Publication

Article

Turbomachinery Magazine

No Stopping the LNG Juggernaut

Author(s):

NEW LNG TERMINALS, SKYROCKETING ORDERS AND WORLDWIDE PRODUCTION ARE AT RECORD LEVELS

Liquefied Natural Gas (LNG) is in the midst of a global boom. Import and export terminals are being added across the world. Orders for equipment are flooding in. New, state-of-the-art mega-facilities are coming online, and worldwide production is hitting record levels year after year. There appears to be no stopping the LNG juggernaut.

Where gas is abundantly available, export terminals are being erected. Where it is in short supply, import terminals keep popping up. And the pipeline for more terminals extends well into the future.

Global demand for LNG grew by 12.5% to 359 million m.t. in 2019, according to Shell’s latest annual LNG Outlook. Some 40 million m.t. of additional supply became available last year, the highest ever single year jump and a record year for investment decisions for new or expanded liquefaction capacity.

“The global market continued to evolve in 2019 with demand increasing for LNG and natural gas in power and non-power sectors,” said Maarten Wetselaar, Integrated Gas and New Energies Director, Shell. “Record supply investments will meet people’s growing need for the most flexible and cleanest-burning fossil fuel.”

Europe was the home for the majority of 2019 consumption growth. Competitively priced LNG encouraged more coal-to-gas switching in the power sector. China, too, has become an LNG consumption haven, with imports rising by 14% for the year.

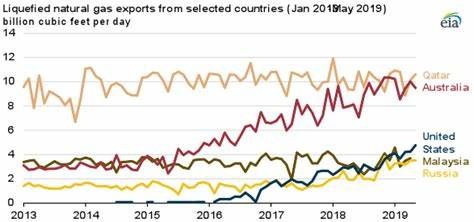

“LNG demand is growing very strongly across the world,” said Fatih Birol, Executive Director, International Energy Agency (IEA). “Countries like the U.S., Canada, Qatar and Australia are making big inroads in terms of expanded LNG export capability.”

"By 2025, LNG will serve more than a quarter of worldwide demand for gas."

Turbomachinery surge

Natural gas consumption is expected to rise to 156 trillion cubic feet (Tcf) worldwide in 2025, according to Forecast International. By that time, LNG will serve more than a quarter of worldwide demand for gas.

This, in turn, will drive the procurement of mechanical drive machines as gas needs to be transported by pipeline to LNG export terminals and from LNG import terminals to demand centers.

The Calcasieu Pass LNG project in Louisiana[/caption]

While smaller gas turbines (GTs) will be used in some cases, Forecast International believes in the coming decade more than half of all models sold for this purpose will be at least 7.5 MW in size. Aeroderivatives, such as the GE LM2500/2500+ and competing models from Siemens, are likely to be in demand.

Similarly, Solar Turbines has plenty of orders to replace older and smaller Solar Centaur and Taurus GTs with larger and more modern units. As a result, Forecast International predicts a 16.7% rise in sales of mechanical drive GTs delivered between 2019 and 2028, compared with the previous ten-year period.

That adds up to $23.95 billion over the decade. Whether from new pipelines or upgrades to existing compressor stations, sales of 3,294 turbines are expected for the forecast period.

Baker Hughes, for example, is dealing with the largest order backlog in its history. From the last quarter of 2018 to the end of 2019, the company was awarded 90 million m.t. per annum (MTPA) of LNG contracts.

Projects include LNG Canada in British Columbia, Golden Pass LNG in Texas, BP’s Greater Tortue Ahmeyim floating LNG in Africa, Mozambique LNG and Calcasieu Pass LNG in Louisiana. That adds up to dozens of compressors and GTs.

Hot on the heels of a best ever year, Baker Hughes received an order for six 7EA GTs and twelve centrifugal compressors for three LNG trains with a capacity of 16 MTPA of LNG for the Golden Pass LNG export facility in Sabine Pass, Texas. Golden Pass is being jointly developed by ExxonMobil and Qatar Petroleum.

Baker Hughes is also providing turbomachinery for the Calcasieu Pass LNG and the Greater Tortue Ahmeyim FLNG project. The later will consist of four trains using the PGT25+G4 aeroderivative GT to drive a centrifugal compressor.

Global energy firm Jera is a major participant in the Freeport LNG project in Texas that started commercial operation for its first liquefaction train at the end of 2019. It produces LNG for export from natural gas procured in the U.S. When all three trains at Freeport are operational, its capacity will be 15 MTPA.

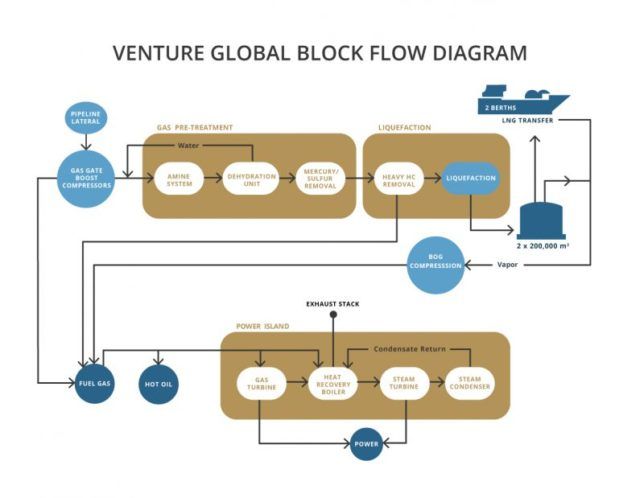

Venture Global is developing several LNG projects in the U.S. This includes Plaquemines LNG in Louisiana. It consists of 18 liquefaction blocks, each with a capacity of 1.2 MTPA.

It has 200,000 cubic meter LNG storage tanks with cryogenic pipeline connections to the plant and the three docks that can host ocean-going vessels.

Each ship can pick up to 185,000 m3 per load. Its combined cycle power plant has a capacity of 611 MW. A second project phase will double the power plant’s capacity.

Venture Global is also involved in the Calcasieu Pass project, which will have nine 1.2 MTPA liquefaction blocks and two 200,000 cubic meter LNG storage tanks. There will be two 0.6 MTPA trains per block, each with an electric driver.

The combined cycle power plant will use feed gas and boil off gas to produce power to drive the electric motors of the liquefiers. A 5 x 2 GT-to-steam-turbine configuration makes maintenance easier while maintaining production.

An LM6000 aeroderivative GT will also be placed on site for startup and peaking needs. The project has 20-year LNG sale and purchase agreements with Shell, BP, Edison, Galp, Repsol and PGNiG. Additionally, Venture Global is developing the 20 MTPA Delta LNG project in Louisiana.

LNG development specialist NextDecade is working on an export terminal for Permian Basin shale gas. The 27 MTPA Rio Grande LNG facility is in Brownsville, Texas. The 4.5 Bcf/d Rio Bravo Pipeline will funnel gas from Agua Dulce, TX to the export terminal.

NextDecade hired Bechtel for engineering, procurement, and construction (EPC). The first phase of Rio Grande LNG consists of three liquefaction trains, two 180,000 cubic meter storage tanks and two marine berths.

Each liquefaction train is expected to have a capacity of up to 5.87 MTPA. Technology providers include Air Products and Baker Hughes. It should commence operations in 2023.

“Once we get the first two trains running, we can add more trains easily as the costs go down,” said Matt Schatzman, Chairman & CEO of NextDecade. “Cheniere LNG already has six trains, and we are adding a third train at the Corpus Christi LNG facility.”

World LNG tour

The U.S. is far from the only game in town. Projects are popping up all over the globe. Jera reports projects as far apart as Africa and Canada. Jera provides receiving and storage facilities to the LNG market.

Its assets include 7.74 million cubic kiloliters of LNG tank capacity, representing 40% of the Japanese total as well as eight LNG receiving terminals. Hendrik Gordenker, Chief Global Strategist at Jera, noted that there are so many more sources of LNG than before, citing Canada and Mozambique as recent examples.

“LNG competitors include renewables, coal and pipeline gas,” Gordenker said. “New markets face a lot of investment to establish the terminals, turbomachinery and transport for LNG.”

LNG Canada, for example, is an export facility under construction in Kitimat, British Columbia. A joint venture between Royal Dutch Shell, Petronas, PetroChina, Mitsubishi and Korea Gas, it will consist of two LNG processing trains. LNG Canada represents the largest private sector investment in Canadian history. And it should be operational around 2025, according to Peter Zebedee, CEO of LNG Canada.

Extensive preparation work has been done including clearing away vegetation, dredging to allow for the large LNG carriers to berth at its jetties, and construction of a village to house 4,500 workers. It is permitted to export 28 mtpa of LNG annually.

Dredging in the Douglas Channel in British Columbia.[/caption]

The project is part of Canada’s reaction to the shrinkage of U.S. demand for Canadian oil and gas. Canada traditionally sold almost all its natural gas to its southern neighbor. But the low price of U.S. shale gas changed everything. Now Canada’s abundant supply of natural gas is looking for new markets in Asia.

“Our advantage is that 93% of our electrical power is hydro-based and this makes for production of some of the cleanest LNG in the world,” said Zebedee. “Independent benchmarking studies show that LNG Canada will emit 50% fewer greenhouse gas emissions than the average facility, and 30% fewer than the best performing facility.”

Nigeria LNG consists of six trains capable of producing 22 mtpa of LNG. A typical train consists of GE 7EA GT drivers for Baker Hughes 3MCL horizontally split centrifugal compressors, AN200 axial compressors and 2BCL radially split centrifugal compressors. On the power generation side, the train uses four GE Frame 6B GTs.

The company boasts 23 ships that delivered close to 5,000 cargoes to date. It currently has 200 Tcf (trillion cubic feet) of proven reserves with the potential for up to 600 Tcf ― lots of room for expansion in Nigeria. Thus, a seventh train is under development to bring annual production capacity to 30 mtpa.

Tony Attah, CEO of Nigeria LNG, said his company has reduced gas flaring from 65% to less than 20% with more work being done to bring it down further.

Oman LNG operates three liquefaction trains with a capacity of 10.4 MTPA. The company is adding a new gas engine-driven power plant by MAN Energy Solutions. Oman LNG recently inked a deal to supply 1.1 MTPA of LNG to BP Singapore for seven years.

Australia has been a star in the LNG world for some time. It is on track to surpass Qatar as the world’s top exporter. Australia’s capacity is around 11.4 Bcfd (billion cubic feet per day), following eight big LNG projects coming online since 2012: Wheatstone, Ichthys, Pluto, Gorgon, Queensland Curtis, Gladstone, Australia Pacific and Prelude. Gorgon, off the northwest coast, for example, produces 15.6 MTPA of LNG via three trains.

Hitoshi Okawa, Executive Vice President Australia for Japanese oil & gas company Inpex, the developer of the Ichthys LNG project, said his company is backing LNG and natural gas as a long-term and fundamental solution for the low-carbon economy.

As a result, the company is shifting its portfolio from oil to gas. It used to hold 80% oil and 20% gas. It has reduced its oil holdings to 60% and is aiming for 50%.

“Without gas and LNG, we won’t have growth,” said Okawa.

Mark Gvetvay, CFO of Russian natural gas producer Novatek, touted Russia as being highly gasified yet having a low carbon footprint. Natural gas is far more than a short-term transition fuel, he says.

His company is involved in building more infrastructure to support rapid expansion of Asian markets which currently lack the capacity to store LNG. This includes Arctic LNG 2 in Siberia, due to open around 2023.

Once operational, Arctic LNG 2 will have a production capacity of almost 20 MTPA. Novatek is working with Italy’s Saipem to build offshore platforms for Arctic LNG 2. Train two and three of Yamal LNG are operational, taking that site to 16.5 MTPA.

LNG is everywhere

The sheer volume of cheaper LNG coming onto the market is opening the door to LNG-fueled transportation. Nigeria LNG is using some of its natural gas reserves to provide alternatives to the wood-burning fuel prevalent in the nation.

Chart Industries, a company that has supplied cryogenic equipment for LNG to 71 countries (including cold boxes and brazed aluminum heat exchangers for Venture Global’s 10 MTPA Calcasieu Pass LNG export terminal project in Louisiana) is installing LNG fueling terminals around the world.

According to President & CEO Jill Evanko, Chart completed the installation and commissioning of Europe’s largest LNG fueling station for Alternoil on Germany’s main A1 highway. Chart’s Saturation on the Fly technology eliminates methane emissions and recognizes both spark-ignited and compression engines. This allows the station to fuel all LNG trucks, regardless of original equipment manufacturer or brand.

Further, truck maker Iveco has announced an LNG truck that can travel 1,200 km per load. And recent tightening of shipping regulations is forcing many carriers to consider switching from diesel to LNG.

Fueled by consumer, industrial and power generation consumption, LNG expansion is predicted to continue for some time. Global LNG demand is expected to double to 700 million m.t. by 2040. South and Southeast Asia are expected to generate more than half of the increased demand over the next two decades.

But even in regions avowedly anti-gas, LNG terminals multiply. The reality is that natural gas is in high demand, and LNG is often the easiest way to get it to these markets.

“The LNG market is growing and that will continue for a long time to come,” said Mike Sabel, Co- Founder & Co-CEO and Founder, Venture Global. “The current growth potential is greatly underestimated.” ■

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.