CMS Energy Launches $150 Million Tender Offer for Outstanding Notes

Tender Offer commences for the purchase of various series of notes, with conditions and caps outlined.

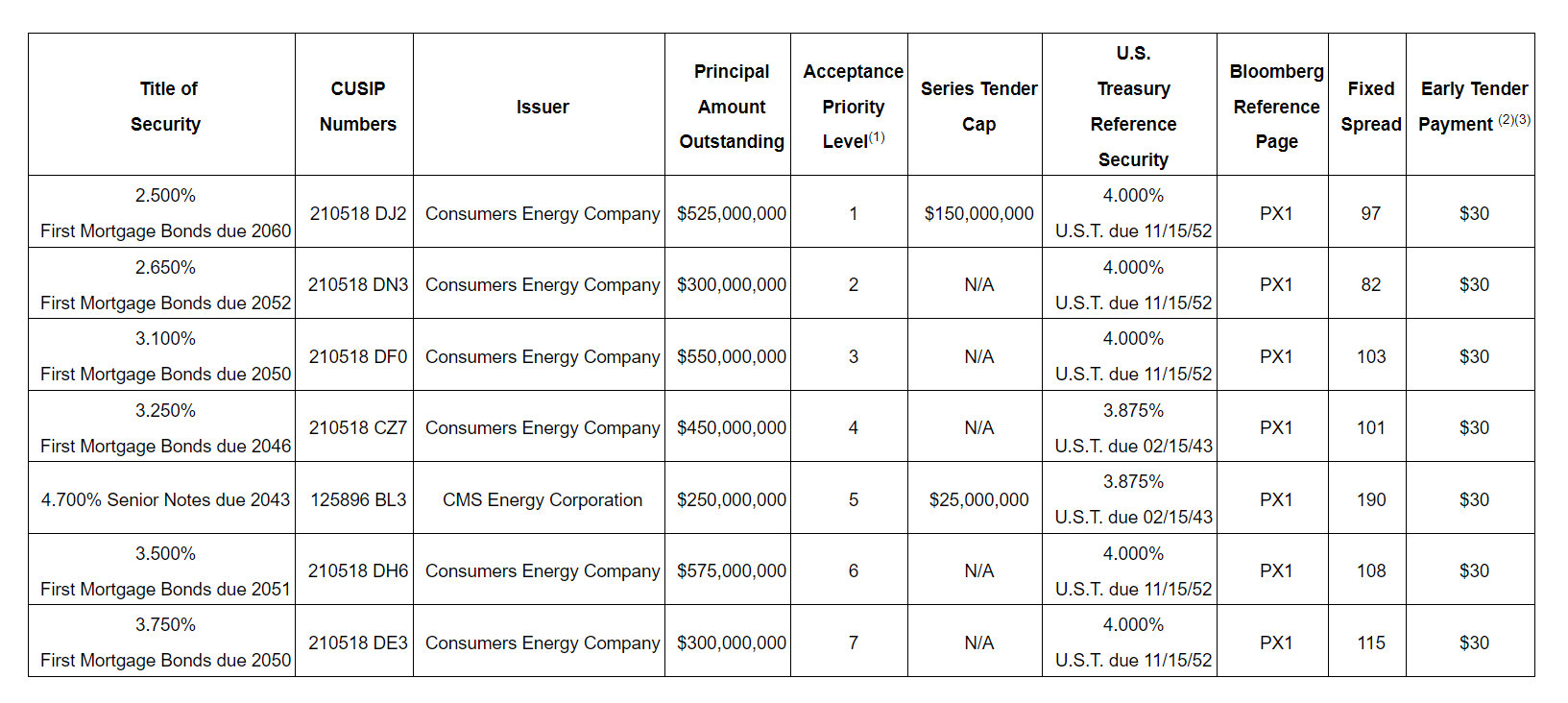

CMS Energy Corporation and Consumers Energy Company have begun a cash tender offer for the purchase of up to $150 million in outstanding notes. The notes, issued by either CMS Energy or Consumers Energy Company, have specific acceptance priority levels and series tender caps detailed in a provided table.

The tender offer is conducted under the Offer to Purchase, dated May 3, 2023, with an expiration date of June 1, 2023. To receive the Total Consideration, note holders must tender their notes before the Early Tender Date, May 16, 2023. Holders who tender their notes after this date but before the expiration date will only be eligible for the Tender Offer Consideration. Accepted notes will also receive accrued and unpaid interest up to the settlement date.

Total Consideration for each $1,000 principal amount of notes will be determined by the Fixed Spread and yield to maturity, based on the bid-side price of the applicable U.S. Treasury Reference Security. Tender Offer Consideration is equal to the Total Consideration minus the Early Tender Payment.

Note acceptance will be based on the Acceptance Priority Levels, with priority given to notes tendered on or before the Early Tender Date. Proration may occur for certain series of notes to avoid exceeding the Aggregate Maximum Purchase Price or applicable Series Tender Cap.

The tender offer will expire on the designated Expiration Date, with the settlement date for notes tendered on or prior to the Early Tender Date expected to be May 18, 2023. The settlement date for notes tendered after the Early Tender Date but before the Expiration Date is expected to be June 5, 2023. Validly tendered notes may be withdrawn before the Withdrawal Deadline on May 16, 2023.

CMS Energy's obligation to accept and pay for validly tendered notes is not subject to a minimum tender condition but is contingent upon the satisfaction or waiver of conditions outlined in the Offer to Purchase. CMS Energy reserves the right to amend the tender offer in accordance with applicable law.

Barclays Capital Inc. and J.P. Morgan Securities LLC are acting as dealer managers for the tender offer, while D.F. King & Co. Inc. serves as the information agent and tender agent. The Offer to Purchase and related materials can be obtained by contacting D.F. King.

CMS Energy is a Michigan-based energy company, primarily operating through its subsidiary, Consumers Energy Company, an electric and gas utility. CMS Energy also owns and operates independent power generation businesses.

GE Vernova Plans $14.2B Investment in Saudi Arabia’s Energy Supply after President Trump’s Visit

May 14th 2025President Trump and the Prime Minister of Saudi Arabia’s visit prompted the collaboration with GE Vernova to potentially supply advanced heavy-duty gas turbines built in Greenville, SC.

.png&w=3840&q=75)

.png&w=3840&q=75)

.png&w=3840&q=75)

.png&w=3840&q=75)