzo Simonelli, Baker Hughes chairman and chief executive officer, said, "We were pleased with our first quarter results and remain optimistic on the outlook for 2023. We maintained our strong order momentum in IET and SSPS. We also delivered solid operating results at the high end of our guidance in both business segments, booked almost $300 million of New Energy orders and generated approximately $200 million of free cash flow."

Simonelli acknowledged the macro volatility at the beginning of 2023 but remained confident in the prospects for energy services and Baker Hughes.

He also highlighted the company's diverse portfolio, which includes both long-cycle and short-cycle businesses that can navigate variable conditions across the energy sector. He emphasized the increasing importance of natural gas and LNG in the energy transition, noting that the case for a multi-decade growth opportunity in gas is steadily improving.

During the first quarter, Baker Hughes' Oilfield Services & Equipment (OFSE) business segment secured its largest subsea tree order in almost five years through a contract with Azule Energy in the Agogo oilfield offshore Angola. The company will supply subsea equipment and services, including 23 subsea trees and 11 Aptara manifolds. OFSE also won a multi-year contract from Wintershall Dea for integrated well construction and completion services.

The Industrial & Energy Technology (IET) business segment experienced a strong quarter commercially, continuing the momentum from the end of 2022. Gas Tech Equipment secured multiple LNG awards, including an order to supply two main refrigerant compressors (MRCs) for the North Field South project executed by Qatargas. IET also received an order from Bechtel to supply two MRCs for Sempra Infrastructure's Port Arthur LNG Phase 1 project in Jefferson County, Texas.

IET secured orders for smaller-scale LNG facilities, such as a contract from Wison to supply four electric LNG (e-LNG) compressor trains for an onshore LNG plant. The IET Gas Technology Services product line also strengthened long-term relationships with key customers, securing multiple contracts across both LNG and non-LNG segments.