Worldwide Market Report: 2020 proved to be an interesting year for gas turbines

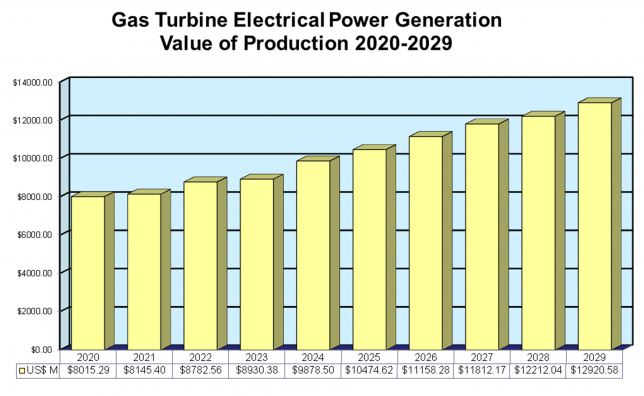

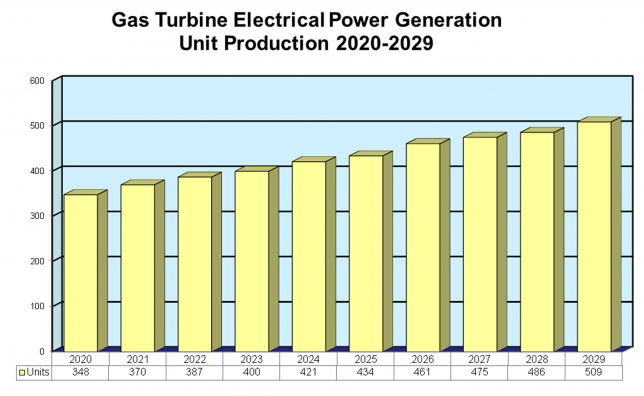

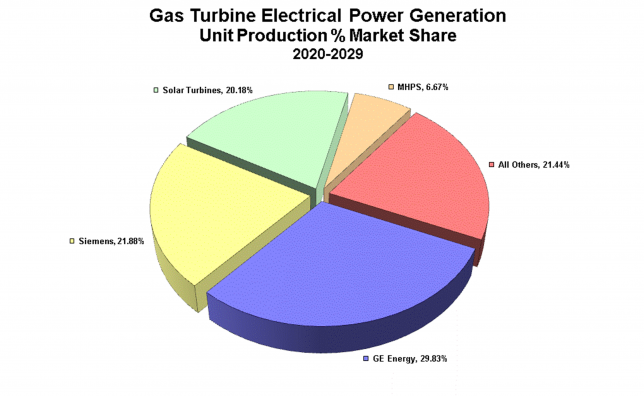

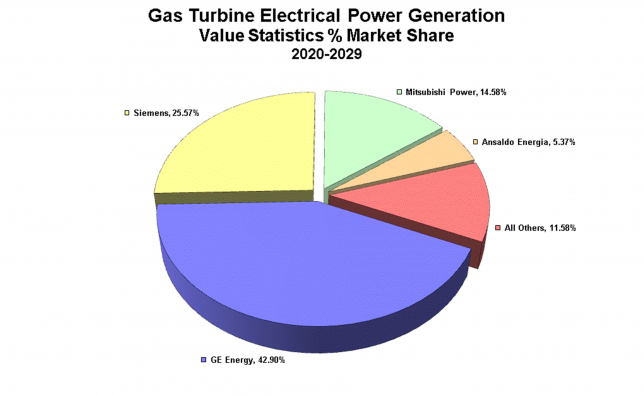

Forecast International’s analysis of the market for gas turbine-powered electrical generation for 2020-2029 projects sales totaling $102.33 billion. This is an increase of 6.5% from the sales projection for the 2019-2028 period. In terms of units, the analysis projects worldwide sales of 4,291 gas turbines for electrical power production between 2020 and 2029. This represents an increase of 4.8% over the equivalent figure in last year’s review. This is the first sign in five years of a recovery in the gas turbine electrical power generation market. Efforts by the companies operating in this sector to adapt to the hostile environment are finally bearing fruit.

Despite this improved outlook, 2020 will not be remembered as the year when the recovery started. The worldwide Covid-19 pandemic stole the headlines, shutting down the power generation industry along with much else. The dominant response was to institute a lockdown. Companies sent most workers home. Government policy severely restricted movement and interaction. The effect was to drastically reduce industrial activity for at least three months and possibly much longer.

Yet for all the dramatic scenes of closed stores, empty roads and people either unemployed or working from home, evaluation of the impact of Covid-19 on the market shows that it will only be short term and is already quickly being absorbed. This situation can be summarized by saying that the effect of the virus was to suppress the market in the short term, but to bring about a corresponding enhancement in medium-term recovery.

In the power generation sector, the initial result of the Covid-19 pandemic was a decline in energy demand of between 19% and 21% due to industrial facilities closing operations. This was partly offset by arrangements for staff to continue working from home. As countries adapted to the new environment, electric load declines of 3% to 11% were recorded. Less than half of the reduction is probably attributable to the virus. These developments led the U.S. Energy Information Administration (EIA) to project that a total of 4.9 GW of previously planned capacity expansions will be delayed into at least 2021 or 2022.

Even this may prove to be unduly pessimistic. The situation as it developed throughout 2020 is much more complex than a simple cause-and-effect relationship. At the time of writing, an examination of expenditures and contracts showed that some orders, especially those from government organizations have been brought forward. The U.S. Navy, for example, has brought some warship construction orders forward by three to four months. This appears to have been done to support companies with income during the lockdowns while also providing the resources needed to make their facilities compatible with Covid-19 health and welfare requirements.

Further complicating matters, problems caused by the pandemic may have been contained in the short term. But a longer-term problem is emerging. The power generation gas turbine industry and its clients have coped with the maintenance and support side of operations by running down established stockpiles of components and deferring scheduled maintenance for which parts were scarce or unavailable. The latter, in particular, can only be continued for so long. The consequences from work deferment may echo in unexpected ways for several months or years.

OEM restructuring

As a direct outcome of the power generation industry recession that started in 2014, all three of the leading companies in the power generation equipment sector – GE, Siemens and Mitsubishi Power – have undertaken major restructuring to reduce costs and rationalize production. In an inevitable result, these companies announced major redundancies.

At present, GE controls some 42.9% of the projected market by value, Siemens 25.7% and Mitsubishi Power 19.5% for a total of 88.1%. Siemens has formed its energy operations into a new consolidated group known as Siemens Energy, which has been spun off as a separate entity. In effect, Siemens has converted itself from a conventional multinational conglomerate into a constellation of three companies. They each operate (and are quoted on the stock market) independently and are subject to strategic guidance from the central holding company. That holding company holds a dominant but not majority shareholding in each of the constellation companies.

GE adopted a different strategy with its Baker Hughes subsidiary. Baker Hughes (no longer BHGE) has rationalized its activities, discontinued marginal and no-longer-viable product lines and streamlined its business. This process was completed when the revived and modernized company was launched as an independent entity. GE retains a non-majority stockholding. This process is normally a prelude to the floated entity being acquired by another company, although the process may take months or years to be completed. It is not yet clear whether this will take place with Baker Hughes.

The former Mitsubishi Hitachi Power Systems (MHPS) was subject to a different process. It had been apparent for some years that the formation of the Mitsubishi-Hitachi joint venture had generated neither the business opportunities nor the technology benefits expected. Both companies were heading in different directions. Opportunities for synergistic growth declined quickly. Representatives of Mitsubishi Heavy Industries interviewed at trade shows made little effort to hide their disillusionment with the benefits of the partnership. In the early months of 2020, MHPS ceased to exist. Mitsubishi Power emerged.

Market recovery

Despite the eruption of the pandemic, the impact of reduced demand, overcapacity, and soft prices will slowly work itself out and a recovery will take place. Covid-19 has extended this recovery later than originally projected. But it will be slightly stronger as projects delayed from 2020 finally get underway. Once the middle- and long-term periods are reached, the industry will be dominated by large combined-cycle facilities in the industrialized nations, notably Japan and countries in Europe and Asia.

All this reflects the current need for more baseload capacity additions, as well as for increases in individual power plant capacity. In the mid- and long-term, escalating demand for electricity supplies will continue to drive worldwide demand for gas turbine-based power plants using the latest technology. As a result, the focus of investment will be on the largest and most expensive category of industrial gas turbines – those with the highest outputs. They can be expected to be procured heavily in areas such as China, North Korea, Vietnam, Indonesia, Thailand, Brazil, and the Middle East.

But analysis of the power generation gas turbine market is being complicated by increasingly complex and more granular market drivers. The primary drivers in today’s environment are neither technical nor economic. They are political and environmental. Environmental objectives of reducing emissions and economizing on the use of fossil-fuel resources are being met by subsidies to promote the deployment of renewable resources and low-emissions fuels. These distort the market and serve to complicate the relationships between energy demand and generation capacity.

Supply and demand

The once-simple relationship was: increasing demand for electrical power, which translated into the installation of additional capacity and leading to the installation of gas and steam turbines. Over the last 15 years, however, this simple pattern has fragmented. More recently, a significant proportion of demand has been met by improving efficiency. Modern control systems have also reduced the amount of spinning reserve required as a proportion of baseload capacity. A case could be made that the root of today’s problems could be the progressive change from a simple bilateral relationship between supply and demand to the current, highly complex multilateral relationship.

With so many factors influencing the marketplace, gas turbine procurement is no longer directly related to rising power demands. Instead, the option of procuring additional gas turbines is but one of many that exist. The same effect may be obtained by converting an existing simple-cycle plant to combined cycle through the installation of a heat recovery steam generator (HRSG) and a steam turbine. An indirect approach may be to invest the money that would have been used to procure new power generation facilities in grants to improve domestic energy efficiency and thus reduce power demand. These options are not theoretical; they already exist and account for a steadily rising proportion of power generation capacity.

Small vs large GTs

The modularity and flexibility of smaller turbines as well as their low emissions levels are major advantages promoting their adoption. However, they are being offset by the continued development of diesel engines for hospitals, schools and other standby power applications. Largely as a result of continued application in the personal vehicle market, the new generation of diesels is quieter, has reduced levels of emissions and can burn natural gas as fuel. With these advantages, diesels continue to be viable competitors. Superior operating economics in some cases make them attractive in certain applications.

At the other end of the scale, the power output of large gas turbines continues to increase. While 200 MW was considered a large gas turbine a few years ago, outputs five times that figure are not uncommon. A growing number of large turbines are being deployed with heat recovery units in combined cycle power plants with efficiencies well over 60%.

An examination of output power from gas turbines and their unit cost reveals a non-linear relationship. A 400 MW gas turbine costs significantly less than two 200 MW machines. The difference increases steadily as output rises. Therefore, it is much more economical to use the largest gas turbines when building large, centralized power generation facilities.

Once more, the situation becomes complex. A large centralized power station requires a sophisticated and reliable electrical grid to distribute the generated power. This is not necessarily available in many parts of the world. In such cases, the costs of establishing such a grid must be included within any economic analysis. In some cases, the added capital cost of establishing distributed generating capacity using numerous smaller turbines may be less burdensome than the costs of providing a distribution net.

The same may apply to fuel sourcing. If coal is abundant and the infrastructure to transport it to the point of use already exists, these factors may override the advantages of gas. An example can already be seen in the development of integrated coal gasification plants and the continued procurement of coal-powered steam turbines.

In summary, Covid-19 has brought into focus the extent to which economic analysis of the power generation gas turbine market and its structure extends far beyond a simple consideration of gas turbines themselves. The days are long gone when developments in that market were directly related to changes in demand for power. Trends in power demand are but one factor in a complicated equation wherein many of the variables in play are either subjective or hypothetical. At times, these variables may be unpredictable and arrive from left field. Perhaps the major lesson from 2020, then, is that overall, the three major power generation gas turbine producers have coped relatively well with a complex and unfavorable environment.

Stuart Slade is the Senior Industrial & Marine Gas Turbines Analyst at Forecast International. This article provides data compiled from Forecast’s Platinum 4.0 information and analysis service.

Carter Palmer is an Industrial & Marine Gas Turbine Analyst at Forecast International with a focus on smaller gas turbines and microturbines. For more information, visit: www.forecastinternational.com