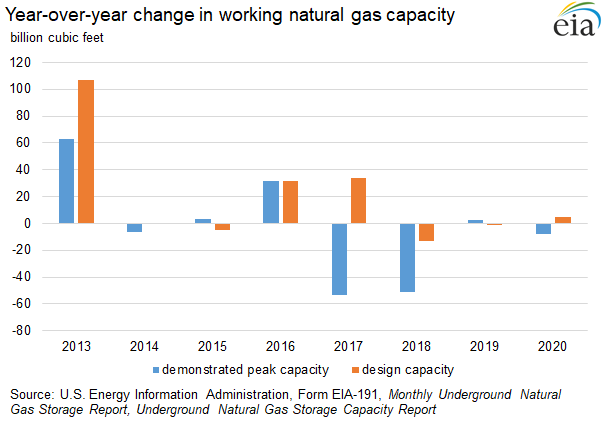

New data show little change in natural gas design and peak capacity

Design capacity reported a small increase, and demonstrated peak capacity reported a small decrease. The growing trend toward more natural gas-fired electricity generation generally encourages more storage capacity.

Two metrics for assessing underground working natural gas storage capacity in the Lower 48 states showed mixed results for 2020 compared with 2019. Design capacity reported a small increase, and demonstrated peak capacity reported a small decrease.

Design capacity

Design capacity, sometimes referred to as nameplate capacity, is based on the physical characteristics of the reservoir, installed equipment, and operating procedures on the site, which often must be certified by federal or state regulators. We calculated design capacity as the sum of the reported working natural gas capacities of the 387 active storage fields in the Lower 48 states as reported on Form EIA-191, Monthly Underground Natural Gas Storage Report, as of November 2020. We excluded the 25 inactive fields in the Lower 48 states from the total. The design capacity metric is a theoretical limit on the total amount of natural gas that can be stored underground and withdrawn for use.

Demonstrated peak capacity

Demonstrated peak capacity, or total demonstrated maximum working natural gas capacity, represents the sum of the largest volume of working natural gas reported for each individual storage field during the most recent five-year period, regardless of when the individual peaks occurred. In this report, the most recent demonstrated peak covers the November 2020 report period (December 2015 through November 2020). Demonstrated peak capacity is based on survey data from Form EIA-191 and is typically less than design capacity because it relates to actual facility usage, rather than potential use based on the design of the facility.

Natural gas design capacity was essentially unchanged in 2020; however, some operators revised earlier estimates, increasing working gas capacity. Design capacity of underground natural gas storage facilities in the Lower 48 states increased by 4 billion cubic feet (Bcf), or 0.1%, in the November 2020 report period compared with the November 2019. A couple of notable revisions increased working gas capacity reported for 2019 in the Mountain and Pacific regions, which reflects the operators’ reassessments of the operational characteristics of the affected fields.

In the Mountain region, Spire Storage West revised the working gas capacity at the Belle Butte field (formerly Ryckman Creek) up by 16 Bcf to 35 Bcf as of February 2019. Spire Inc. acquired Ryckman Creek Resources and Clear Creek Storage in Wyoming in 2018. After this acquisition, Spire Storage West reported reduced working natural gas capacity at the Belle Butte (formerly Ryckman Creek) field by 16 Bcf. The field’s estimated operational capacity in 2019 was 19 Bcf, compared with 35 Bcf in 2018. However, Spire Storage West has since decided to operate the Belle Butte field at the FERC-authorized working gas capacity of 35 Bcf. Aside from this revision, working gas capacity remained unchanged in the Mountain region during 2020.

Working natural gas design capacity increased by 5 Bcf in the South Central region. The most notable increase in the region was the 4.2 Bcf gain reported for the Egan Storage Dome by Egan Hub Partners. Dewatering the salt cavern raised the capacity of this field.

In the Pacific region, the Northwest Natural Gas Company revised the working gas capacity for the Mist field in Oregon, increasing capacity by 1.5 Bcf to 4 Bcf for 2019. The North Mist capacity expansion came came online in May 2019. Northwest Natural revised its early estimates of the design capacity of the Mist field—the only new natural gas storage reservoir to come online in 2019—based on the observed operational characteristics of the facility. Working gas capacity remained unchanged at the facility in 2020.

Demonstrated peak capacity decreased in 2020 as the decline in the Pacific region more than offset gains reported in other regions. Overall, demonstrated peak capacity declined by 8 Bcf, despite reported increases in five of six regions in the Lower 48 states as of the November 2020 report period compared with the November 2019 report period. Despite the net decline in demonstrated peak capacity for the Lower 48 states, the overall trend was toward increased usage of natural gas storage and higher working natural gas storage levels for the second year in a row.

Demonstrated peak capacity declined by 34 Bcf in the Pacific region because previous peak levels—predating the 2015 natural gas leak at the Aliso Canyon natural gas storage facility in California—are no longer included in the five-year range (December 2015–November 2020). The Aliso Canyon field has operated at reduced levels since coming back online following the leak. Despite the decline in demonstrated peak capacity for the region, natural storage facilities in the Pacific region also saw increased usage during 2020 like in the other regions.

The South Central region reported the biggest increase in demonstrated peak capacity in 2020, increasing 10 Bcf (0.7%) over the previous year. Salt facilities accounted for 8 Bcf of this year-over year increase. The Midwest had the next largest increase at 7 Bcf, followed by the Mountain region at 7 Bcf and the East region at 3 Bcf.

In recent years, several offsetting trends have affected the industry’s decisions about changes to underground storage capacity levels. Several recent trends may have reduced the need for investment in additional underground storage:

Although natural gas production declined in 2020, overall higher levels of natural gas production compared with a few years ago may have reduced some customers’ need to withdraw from storage to meet their natural gas needs. Increased output in the Appalachian Basin, the Permian Basin, and the Haynesville shale formation has driven production growth.

In recent years, natural gas prices have fallen and become less volatile.

The seasonal spread between summer and winter natural gas prices has become increasingly smaller, reducing economic incentives to inject natural gas into reservoir and aquifer storage.

Midstream infrastructure buildout (such as pipelines and compressor stations) has enhanced grid interconnectedness and flexibility, allowing natural gas to more easily reach end users.

Other factors could increase the need for additional storage

The growing trend toward more natural gas-fired electricity generation generally encourages more storage capacity. This trend continued in 2020, and July 2020 holds the record for the most natural gas consumed in the electric power sector in a single month. Natural gas remains an important fuel to support the growing use of renewable energy-sourced operations such as wind and solar power.

Increasing exports of natural gas also could increase natural gas storage capacity in the Gulf Coast region to support pipeline exports of natural gas to Mexico and liquefied natural gas (LNG) exports.

Working natural gas in storage reached its highest level since 2016: Working gas stocks ended the November 2020 report period at its highest level since 2016, despite decreased natural gas production and continued high demand for natural gas in electricity generation and for export. The higher natural gas storage level was partly because working gas entered the refill season, in April, at 2,006 Bcf —its highest level since 2017— following a relatively mild winter.