U.S. Power Industry Outlook 2021

Renewables expected to surge and fossil-fueled power to sag in new-build generation market.

Energy issues typically don’t move voters, with a few narrow exceptions. That seemed particularly true during the presidential election season. The Covid-19 pandemic and the social and economic calamity it created crowded out nearly every other issue.

Both presidential candidates had energy platforms. But rare was the TV talking head who argued for one or the other candidate based on their energy plans.

Energy companies have a keen interest in who occupies the White House, of course, no less than who controls the House and Senate. Regulations, laws and presidential decrees shape the business environment in which the electricity business operates. But as the Trump administration continued its efforts to achieve “energy dominance,” largely through regulatory action, the focus has largely shifted to courts and corporate boardrooms.

"Social trends and norms like working remotely could have a longstanding impact across the U.S. economy."

Energy transformation

The transformation of the U.S. electric generation industry continued in 2020. However, several companies pressed the “pause” button on construction plans for new generation as the nation struggled to defeat the pandemic and repair the economic destruction it caused.

Still, the broad outlines for the 2021-2025 period are clear: renewables, often buttressed by battery energy storage systems (BESS), are expected to continue to crowd out coal and, increasingly, gas-fired new-build generation.

Electricity demand growth, anemic before Covid-19, took a dive as businesses closed and many worked remotely. Residential electric demand grew, but not enough to offset the loss of commercial & industrial load. As states reopened their economies during the summer and infection rates soared, commercial establishments like bars, restaurants and theaters were once again shuttered, causing electricity demand to fall a second time.

"Renewables, often buttressed by battery energy storage systems, are expected to continue to crowd out coal and, increasingly, gas-fired new-build generation."

Covid-19 therapies could come in 2021. But the reality is that the 2021-2025 period will start off on a depressed baseline for the industry.

Social trends and norms like working remotely could have a longstanding impact across the U.S. economy. Increased digitization means more work can be done remotely. Who wouldn’t opt for Zoom meetings in their den instead of a drive-time slog? Over the course of 2020, employees and employers grew more comfortable with remote working arrangements.

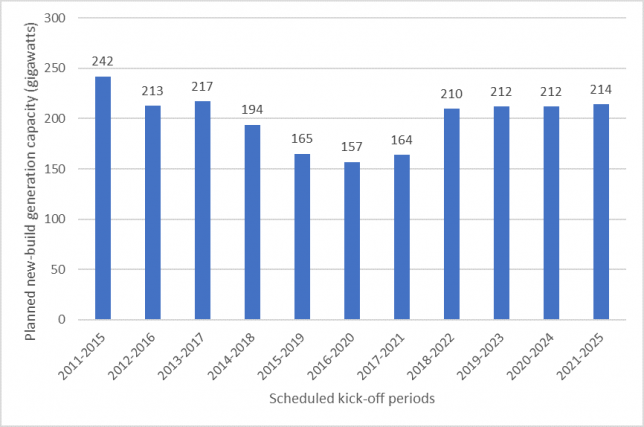

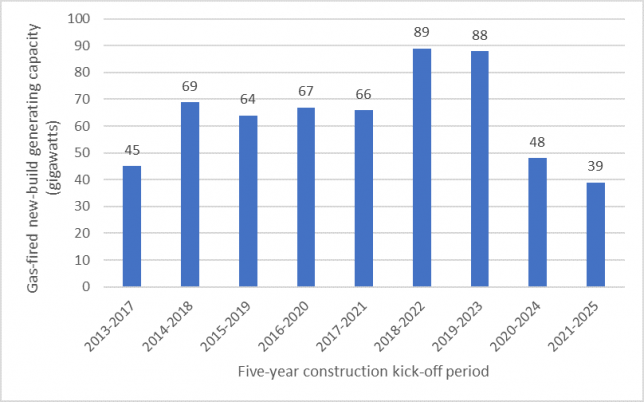

It’s unclear exactly how a shift to remote working could affect electric demand or plans to construct new generation capacity. Data tracked by Industrial Info Resources (IIR) shows developers plan to begin construction of about 214 GW of new generating capacity over the 2021-2025 period (Figure 1). That’s almost exactly the same as what was planned to kick off in the last three five-year periods (2018-2022, 2019-2023 and 2020-2024) and well above construction plans for the 2015-2019, 2016-2020 and 2017-2021 periods.

Figure 1: Top-line plans to build new generation. Source: Industrial Info Resources.

In aggregating planned construction kickoffs, all the planned construction activity won’t take place according to the developers’ schedule. In any given five-year period, roughly 30% of planned construction kickoffs will be cancelled or postponed; permitting issues, supply chain disruptions, regulatory decisions and inability to secure financing can reshape developers’ plans.

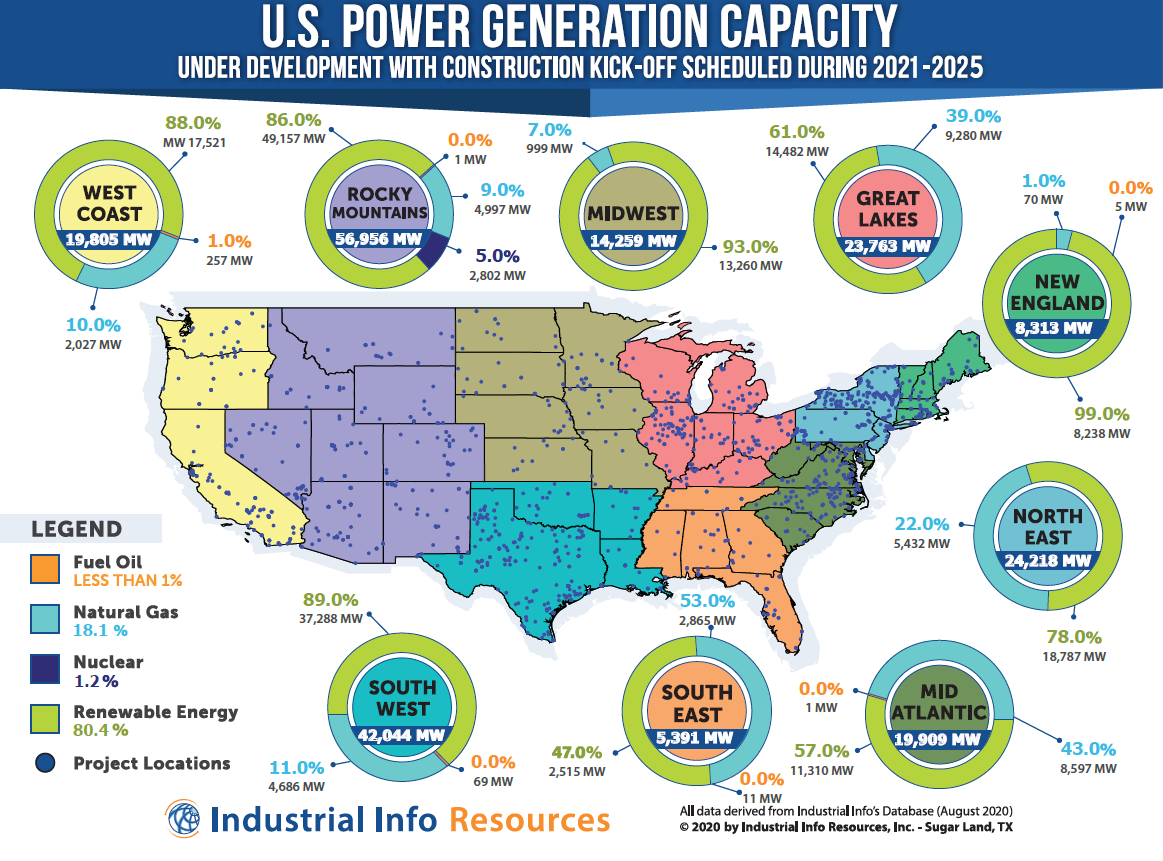

Approximately 80% of new-build generation scheduled to begin construction between 2021 and 2025 is expected to be renewables, mostly wind and solar (see map). Gas-fired generators will account for about 18% of new-build generation, with nuclear taking about 1% of the market.

Note that this is a particularly dynamic market. While their zero fuel costs give renewable energy projects a cost advantage compared with other types of generation, many renewable projects will require backup power. That points to increased demand for gas turbines and gas-fired reciprocating engines.

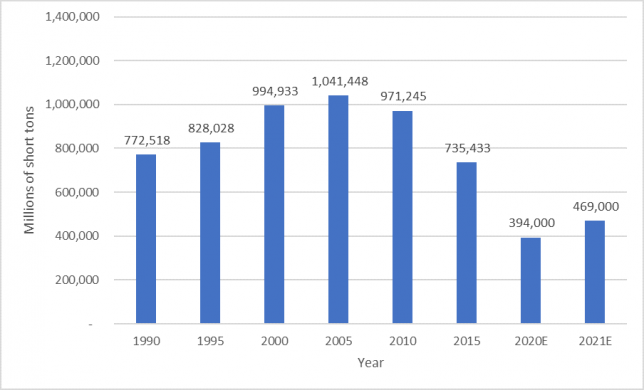

Figure 2: Consumption of coal by U.S. electric generators.

Source: Electric Power Monthly and Short-Term Energy Outlook reports, U.S. EIA.

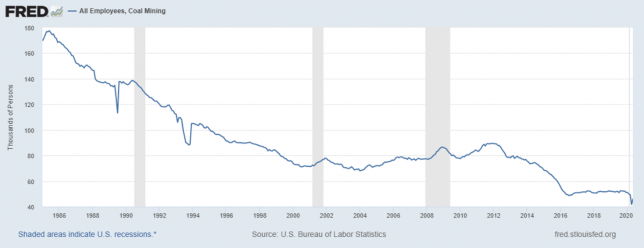

Longstanding trends like the decline in coal used to generate electricity (Figure 2) and the declining number of people working as coal miners (Figure 3) accelerated in 2020. Though coal use by electric generators is expected to increase a bit in 2021, there is little reason to think either trend will take a significant, longstanding positive turn over the next five years.

Figure 3: Coal mining employment.

Source: Federal Reserve Bank of St. Louis.

Coal outlook

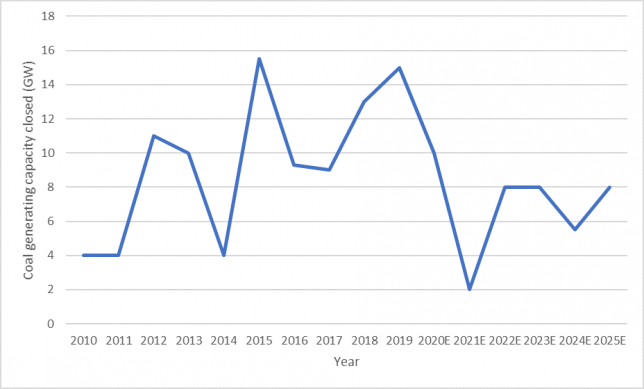

Roughly 94 GW of coal-fired generating capacity was retired between 2010 and 2019, and another 33 GW is scheduled to retire over the next five years (Figure 4).

During 2020, state-level integrated resource planning (IRP) processes at utilities from Portland, Oregon, Tucson, Arizona and Jacksonville, Florida, all came to the same conclusion: accelerate the reduction or elimination of coal-fired power. Continued low prices for natural gas as well as improved economics of renewable energy, coupled with regulators’ wish to see increased funding for conservation and energy-efficiency programs, all combined to squeeze the share of the power market served by coal.

Figure 4: Coal-fired generating capacity retirements.

Source: Industrial Info Resources.

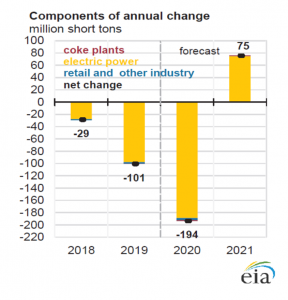

The U.S. Energy Information Administration (EIA) projects that the share of electricity produced by coal will fall from 24% in 2019 to about 18% in 2020 before rising to 21% in 2021. By contrast, coal accounted for nearly half of the electricity generated in the U.S. as recently as 2009. The EIA calculated demand for coal by electric generators would fall about 194 million short tons in 2020 from 2019 levels, but rise about 75 million short tons in 2021 (Figure 5).

Figure 5: Changes on demand for coal in the U.S. Source: EIA.

Coal advocates witnessed a number of negative developments for their interests in 2020, including:

• PacifiCorp released multibillion-dollar request for proposals (RFP) for new generation in mid-2020. Though billed as an “all-source” RFP, PacifiCorp’s interest was in securing renewables and closing coal-fired plants. In a separate RFP, the utility was seeking bids for as much as $1.8 billion in new transmission projects, mainly to carry electricity from remote sites to population centers. PacifiCorp had committed to closing about 2,800 MW of coal-fired generation by 2030. It accelerated the retirement dates for several of its units as part of the IRP process.

• Northern Indiana Public Service Company (NIPSCO) continued efforts to “green” its generation portfolio. It plans to retire about 1,600 MW, or nearly 80%, of its remaining coal-fired generation by 2023, and to exit coal-fired generation completely five years later. It came down to dollars and cents: Utility officials said replacing coal-fired generation with cleaner resources is expected to save customers more than $4 billion over 30 years. One of the coal-fired plants NiSource expects to retire in 2023 is the R.M. Schahfer Generating Station, which began operating in 1976.

• JEA (Jacksonville Electric Authority) and FPL (Florida Power & Light), joint owners of the 848-MW Unit 4 of Plant Scherer in Georgia, agreed in mid-2020 to retire that unit on January 1, 2022.

In decrying the early retirement of Unit 4 at Plant Scherer, Michelle Bloodworth, president and chief executive at America’s Power, a coal industry advocacy group, told a trade publication: “Coal-fueled power plants are one of the nation’s most-fuel secure sources of electricity, which means they are more reliable and resilient than almost any other source of electricity. The retirement of Unit 4 at Plant Scherer is part of an unfortunate trend that is leaving the electricity grid less fuel secure even though many policymakers are expressing concerns about the loss of fuel-security.”

However disruptive the premature retirements of coal-fired units may be to local communities, there’s little doubt that more are on the way.

Platte River Power Agency, a Fort Collins, Colorado-based joint action agency, in late 2018 adopted a goal of 100% non-carbon energy mix. Meeting that goal will require closing the recently built 280-MW Rawhide Unit 1 coal-fired plant in 2030, 16 years earlier than scheduled. Its generation will be replaced by wind, solar and battery energy storage.

Colorado Springs Utilities, also in Colorado, in June 2020 decided to close its two coal-fired plants by 2030 and ramp up its investments in renewables and battery energy storage. “The industry is moving to decarbonize, and we don’t intend to stand still,” Aram Binyamin, chief executive, said in an interview.

As has been the case for several years, there are no plans on the horizon to build new coal-fired power plants. Over the next five years, the commercial opportunities that exist within the coal fleet are in-plant capital, environmental remediation and dismantlement & demolition. We estimate those opportunities amount to about $10 billion over the 2021-2025 period.

Natural gas outlook

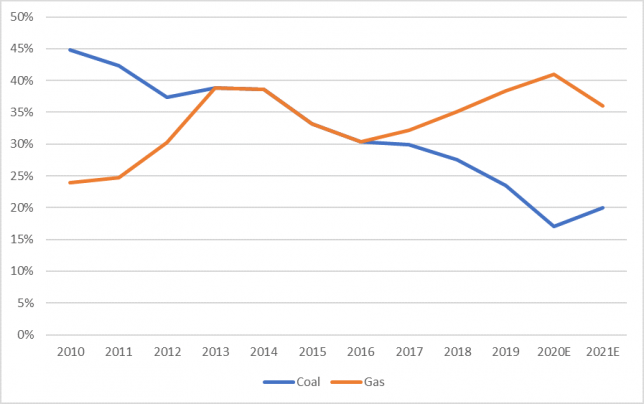

For much of the last decade, gas and coal have waged an intense fight for market share among electric generators, with gas taking an ever-larger share of the fuels market (Figure 6). But in 2020, as states like California and New York adopted ever-stricter renewable portfolio standards (RPS) and decarbonization plans, gas’ share of the market, estimated at about 40%, began to slip.

Figure 6: Coal vs. gas in U.S. electric power generation. Source: EIA.

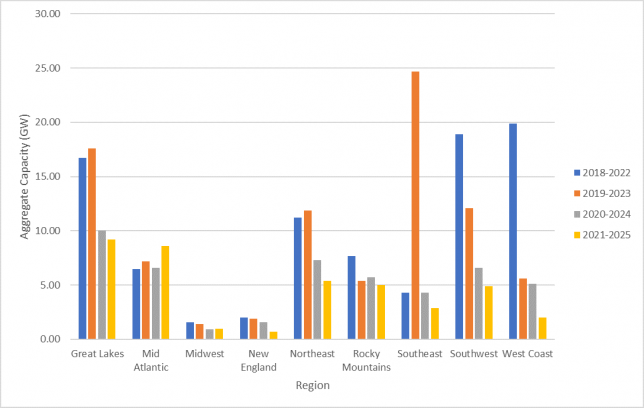

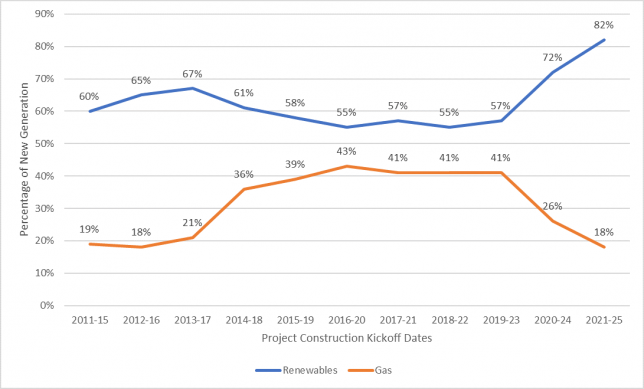

As shown in Figure 7, gas-fired power projects were all the rage for the 2018-2022 planned period, where four regions (Great Lakes, Northeast, Southwest and West Coast) each had plans to build between 10 GW and 20 GW of new gas-fired electric generation. Following a surge in the Southeast, where nearly 25,000 MW were planned to be constructed during the 2019-2023 period, new-build announcements have trended down sharply across the U.S. over the last two years.

Figure 7: Planned new-build gas-fired generation, by five-year period. Source: IIR.

Over the next five years, developers plan to build nearly 10 GW less gas-fired generation than they planned only a year ago: 39 GW in 2021-2025 vs. 48 GW in 2020-2024. As recently as 2018, developers had a five-year plan to build as much as 88 GW of gas-fired generation (Figure 8).

It’s not because the fuel isn’t cheap. Gas prices have been low for years. They are projected to stay there for the foreseeable future. Rather, state regulators, who must certify new-build construction projects, have grown increasingly concerned about how carbon dioxide emissions could be accelerating climate change. That, plus economic factors, have combined to squeeze new-build gas generation.

Regulatory and legislative mandates to increase renewables and cut carbon emissions have shrunk the electric generation fuel pie. At least seven states, including California, Arizona and New York, have effectively banned construction of new gas-fueled generators. Data we are tracking shows that developers have cancelled plans to build at least 33 gas-fired power plants across the U.S. valued at about $13.6 billion that were scheduled to begin construction between 2021 and 2025. Many cited market conditions for their decision. “Market conditions” could be a euphemism for an adverse regulatory environment, or low demand growth, or a variety of other factors.

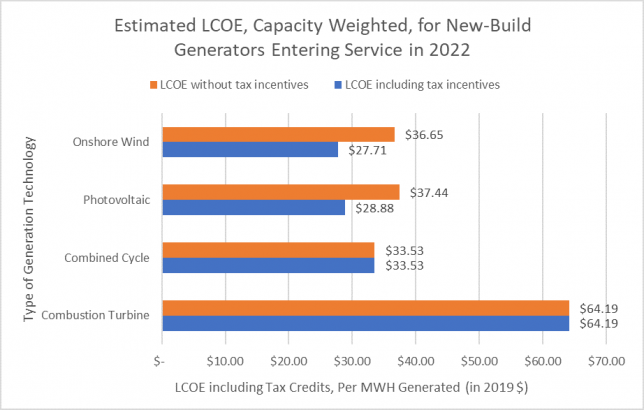

Increased efficiencies have made renewables like wind and solar increasingly competitive with gas-fired combined-cycle plants. The growing competitiveness of renewables was shown in the U.S. EIA 2020 Annual Energy Outlook, released in early 2020. Though recognizing that there were variances across regions, the agency’s estimated levelized cost of electricity (LCOE) for new-build generation showed that, when the effect of tax incentives was included, renewables had a lower LCOE than a new-build gas-fired, combined-cycle generator. But when the tax incentives were removed, combined-cycle generation had a LCOE that was several dollars less on a megawatt-hour basis than renewables (Figure 9). This particular estimate of LCOE from the EIA was for new-build generators that entered service in 2022, measured in 2019 dollars, on a capacity-weighted basis.

Figure 8: Plans to build new gas-fired generation fall sharply. Source: IIR.

Figure 9: Levelized cost of electricity for new-build plants entering service in 2022 (measured in 2019 dollars). Source: EIA.

And then there is the PR push. Over the last decade, in an effort to burnish their credentials as environmentally conscious businesses, utilities started distancing themselves from coal and embracing gas. These days, many of those same utilities are embracing renewables and distancing themselves from gas. Utilities across the country, including Duke Energy, Florida Power & Light, Southern Company, American Electric Power and Salt River Project, announced plans of varying aggressiveness to decarbonize their generating fleet. Since those utilities already closed most of their coal-fired units, the current plan to decarbonize focuses on building renewables and either closing operating gas plants or cancelling plans to build them.

Across the U.S. during the 2010-2019 period, about 48 GW of gas-fired generation capacity was closed. Looking forward a decade, another 13.27 GW are scheduled for retirement.

As Yogi Berra said, “It’s tough to make predictions, especially about

the future.”

Less-efficient, simple-cycle steam generators account for many of the gas plants that have been closed or are slated for closure. Some of those units had earlier switched from coal, but could not operate at an efficiency that kept them competitive. Similarly, some older combustion turbine plants are being replaced due to lower efficiency.

But slumping electric demand and continued declines in the cost to construct renewable generation have led some utilities and power developers across the U.S. to pull the plug on plans to build new high-efficiency gas-fired power plants in 2020:

• Florida Power & Light cancelled plans to build a 1,429 MW combined cycle gas-fired power plant in Hendry County, Florida. That project had a total investment value of about $1.5 billion.

• Invenergy cancelled plans to build a 900 MW power plant, the Clear River Energy Center, in Rhode Island. That project was valued at about $1.1 billion.

• Panda Power Funds cancelled plans to build the 1,000 MW, $850 million Hummel Power Station in Pennsylvania.

• Another casualty: The Long Island Energy Center, a 752 MW, $800 million project being developed by Caithness Long Island.

Xcel Energy, too, has been going green for years, investing billions of dollars in wind farms and solar facilities across its eight-state footprint. In mid-2020, the utility asked its Minnesota regulators for permission to accelerate the deployment of nearly $3 billion in planned projects centered on clean energy, resiliency, and keeping customer bills low. Notably, that plan did not include any new gas-fired generation. Xcel Energy was responding to a call from the Minnesota Public Utilities Commission for utilities to investigate investments they could make that would help the state’s economy recover from the economic devastation caused by the COVID-19 pandemic.

As shown in Figure 10, for all sorts of reasons, the dash to gas in the new-build generation market has slowed markedly from earlier years.

Figure 10: Proposed new build generation: Renewables vs. gas. Source: IIR.

Renewables outlook

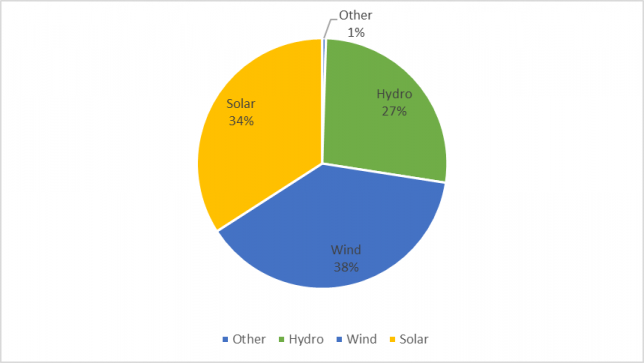

As has been the case for the last few years, renewables are getting an ever-larger slice of the new-build generation pie. About 173 GW of new renewables capacity is scheduled to begin construction over the 2021-25 period.

As with all such projections, there will be cancellations and delays. Not all the planned capacity additions will begin construction according to schedule. Renewable energy projects have a higher rate of project fallout, about 30%, compared with 25% of gas plants that get deferred or cancelled. Still, project developers have a very large pipeline with a deep green hue.

The regions with the greenest hue include New England (where renewables account for about 99% of all scheduled new-build projects on a GW basis), the Southwest (89%), the West Coast (88%) and the Rocky Mountains (86%).

In terms of amount of renewable generation scheduled to be built, the Rocky Mountains region is in first place, with plans to build about 49 GW over the next five years, followed by the Southwest (37 GW), the Northeast (19 GW) and the West Coast (18 GW). As shown in Figure 10, renewables will capture four out of every five gigawatts of planned new-build generation.

Figure 11 shows that wind, with a market share of about 38%, is expected to be the largest type of renewable generation built over the 2021-2025 period. That’s a reversion to the mean and a reversal from last year’s analysis, when solar was nearly double that of planned wind farm construction, 51% to 26%, in the new-build renewables market.

Figure 11: Market share of new-build renewable generation. Source: IIR.

Wind’s fortunes are benefitting from a late-2019 one-year extension of the federal Production Tax Credit (PTC) and an increase in its value. Prior to that extension, wind projects that began construction in 2019 were eligible for a federal tax credit of about one cent per kilowatt-hour (kWh) of energy produced. With the one-year extension due for expiration at the end of 2020, wind energy projects beginning construction in 2020 were eligible for a credit of 1.5 cents per kWh. The federal largesse led to a surge in wind energy project construction in 2020.

Guidelines provided by the Internal Revenue Service (IRS) define “begin construction” as either starting pre-construction activities or legally committing to a portion of the heavy equipment needed for a particular plant i.e., construction could “start” on a project during 2020 but not be completed for several years.

The solar power industry did not get its Investment Tax Credits (ITC) extended or increased in that late-2019 tax bill. Solar generation projects are eligible for a 26% tax credit for projects that began construction in 2020. In 2021, the credit falls to 22%, and after 2021, the ITC falls to 10%. Federal tax policy has long had a significant impact on renewable energy project development. As a case in point, we expect that when the PTC expires at the end of 2020, wind farm construction will fall by nearly $9 billion from 2020 to 2021. Construction of solar power, conversely, is expected to rise in 2021 compared with 2020, so developers can capture the 22% ITC before it falls to 10%.

As they are sited remotely, far from load centers, the fate of many utility-scale renewable energy projects depends on having sufficient transmission system capacity to bring the green juice from where it is generated to where it is needed.

But when governments give, they also can take away. Some states, such as California, are starting to cast a doleful eye on large-scale transmission projects, seeing them as harmful to the environment and a throwback to the prior era of central station generation. Instead, some regulators advocate smaller-scale (less than 1 MW capacity) solar generation that could power a neighborhood. Of course, regulators have encouraged rooftop solar panels for residential, commercial, industrial and institutional customers for years.

Renewable energy projects also were hard hit by two supply chain disruptions in 2020: the Covid-19 pandemic and the Trump administration’s imposition of tariffs on solar panels imported from China, the world’s largest solar panel manufacturer.

Nuclear outlook

By early 2021, construction on Unit 3 of the Alvin W. Vogtle Nuclear Power Station is expected to be finished, according to the most recent estimates from operator Georgia Power. Unit 4 is scheduled to come online sometime in 2022. That would end the saga of adding two units to Vogtle, a project originally budgeted at about $12 billion that more than doubled to an estimated $27 billion. The new units were originally scheduled to come online in 2016 and 2017. If the final cost tally holds at $27 billion, that would work out to about $12 million per megawatt of installed capacity — far and away the most expensive power project, both in aggregate costs and on a cost-per-MW basis, ever built in the U.S.

With the 2017 termination of efforts to add two units to the Virgil Summer nuclear power station, the Vogtle project remains the only nuclear project that is still being built in the 2021-2025 period. To be sure, there are other proposed new-build nuclear power projects that have scheduled construction to begin during that five-year period, but we doubt construction will begin on any of those projects according to schedule. There are serious questions as to whether any of those projects ever will be built.

The Tennessee Valley Authority (TVA) has been postponing the start of construction for small modular reactors (SMRs) at its Clinch River site in Tennessee almost since the project was first announced a decade ago. Current thinking is that construction could start in late 2027. The first SMR reactor design was recently approved by the Nuclear Regulatory Commission (NRC).

Another SMR project remains under development. This one, scheduled to be built in Idaho, has a 2023 kickoff year. We remain doubtful this project will hold to its schedule. The NRC approved its first 50 MW SMR reactor design in late August after a 42-month review.

That leaves the Blue Castle Nuclear Power Station in Utah as the only other new-build nuclear generation project scheduled to begin construction over the next five years. That two-unit project is expected to utilize two AP1000 reactors, the same reactors being deployed at the Vogtle station. Initial costs are estimated at $20 billion. That project, first announced in 2008, has gone through numerous changes and delays. At this point, ground is scheduled to be broken in 2025.

The disastrous experiences at the Summer and Vogtle stations long ago soured power executives on new-build nuclear. The Blue Castle or SMR projects may kick off near the end of the 2021-2025 period, but we doubt it. We remain unconvinced that any of those projects will ever be built.

With most power unit uprates having been either completed years ago, postponed or cancelled, that leaves refuelings and decommissionings as effectively the only nuclear power spending during the next five years.

"Power-sensitive retailers, manufacturers and healthcare organizations are growing more interested in microgrids."

It’s unfortunate that the power industry’s upbeat predictions about a nuclear renaissance a decade ago were never fulfilled. Had the shale revolution not lowered natural gas prices, and if renewable energy projects’ efficiencies stayed low, things might have turned out differently.

The Chapter 11 bankruptcy of Westinghouse in 2017 made a bad situation worse, but by then the industry’s enthusiasm for new-build nuclear power had long since evaporated.

Energy storage outlook

The energy storage sector has experienced sharp growth in recent years. Looking out over the 2021-2025 period, spending is expected to increase dramatically. We include various technologies in this sector, including various types of battery energy storage systems (BESS), ice thermal storage, flywheels and fuel cells.

This sector is drawing so much interest because the technologies can be used to meet a variety of needs: generation support for renewables and fossil-fueled generation, grid stability and security for T&D assets, and microgrid integration, among other uses.

Not too long ago, energy storage technologies were an interesting but underexplored technology cluster. Now, storage has become a multibillion-dollar part of an industry in transition. But during 2020, development and deployment of lithium-ion BESS has been slowed by supply chain snafus created by the pandemic.

About 200 U.S. storage projects are currently being tracked, excluding pumped storage, which are scheduled to begin construction over the next five years. Their total value is about $21 billion. Roughly two-thirds of that projected spending is for BESS. Not all energy storage projects will begin construction according to their current timelines. But it is clear that the days of storage being dismissed as a niche industry are long gone.

Developers have scheduled construction to start on about 8 GW of BESS projects over the next 24 months across North America. Over the next five years, the U.S. regions with the greatest level of BESS activity are the West Coast, Rocky Mountains, Northeast and Southwest.

The 2021-2025 period is expected to see continued emphasis on BESS research & development — particularly related to safety — as well as increased numbers of pilot demonstrations and full-scale commercial deployments. BESS has become the belle of the electrical ball. Whether utilized as standalone power generation or in renewable energy or grid support, this sector of the power industry has expanded dramatically and is expected to continue doing so.

Regulatory treatment of investments in energy storage projects is critical. In 2018, the Federal Energy Regulatory Commission (FERC) issued Order 841, supporting the integration and compensation for energy storage. In a mid-2020 decision, the U.S. Court of Appeals for the D.C. Circuit upheld FERC’s Orders 841 and 841A, which established a framework for electric storage resources to participate in wholesale markets.

The court ruled that “keeping the gates open to all types of electric storage resources — regardless of their interconnection points in the electric energy systems — ensures that technological advances in energy storage are fully realized in the marketplace, and efficient energy storage leads to greater competition, thereby reducing wholesale rates.” The FERC adequately explained its refusal to permit a state opt-out for these resources, the court decided, noting that the burdens created by electric storage resources were outweighed by the benefits they created.

Most Regional Transmission Organizations (RTO) have been working hard to integrate storage. While an appeal of the D.C. court’s ruling always is a possibility, we think the court’s ruling clears away most of the regulatory clouds that have been hanging over energy storage.

"Spending by non-utilities on industrial energy production has taken off massively in recent years."

Microgrids outlook

Spending on microgrids has increased in recent years, often driven by prolonged power outages following severe weather. Utilities and commercial & industrial customers have scheduled more than $1 billion of microgrid construction projects to start in 2020.

Microgrids have the potential to serve a wide array of commercial, industrial, institutional and military customers — really any type of non-residential customer that cannot tolerate prolonged power outages. Power-sensitive retailers, manufacturers, and healthcare organizations are growing more interested in microgrids. They are viewing microgrids either as a back-up for grid-supplied power or as a way to island themselves from the electrical vicissitudes of the grid.

The quality and cost of grid-delivered electricity exert a powerful impact on microgrid deployment. The higher the cost of grid-supplied electricity, the easier it is to make a case for a microgrid. Similarly, poor-quality power trips off advanced machinery at customer sites, leading to delays and waste.

Microgrids are increasingly showing up in airports, city centers, emergency response organizations, and as a backup for industrial sectors supply. Microgrids that include generation assets can play a role in reducing electric peaks from nearby utilities as well.

Another driver for growth could be the public safety power shutoffs (PSPS) enacted in California in 2019 to protect against wildfires sparked by electrical equipment. With California perennially in wildfire mode, we expect growing interest in microgrids by California-based businesses and institutions.

Over the next five years, we expect project spending on microgrids to be the heaviest in the Northeast, New England and West Coast. That spend could rise if retail electric prices rise or severe weather leads to prolonged outages.

Industrial energy production outlook

Spending by non-utilities on industrial energy production (IEP) has taken off massively in recent years. This is often driven by major companies such as Google, Amazon, Apple, Walmart, Target, and others deciding to build sizable renewable energy projects to power their data centers and fulfill corporate commitments that are aimed at shrinking their carbon footprint. Typically, these wind farms are 80 MW or larger and can meet all or nearly all of the electric demand of a given facility. Any surplus can either be banked in energy-storage projects or sold back to the local utility.

Over $10 billion of renewable energy projects is expected to be added to industrial sites over the next 36 months. Sectors with the greatest interest in IEP are universities, prisons, airports, transit systems, and chemical manufacturers.

Whether it’s in conjunction with a microgrid project or a stand-alone distributed energy resource, spending on industrial energy production should continue to grow as a sector of the electric generation business.

Looking ahead

For more than a century, state regulatory authorities were the main driver affecting power industry spending. But in recent years, changing generation technologies, shifting business models, fluctuations in fuel prices and the rise of customer expectations have joined state regulators in pushing the industry forward. The federal government — Congress, the president and the courts — also has a role in those changes. But the changes taking place outside the Beltway have surpassed the impact of those emanating from inside it.

The changes observed in recent years, mainly the shift to renewable energy, will prove hard to reverse. But, as baseball philosopher Yogi Berra once said, “It’s tough to make predictions, especially about the future.” ■

____________

Britt Burt is vice president of Global Power Industry Research for Industrial Info

Resources (IIR), which is headquartered in Sugar Land, Texas, and has six offices in North America and 12 international offices.

Brock Ramey is North American Power Specialist for IIR, which provides global market intelligence for companies in the power, heavy manufacturing and industrial process businesses. For more information see www.industrialinfo.com or email powergroup@industrialinfo.com.