Carbon Capture and Storage is on the Rise

The number of carbon capture and storage (CCS) facilities in the pipeline is at an all-time high, with accelerating momentum for deployment and application across industries.

CCS is on the rise globally, as governments, industry, and communities grapple with the increasing urgency of addressing climate change. Data from the Global CCS Institute indicates a period of unprecedented growth, with the number and capacity of CCS facilities in the project pipeline at an all-time high. The Institute’s 2023 Global Status of CCS Report noted a 102% increase in CCS facilities in the pipeline compared to 2022: As of April 2024, there are 564 commercial CCS facilities in the project pipeline.

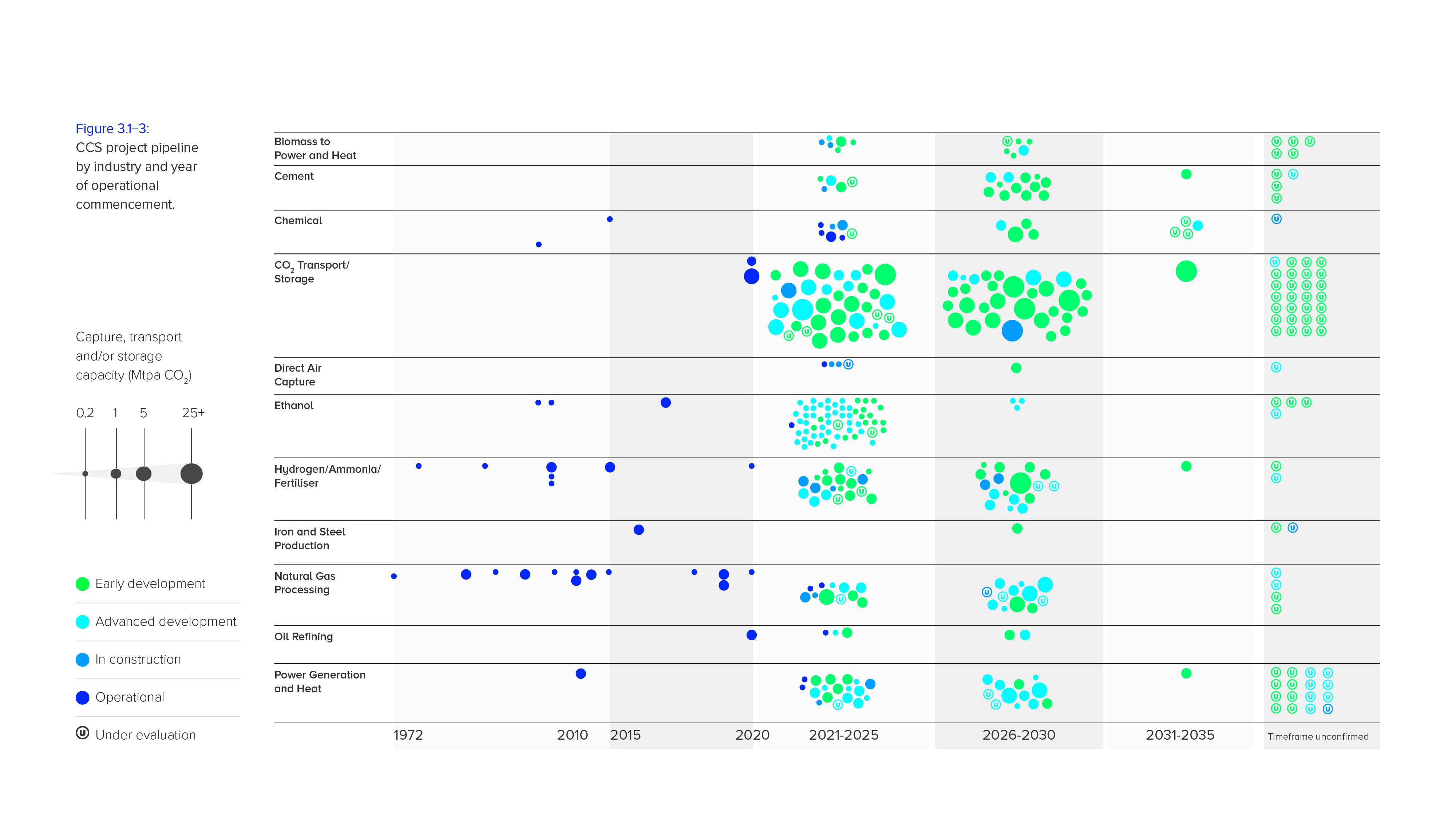

The Institute also noted accelerating momentum for CCS in industries beyond the lower-cost applications of gas processing, ethanol, and ammonia production. CCS is being integrated into industries such as cement, steel, chemical plants, power plants, and even carbon-removal technologies, such as direct air capture (DAC), bioenergy with CCS (BECCS), and waste-to-energy plants.

Despite this rise in CCS, the data show more efforts are needed to be on track with the scale of deployment required to meet global climate goals. According to scenarios by the Intergovernmental Panel on Climate Change (IPCC) and the International Energy Agency (IEA), CCS deployment must scale up to gigatons of stored CO2 per annum to mitigate climate change and reach net-zero emissions by mid-century.

CCS in operation at Chevron Australia's Gorgon natural gas plant, Western Australia. Credit: Global CCS Institute

NORTH AMERICA IS LEADING THE WAY

Scale-up of CCS project capacity is being driven mostly by North America, where the United States leads in deployment with 73 new CCS facilities entering the pipeline in 2023. The top applications for carbon capture in the United States are ethanol, ammonia, hydrogen, and fertilizer production, as well as power generation and heat.

U.S. CCS scale-up is supported by policies and clear regulatory frameworks, which have significantly improved the business case. Economic incentives include the enhancement of the 45Q tax credit for stored CO2, now set at US$85 per ton, through the Inflation Reduction Act. Additional federal funding for CCS projects is accessible through initiatives such as the CHIPS & Science Act (2022) and the Bipartisan Infrastructure Law (2021).

The United States’ goal of carbon-free electricity by 2035 has also turned attention to the potential to scale up CCS at fossil-fuel power plants. Projects at various stages of development continue at 23 power/heat facilities, with more than half planning to be operational in the late 2020s.

Considerable geological storage resource development is also underway in the United States, with the Environmental Protection Agency (EPA) receiving an unprecedented number of Class VI permit applications. As of March 15, 2024, 130 well permit applications for 44 projects were under review and an additional 69 well permit applications for 33 projects were being reviewed in states that have Class VI primary enforcement authority (Louisiana, Wyoming, and North Dakota).

In Canada, the federal government released its Carbon Management Strategy, setting out a vision for carbon-management technologies to be deployed to help achieve the country’s climate objectives. The 2023 federal budget also included significant support for CCS deployment, including an investment tax credit to cover up to 50% of the capital cost of CO2 capture projects until 2030.

In Alberta, 25 storage hubs were proposed through the provincial Technology Innovation and Emissions Reduction Regulation (TIER). The province also announced that the Alberta Carbon Capture Incentive Program would provide a grant of 12% for new eligible CCUS capital costs to developers.

CCS project pipeline by industry and year of operational commencement. Credit: The Global CCS Institute’s 2023 Global Status of CCS Report.

CARBON PRICE AND GOVERNMENT SUPPORT DRIVE DEVELOPMENT IN EUROPE

In Europe, the business case for CCS deployment is boosted through the Innovation Fund and Connecting Europe Facility as well as individual national subsidy programs. The carbon price of the EU Emissions Trading System (ETS) also provides an important incentive for hard-to-abate industries to consider CCS in their sustainability strategies.

Additionally, as part of the Green Deal Industrial Plan, the European Commission proposed the Net-Zero Industry Act in 2023, which seeks to scale up technologies that will drive decarbonization. The Act proposes an injection target of 50 million tonnes per annum (Mtpa) of CO2 stored within the EU by 2030.

There are now more than 100 CCS projects in various stages of development in Europe, representing more than a 60% increase since 2022.

Denmark continues to develop CCS regulations and move toward implementation at speed, aiming to become a European CCS Hub by 2032.

The U.K. government in its Spring 2023 Budget announced it will invest £20 billion in CCS with a target of capturing 20-30 Mtpa of CO2 by 2030.

The Dutch government has continued to reward deployment of CCS in 2023 through its SDE++ subsidy. In October 2023, the Porthos project reached a final investment decision. The Aramis project, which will offer CO2 transport infrastructure from Rotterdam to multiple storage fields in the high North Sea, appears to be fully subscribed for the first 5 Mtpa of CO2 capacity.

Progress on Norway’s full-scale CCS project Longship continues, and Norway is awarding other exploration and storage licenses to expand its CO2 storage capacity to meet growing demand.

BRAZIL'S PETROBRAS LARGEST OPERATING CCS PROJECT IN 2023

Although North America and Europe took the lead in 2023 for projects in the pipeline, Brazil’s Petrobras was the largest operating CCS project. Petrobras reported it injected 10.6 MtCO2 in 2022, increasing the total CO2 injected to 40.8 Mt since operations began. Petrobras projects will reinject 80 MtCO2 cumulatively by 2025.

MIDDLE EAST ON CUSP OF UPTREND

Both the United Arab Emirates (UAE) and Saudi Arabia have announced net-zero targets for 2050 and 2060, respectively. With abundant natural gas, geological storage resources, and existing expertise, oil producers in the Middle East are positioning to become major suppliers to the low-emissions hydrogen and ammonia export markets.

In the UAE, Abu Dhabi National Oil Company’s (ADNOC) CCS projects are being implemented in stages, with 5 Mtpa of CO2 capture expected by 2030.

In Saudi Arabia, the Al Jubail CCUS industrial hub will capture and store 44 Mtpa of CO2 from industrial facilities by 2035.

NETWORKS AND HUBS CREATE EFFICIENCIES

In addition to vertically integrated CCS projects, the Institute has seen a rise in CCS networks and hubs, tracking approximately 115 networks globally in 2023.

These are becoming dominant modes of CCS deployment as they deliver the advantage of shared common infrastructure, which can provide economies of scale and allow several operators to leverage synergies between point-source carbon capture and CO2 removal—all of which can shorten permitting timelines and create efficiencies during both development and operation.

NEW INDUSTRY CCS MODEL RECOGNIZED

With the rise of networks and hubs, the Institute has recognized a new CCS industry model developing in standalone CO2 transport and storage facilities. These facilities are multi-user, multi-industry CO2 facilities and are not limited to a single dedicated CO2 capture source. In 2023, 101 of these facilities were identified globally.

DEVELOPING ECONOMIES NEED SUPPORT

Despite the robust growth in the CCS project pipeline, that growth is not distributed equally across the globe. Most CCS projects are being developed in advanced economies, with projects in developing economies far less common. More support is needed across the global south if climate targets are to be met.

By way of support, the Global CCS Institute created the Southeast Asia CCS Accelerator (SEACA) initiative to work with governments, multilateral organizations, and the private sector to help accelerate investment in CCS as an essential component of the region’s broader efforts to mitigate climate change.

Countries such as Malaysia, Indonesia, Thailand, Brunei, and Timor-Leste are seeking to leverage oil and gas production expertise and infrastructure to establish CO2 storage facility projects to both manage their own emissions and generate revenue from the storage of third-party CO2.

Success can only be achieved through active collaboration between the public and private sectors. Waiting for the market to deliver CCS without a strategy, cooperation between governments and project developers, or the necessary policy interventions will not achieve the scale of deployment required to meet climate goals.

PROJECT FINANCING CRITICAL

Similarly, project financing needs to gain momentum. CCS facilities are capital-intensive, and the availability of finance is critical.

Currently, CCS projects are generally financed by corporate balance sheets, as project finance is not yet widely available.

Recently, financing prospects have improved due to increased policy support and price signals. It is worth noting though that this increase is mostly in equity funding in developed economies benefiting from multiple revenue streams. There has also been an uptick in merger-and-acquisition activity and some consolidation of CCS service providers.

To reach the rates of CCS deployment required to support climate ambitions, project debt finance will need to be as common for CCS projects as it currently is for general infrastructure projects.

SCALING TO 2030 AND BEYOND

While there has been encouraging progress in CCS with good reason to be optimistic, there is still more work that needs to be done.

Achieving global climate targets will require annual CO2 storage rates of approximately 1 billion tonnes per annum (Gtpa) by 2030 and multiple Gtpa by 2050. Reaching this gigaton scale globally requires significantly increasing CCS deployment, particularly in developing economies. Support in the form of capacity building, legal and regulatory framework development, and storage mapping will be essential to accelerate deployment.

Facilitating CO2 transport and storage hubs to attract more capture projects would also help maximize the number of CCS projects deployed.

There is also a need to shorten project lead times without compromising the highest levels of safety, environmental stewardship, accountability, and community engagement.

With further collaboration among governments, industry, investors, and communities, the CCS industry can accelerate deployment and continue its dynamic path for scaling up through 2030 and beyond.

The lead author is Spencer Schecht, Senior Business Development Lead at the Global CCS Institute, an international think tank whose mission is to accelerate the deployment of CCS. Co-authors are Honor Iosif, Public Affairs Manager - APAC, and Joey Minervini, Public Affairs Manager – Americas.