Worldwide Gas Turbine Forecast 2024

There is a positive sales projection for gas turbines over the next decade.

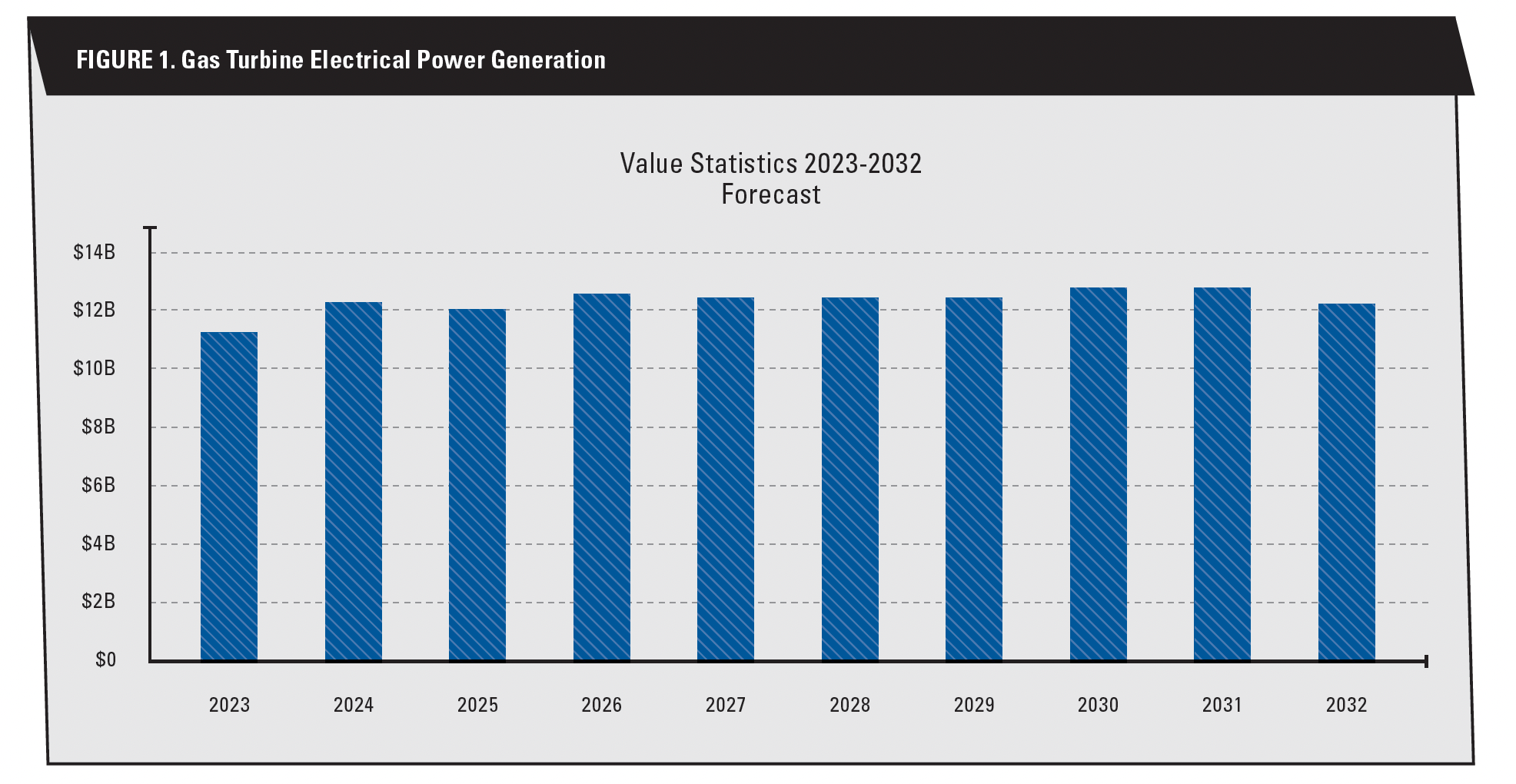

The gas turbine market, in terms of producing electricity, is returning to its pre-Covid levels, and the market will remain stable for the near-to-mid-term future. These levels of production will be driven by gas turbine replacements and the implementation of new facilities to cover increasing power demands worldwide. Projected energy demand for natural gas usage and in turn gas turbines will be a key driver of production moving forward. Other forms of power production, such as coal, will lose ground to gas turbines and renewables.

If there is one factor that has changed the technology of power generation more than any other it is the shift away from coal as a fuel source and the rise of natural gas. This shift is the result of three converging influences: The first is a general concern over pollution and the drive toward environmental responsibility. This has been given added impetus in recent years by concerns over CO2 emissions and their reported effects on climate. However, the turn against coal predates climate-change issues and owes much to the use of lignite as a power station fuel. Lignite—also known as brown coal or its German equivalent, braunkohle—is laden with impurities and contaminated with materials that give rise to toxic byproducts, including the notorious “acid rain.”

Figure 1: Gas Turbine Electrical Power Generation - Value Statistics 2023-2032 Forecast

The polluting character of coal-fired power generation has led to a concerted drive to get rid of it. In Western Europe, and the United Kingdom in particular, coal-fired power plants are under sentence of death, and dates for their closure have been imposed. In the United Kingdom, coal-fired power has now been phased out from energy production. In contrast, combined-cycle gas turbines account for roughly 52%, and nuclear power 23%, of energy production. This pattern is being repeated across the rest of Europe and into North America. However, coal remains a favored choice for power generation in countries like China and much of Eastern Europe because of those countries’ huge coal reserves and less stringent environmental policies. Even lignite remains in use despite the environmental damage it causes.

Gas turbines are therefore here to stay but are not the only source of power. Although relatively clean when compared to fossil fuel-driven energy production, gas turbines are not as green as wind, solar, and other renewables. Renewable energy plants are notoriously fickle when it comes to output. A heavily clouded, sunless day can drastically reduce power output from solar panels, and a calm windless day can have the same effect on power from wind farms. In theory, at least, there is a marked need to provide additional conventional power-generating capacity to act as a gap filler. The introduction of hydrogen into gas turbines will make them cleaner; however, there are issues such as transportation of the gas and modification of turbomachinery that must be solved before hydrogen’s widespread use. Manufacturers are currently working with their gas turbine products to burn hydrogen; however, mixtures of natural gas and hydrogen will likely be the norm before gas turbines regularly burn 100% hydrogen.

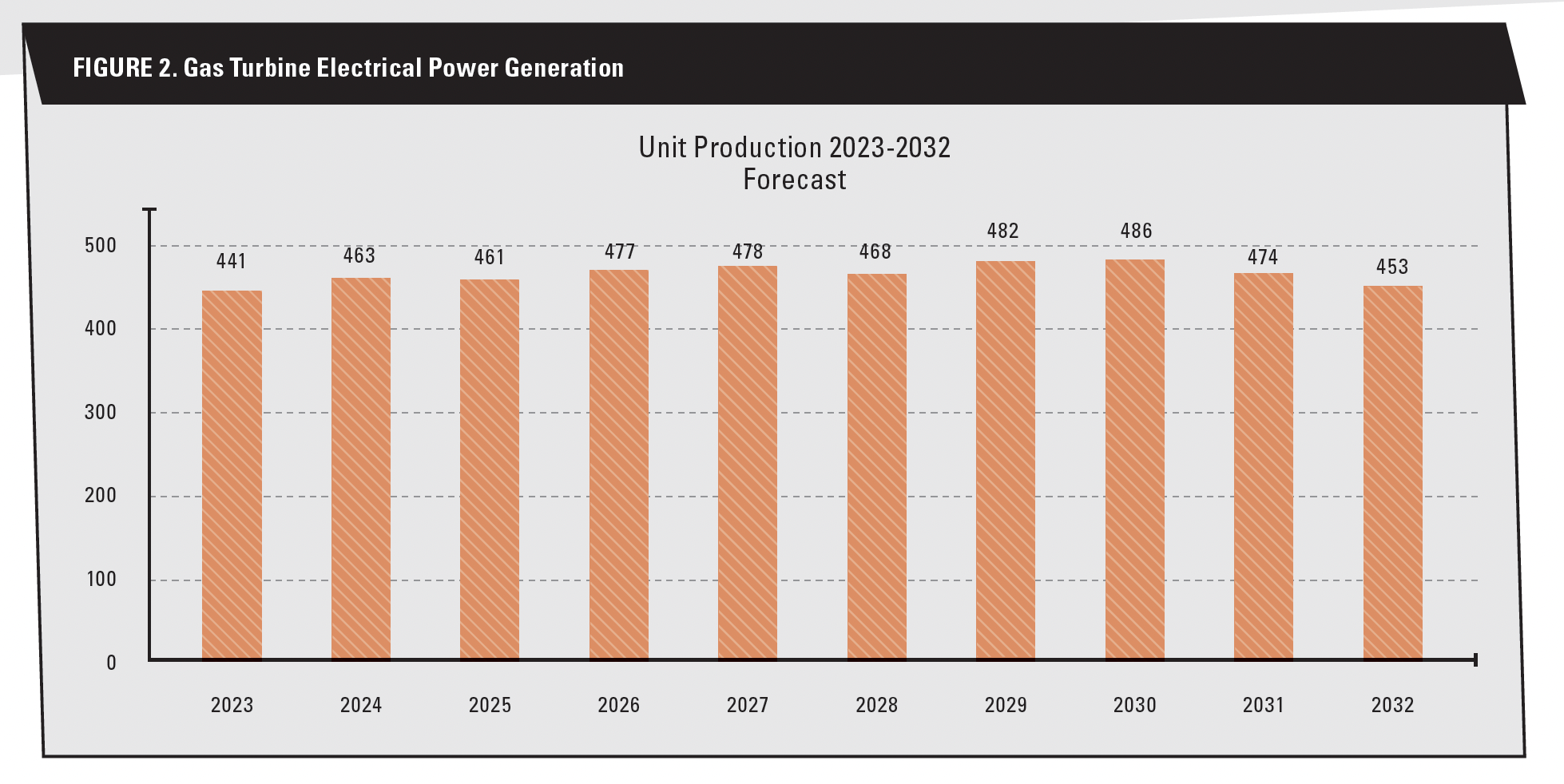

Figure 2: Gas Turbine Electrical Power Generation - Unit Production 2023-2032 Forecast

GE Gas Power, Siemens Energy, Mitsubishi Power, and Ansaldo Energia are forecasted as the top four turbine manufacturers over the next 10 years. Due to the war in Ukraine, both the Russian UEC Perm and UEC Saturn and Ukraine’s Zorya Mashproekt will lose market share as production levels have likely been negatively affected. Recent analysis of UEC Saturn and UEC Perm’s websites suggest that Russia is currently prioritizing service over production. The capacity in Russia is there, so maintenance in their current situation makes more sense than replacing gas turbines for more efficient units. Ukraine is likely in a similar situation.

GE Gas Power, Siemens Energy, Mitsubishi Power, and Ansaldo Energia are forecasted as the top four turbine manufacturers over the next 10 years.

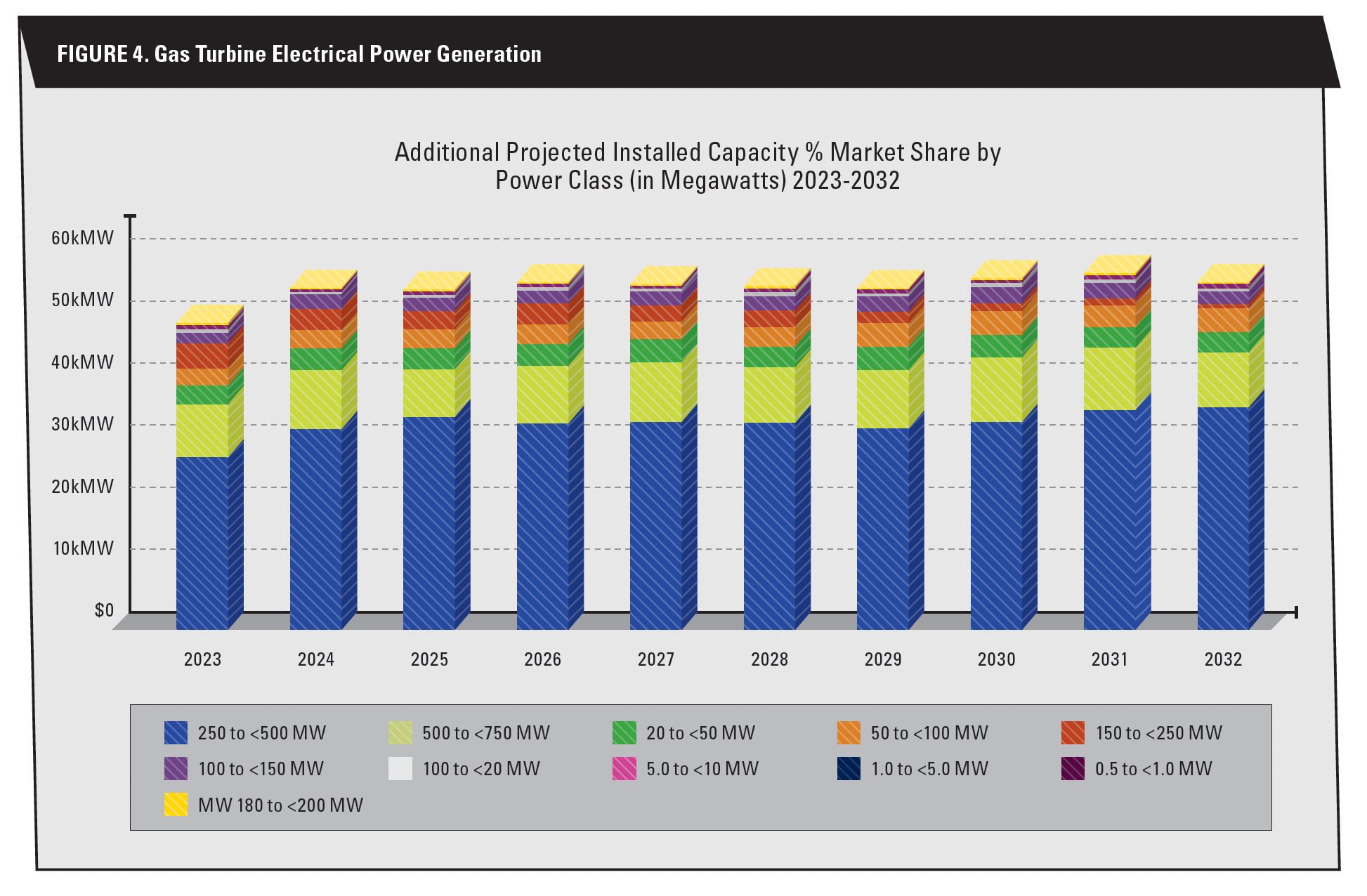

Forecast International is forecasting that the lion’s share of gas turbines sold over the next 10 years will be turbines in the 250-500 MW range for power generation. This conclusion is based on historical sales and the popularity of machines in this class. Turbines of higher output and lower MW still have their place depending on the needs of the end user.

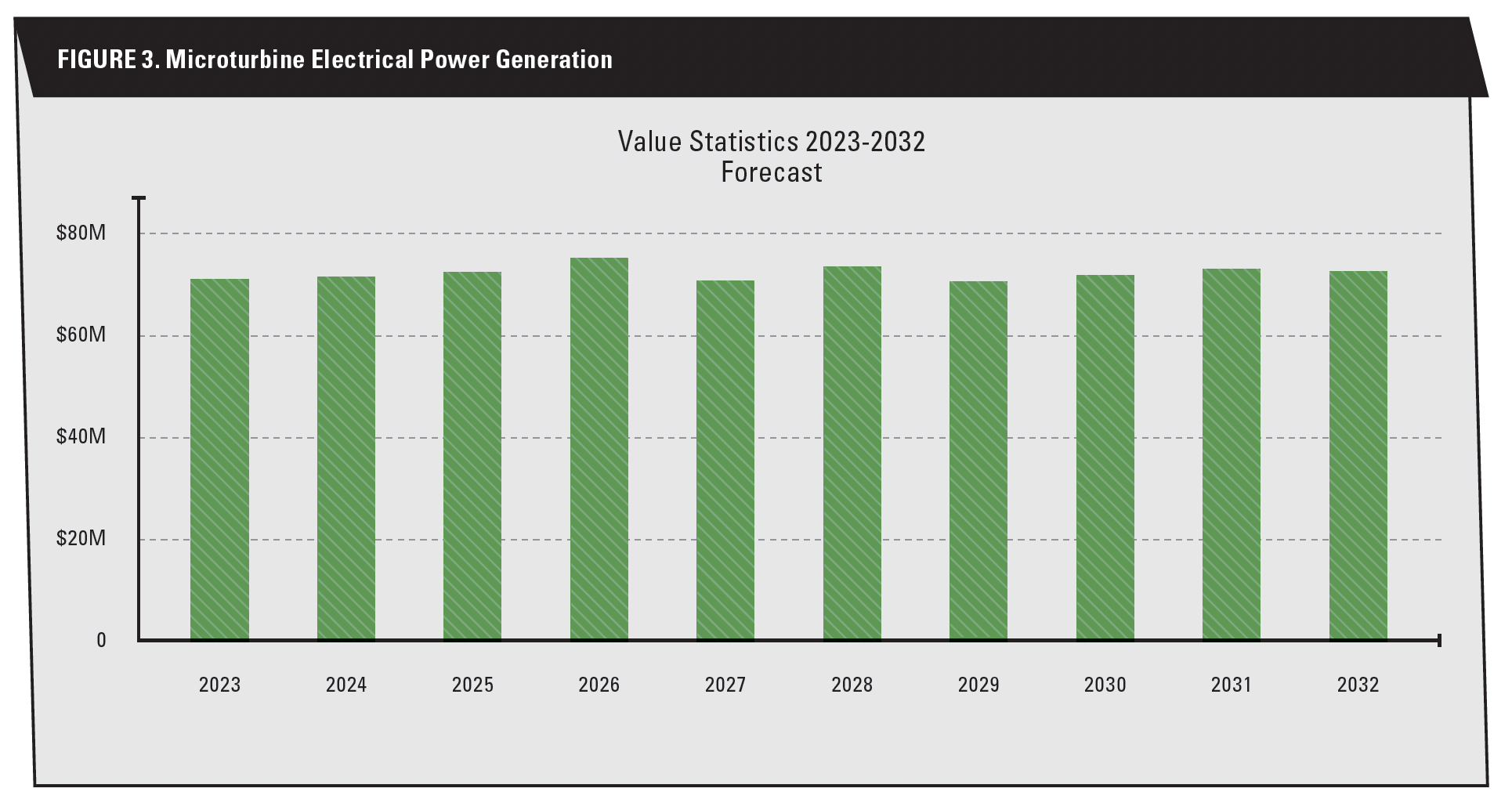

Microturbines also have their niche and are forecasted for slight growth over the next 10 years. Capstone will continue to dominate the market with FlexEnergy following.

The COVID-19 pandemic hurt the market, but with sales recovering, the 10-year forecast should experience minimal growth in terms of unit production and remain largely flat barring any unforeseen circumstances.

Figure 3. Microturbine Electrical Power Generation - Value Statistics 2023-2032 Forecast

Figure 4. Gas Turbine Electrical Power Generation - Additional Projected Installed Capacity % Market Share by Power Class (in Megawatts) 2023-2032

Carter Palmer is an Industrial & Marine Turbine Analyst at Forecast International, a provider of market intelligence forecasting, proprietary research, and consulting services for the aerospace, defense, and power systems industries. Forecast's Platinum 4.4 information and analysis service was used to compile this report. For more information, visit www.forecastinternational.com.